Over human history, money has evolved in many different forms. From the barter system to seashells and coins, there have been many innovations to get to where we are today. Ever since modern banknotes have been introduced, one currency has dominated global markets and trade – the US Dollar.

However, there is now a new competitor in the market. Bitcoin is a digital token that aims to reduce reliance on central authorities and third parties for money. It also has several features that may give it an edge over fiat currencies. So which option is the better choice for payments?

What is Bitcoin?

Before delving into the pros and cons of each option, it is best to understand what the token is and how it works.

Bitcoin is a crypto token that acts as an independent means of payment. It is not controlled by any individual or group, thus removing middlemen from transactions. It was introduced by Satoshi Nakamoto – an anonymous individual or group – in 2009 and has since become the most popular digital token in the world.

Transactions are recorded and stored in a “blockchain”. This is a public ledger of activities on the network that acts as a common database. It can be accessed by anyone from any device, creating a transparent system. Data in the blockchain is secured through encryption.

Bitcoin transactions are bundled into units known as “blocks”. These are securely encrypted sets of data that link with each other, hence making a blockchain. Users of the network can engage in “mining”.

Mining is the process of solving cryptographic puzzles to verify a block and add it to the blockchain. Users are rewarded with more bitcoin tokens for successfully validating a block.

BTC Vs USD: Comparison

We compare bitcoin and dollars based on two different characteristics: functions and characteristics of money. The functions are a store of value, a unit of account and a medium of exchange. Meanwhile, characteristics include durability, portability, divisibility, limited supply, uniformity and acceptability.

| Feature | BTC | US Dollar |

| Store of Value | Volatile store of value | Stable store of value, but it has depreciated over time |

| Unit of Account | Not a widely used Unit of Account | Most widely used Unit of Account |

| Medium of exchange | Growing acceptance | Widely accepted |

| Portability | Highly portable | Less portable than Bitcoin |

| Supply | Capped supply of 21 million | Unlimited supply. Printing of USD is linked to debt cycles |

Functions of Money

- Store of Value – Both options can store value as your dollars or bitcoins will not reduce by themselves. However, dollars are better at maintaining this stored value due to Bitcoin’s high volatility. Even if you can store 20 Bitcoins for a year, their value can change significantly and leave you with less than you started with.

- Unit of Account – The unit of account refers to the value we assign to items. Here also USD takes the lead since all prices are denominated in dollars and not bitcoins.

- Medium of Exchange – Any instrument with a standard value used for transactions can be a medium of exchange. Since both USD and BTC have commonly accepted values, they are effective mediums of exchange.

Characteristics of Money

- Durability – USD comes in the form of banknotes and coins, while bitcoin is only a digital asset. Therefore, bitcoin is more durable as it cannot be damaged while notes may tear.

- Divisibility – Each dollar can be divided into 100 cents. One bitcoin can be divided up to 8 decimal places., which is known as a “satoshi”. Bitcoin is thus more divisible.

- Portability – Since Bitcoin only exists digitally, it is more portable than notes or coins. This is especially true for large transactions.

- Limited Supply – The supply of USD is regulated by the Federal Reserve. They determine whether to create more USD based on economic factors. By contrast, bitcoin has a fixed limit of 21 million BTC. No one can create any more BTC after 21 million have been made.

- Uniformity – This is a tie. Dollars are uniform as every coin and note is made in the same way. Similarly, each bitcoin operates on the same code.

- Acceptability – USD is far more widely accepted than bitcoin. Today, only a small number of individuals are willing to transact in bitcoin while everyone will accept dollars.

Read more: What Is Dollar Cost Averaging In Crypto

Final Thoughts

The dollar is still the preferred mode of transaction for now. However, this may change in the future with further innovation in the crypto field and more acceptance of bitcoins. Through its essential features, Bitcoin is likely to provide a better overall experience than most fiat currencies in the future. While USD is still ahead today, Bitcoin vs US dollar is not over. Furthermore, stablecoins like USDT will help one buy the digital version of US dollar in the crypto world.

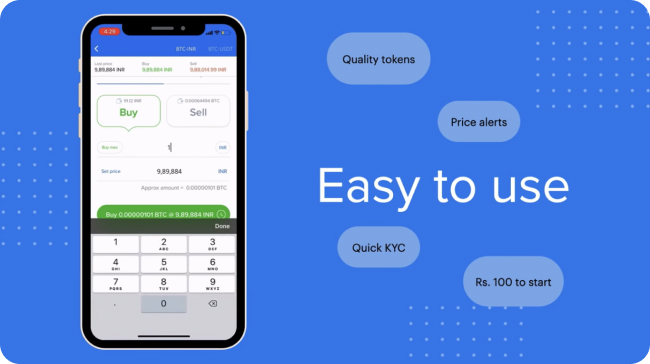

You can now buy Bitcoin and USDT on ZebPay Singapore.