The world of finance has been revolutionised by the use of blockchains and crypto. Payments, investments and even lending have reached a much wider population than possible before. Currently, there are two options within blockchain finance – Decentralized Finance (DeFi) and Centralized Finance (CeFi). But each of them comes with its own set of disadvantages. CeDeFi is here to change all that.

Introduction To CeDeFi

CeDeFi is a combination of DeFi and CeFi, creating a unique blend that integrates benefits from both types of services. In essence, it allows you to explore DeFi services like lending, liquidity and yield farming at a much lower cost than standard DeFi platforms.

Read more: How Does DeFi Lending Work

This brings the best features and characteristics of each system and makes them available to both individuals and businesses. Platforms can deploy trusted smart contracts and have more control over the network, while users can still enjoy DeFi products at a low cost.

How Does CeDeFi Work?

The most important thing to understand about CeDeFi platforms is that they are not entirely decentralized. Unlike DeFi platforms like Aave and PancakeSwap, there is a single company or group of entities in control of a CeDeFi platform.

While this may act as a deterrent for some users, it also allows the network to be more consolidated. Better integration of products across the platform benefits its users through faster updates, lower transaction costs and more liquidity.

However, this centralized control method also means it is not as resistant to outside interference. Decentralized networks allow users from all over the world to access them. This means even locations and countries where crypto may be banned or restricted can use DeFi. But CeDeFi is less resistant to censorship and blocks from governments.

How Did CeDeFi Enter The Crypto Market?

Binance has had a massive role to play in the spread of CeDeFi. Until a few years ago, the DeFi industry was dominated entirely by Ethereum and platforms built on top of it. Binance had its own blockchain known as the Binance Chain, which was created for a network with high throughput that services users of the Binance exchange.

However, they soon saw the opportunity to expand into smart contracts and dApps. This led to the creation of the BNB Smart Chain in 2020, which sacrificed decentralization for much higher scalability and transaction speed. With this, they also coined the term “CeDeFi”.

This new blockchain uses the Proof of Staked Authority consensus mechanism. It thus allows only 21 active validators to participate in block confirmation. The platform is much more centralized than alternatives like Bitcoin and Ethereum, but this has led to easier usage for users and developers alike.

CeDeFi: Advantages & Disadvantages

Verified Services and Products

Every product launched on a CeDeFi platform is thoroughly tested and vetted by those in charge. This greatly reduces the likelihood of scams or vulnerabilities in the product, meaning your money is more secure.

Compliance

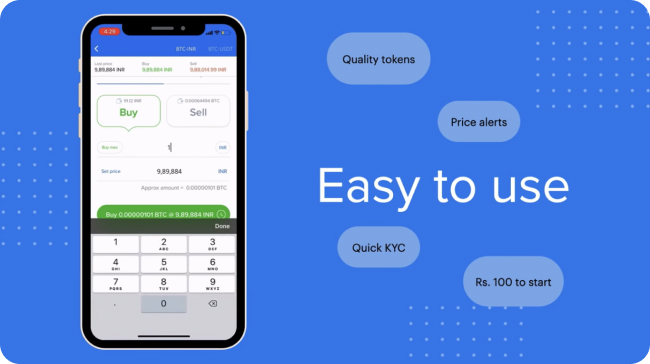

The existence of procedures like know your customer (KYC) makes the process more compliant with regulatory requirements for businesses and individuals alike. You can thus participate or create for CeDeFi with regulatory needs met.

Lower Costs

Consolidation of the network into the control of a small group of entities allows fees to reach almost negligible levels. This is a huge advantage to frequent users of DeFi products.

High Learning Curve

Unfortunately, the products offered through CeDeFi platforms require a lot of familiarity with crypto. This means that they are not as beginner-friendly as using traditional platforms and you may need some time to get used to the products.

New and Unproven

CeDeFi is still in its nascent stage and has not been tested on a large scale. With time, this may change as more users and businesses enter the market.

Could CeDeFi Be The Future of DeFi?

CeDeFi offers DeFi products at much lower costs while allowing for better regulatory compliance and security to users. However, it has its own shortcomings with a high learning curve and a lack of resistance to censorship.

This implies that DeFi will still have its place in the crypto market of the future, as some users will always require the complete freedom that comes with it. However, most ordinary investors may find the features of CeDeFi more attractive than DeFi’s freedom. CeDeFi thus has a lot of potential to grow and gather market share.

Final Thoughts

CeDeFi forms the perfect blend of DeFi and CeFi for regular users. While these platforms may have their shortcomings, it is undeniable that they add value to the lives of many investors. Its future looks promising, especially with large platforms such as Binance and Compound lending support to it.

You can learn more about crypto on ZebPay blogs. Trade confidently with ZebPay Singapore.