Dec. 22, 2020: The Securities and Exchange Commission (SEC) announced that it filed a case against Ripple Labs and two of its executives. The case alleged that XRP was in fact an unregistered security, and not a digital commodity as the company had stated. XRP prices tanked in response, dropping to as low as ₹15.52 in the days following. Ripple seemed to be ready to fight from the beginning, while XRP’s users and community have risen to form a third-party within the case. You may be wondering why this matters. After all, we’re in India and the SEC has no jurisdiction here. But all eyes are on this case, as it may set a precedent for how crypto will be treated across the world.

A clarification at the start. Ripple (the company) and XRP (the asset) are seen as separate entities legally within this case. I will be referring to them as such to better explain the situation.

Before we go into the impact that this case’s outcome will have, let’s take a look at the case itself. There are three parties involved, each with their own stance and priorities.

The SEC Perspective

The SEC is the American equivalent of the Securities and Exchange Board of India (SEBI), and was formed with a three-part mission:

- Protect investors

- Maintain fair, orderly, and efficient markets

- Facilitate capital formation

When the US stock market crashed in October 1929, so did public confidence in its markets. Congress held hearings to identify the problems and search for solutions. These hearings led to the creation of the SEC, amidst the peak of the Great Depression. The SEC mission can be broken down into two common-sense statements:

- Companies offering securities for sale to the public must tell the truth about their business, the securities they are selling, and the risks involved in investing in those securities.

- Those who sell and trade securities – brokers, dealers, and exchanges – must treat investors fairly and honestly.

Now onto Ripple. According to the SEC complaint:

“…Ripple; Christian Larsen, the company’s co-founder, executive chairman of its board, and former CEO; and Bradley Garlinghouse, the company’s current CEO, raised capital to finance the company’s business. The complaint alleges that Ripple raised funds, beginning in 2013, through the sale of digital assets known as XRP in an unregistered securities offering to investors in the U.S. and worldwide. Ripple also allegedly distributed billions of XRP in exchange for non-cash consideration, such as labor and market-making services. According to the complaint, in addition to structuring and promoting the XRP sales used to finance the company’s business, Larsen and Garlinghouse also effected personal unregistered sales of XRP totaling approximately $600 million. The complaint alleges that the defendants failed to register their offers and sales of XRP or satisfy any exemption from registration, in violation of the registration provisions of the federal securities laws…”

This is the case’s foundation, explained.

- XRP, the token, should not be classified as a commodity – but as a financial security. This means that any buying or selling activities should be in accordance with SEC rules and regulations.

- However, Ripple, the company; its co-founder Christian Larsen and CEO Bradley Garlinghouse raised money through an unregistered public offering of XRP tokens beginning in 2013.

- The complaint also alleges that Larsen and Garlinghouse carried out personal unregistered sales of XRP totaling roughly $600 million.

So in one sentence – Ripple and its co-founders raised over $1.3 billion in unregistered sales. This is a big no-no.

“We allege that Ripple, Larsen and Garlinghouse failed to register their ongoing offer and sale of billions of XRP to retail investors, which deprived potential purchasers of adequate disclosures about XRP and Ripple’s business and other important long-standing protections that are fundamental to our robust public market system,”

~Stephanie Avakian, Director of the SEC’s enforcement division on December 22, 2020

But how did the SEC decide that XRP was a security? The Howey Test.

The Howey Test refers to SEC v. W. J. Howey Co, a case that is used to determine whether or not a transaction is to be considered an “investment contract” and therefore a security.

In doing so, the Supreme Court established four criteria to determine whether an investment contract exists. An investment contract is requires four components:

- an investment of money

- in a common enterprise

- with the expectation of profit

- to be derived from the efforts of others

According to the SEC, the “investment of money” test is easily satisfied with digital assets sales, because fiat money are being exchanged. Likewise, the “common enterprise” test is also easily met.

The point of contention lies in #3 and #4. In most cases, whether a digital asset qualifies as an investment contract largely turns on whether there is an “expectation of profit to be derived from the efforts of others.”

The Ripple Perspective

The SEC’s lawsuit seeks billions in penalties from Ripple Labs Inc. and its executives. But the agency does not allege that any of its investors were defrauded. Instead, it complains about the company’s failure to register XRP as a security, calling its sale an “investment contract”.

In an official response to the case, Ripple the company states that the SEC’s theory ignores the reality that XRP is, and has long been, a digital asset with a fully functional ecosystem, with use cases that do not rely on Ripple’s efforts for its functionality or price.

The company points to past statements by SEC officials where it claims that cryptocurrencies like Bitcoin are not securities. The case argues that by arbitrarily deciding XRP sales are investment contracts, while maintaining that Bitcoin and Ether are not securities, the SEC is overreaching its mandate – and seriously threatening the developing cryptocurrency ecosystem as well as America’s vital leadership place within it.

There is also a much simpler question. XRP has been in circulations since 2013. Why was this case only filed in last December?

The XRP Community Perspective

You may have noticed that neither the SEC nor Ripple’s cases consider the countless individuals who hold XRP. The SEC’s suit may have been filed against the company, but it has made it clear that it would go after everyone involved.

There was never one phrase in the mountain of pages the SEC has filed since December 22, 2020 that showed one bit of consideration for the retail investors they are supposed to be defending by their every enforcement action. When we asked the court to hear our voice, the SEC scoffed and insulted us in their formal response, saying that all of us who suffered collateral damage from their ill-conceived lawsuit should remain silent.

~ John E Deaton, April 19, 2021

On April 19, Rhode Island-based lawyer John Deaton submitted a legal filing on behalf of the XRP community. The Motion to Intervene makes it clear that the community has a significant interest in the legal action, but are without any sort of representation.

More than 12,600 people contacted Deaton to join the intervention, according to the document. These XRP community-members are seeking to participate in the lawsuit as a third-party defendant only to protect their interests, and are not asserting any claims against the SEC.

How will this impact crypto?

We’ve already seen the case’s immediate impact.

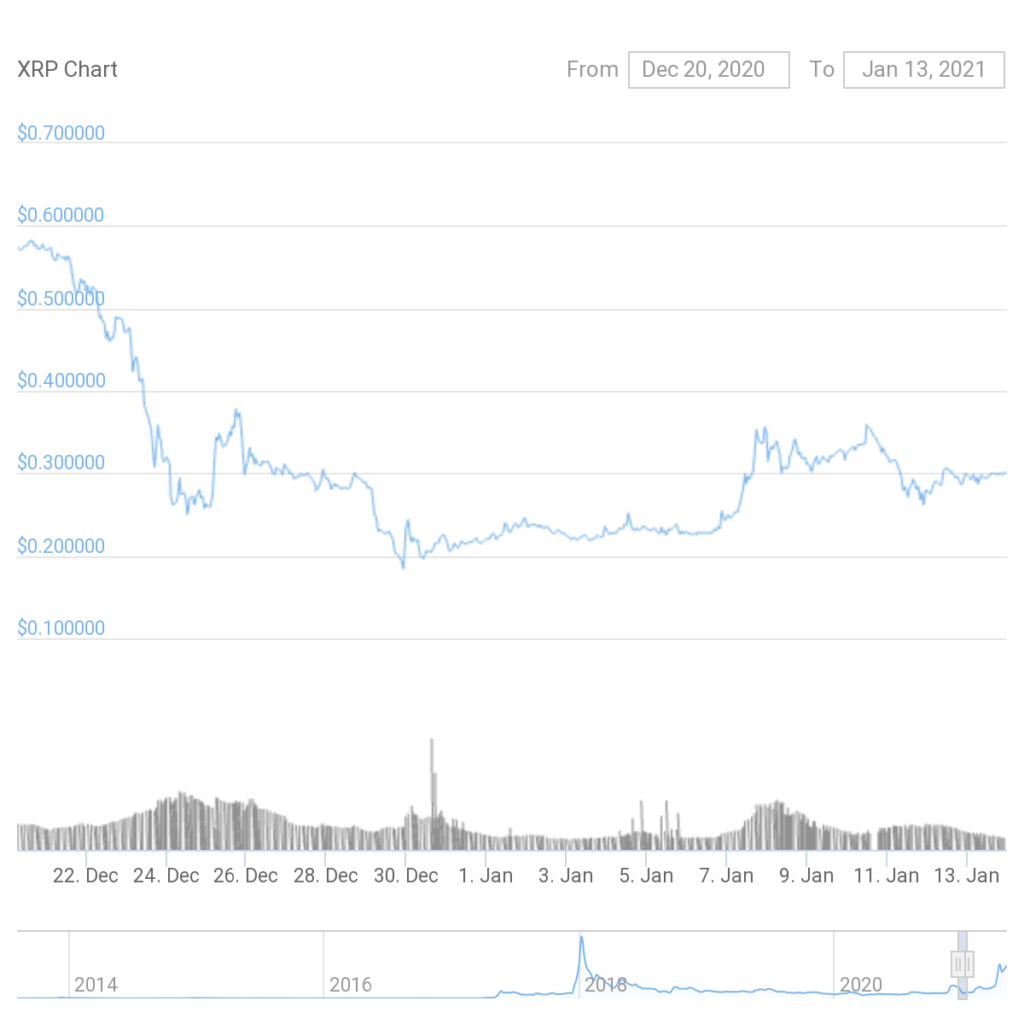

Ripple’s CEO, Brad Garlinghouse, issued a statement warning users a day ahead of the case being filed. Following the news, XRP’s price plummeted, losing as much as 14% before rebounding slightly. Fearful of being caught in the crossfire, several crypto exchanges immediately de-listed XRP.

Suddenly XRP holders were left with a rapidly devaluing asset, which they could not sell anywhere to offset their losses. The only choice remaining was to hold on and hope.

The case itself may take years to reach a resolution. However, if the SEC successfully proves in court that XRP is a security, it will create a legal precedent. A precedent that will leave crypto without an adequate market.

In the US as in India, crypto network developers exist in a regulatory vacuum. According to the SEC, distributing tokens to people may violate the securities laws if the network isn’t functional or decentralized.

But how does the body expect the network to become decentralized unless the tokens are first distributed, and then freely transferable?

For many, the SEC’s action is an overinterpretation of their authority to regulate.

In this case, the SEC may be on trial just as much as the company it is prosecuting.