What is Tokenization?

Imagine you have a pizza that you want to share with your friends. One way to divide the pizza is by cutting it into slices. Each slice represents a portion that can be distributed among your friends. In the world of finance and technology, tokenization works similarly, with the principle being used for digital assets.

Tokenization is the process of assigning digital tokens to real-world assets. These tokens represent ownership or rights to an underlying asset. It’s like giving each piece of the pizza a unique number and saying, “This number represents a slice of the pizza.”

How Does Tokenization Work?

Tokenization involves several steps to transform physical assets into digital tokens:

- Asset Selection: An asset, such as a house, a piece of art, or even intellectual property rights, is chosen to be tokenized.

- Asset Valuation: The asset is appraised or evaluated to determine its value. This step helps in setting the parameters and understanding the worth of the digital tokens.

- Token Creation: Once the value is determined, digital tokens are created on a blockchain platform. These tokens contain information about the asset they represent, like ownership details and any rights or benefits.

- Legal and Compliance: Depending on the jurisdiction, regulatory requirements and legal agreements may need to be fulfilled. This ensures that the tokenization process adheres to the applicable laws and regulations.

- Token Offering: The newly created tokens are then made available for sale or distribution. Interested individuals can purchase these tokens, becoming owners of a fraction or a whole of the underlying asset.

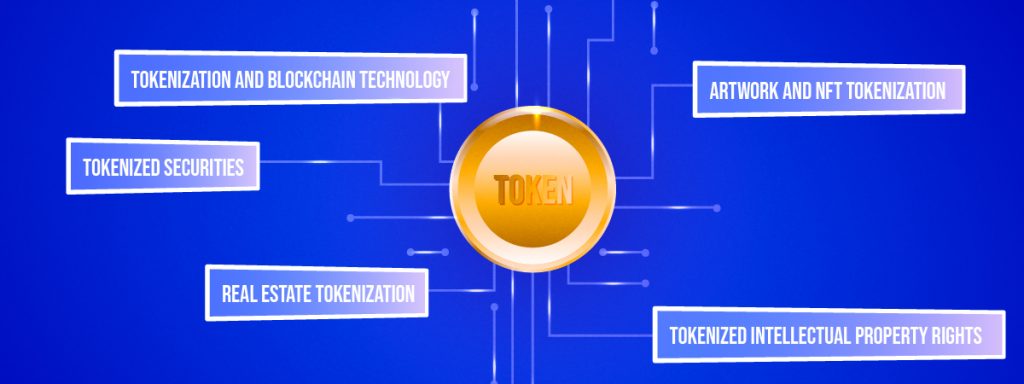

What are the Different Types of Tokenization?

Tokenization is a versatile concept that can be applied to various assets. Let’s explore some common types of tokenization:

Financial Asset Tokenization

Financial assets, such as stocks, bonds, or commodities, can be tokenized. By converting them into digital tokens, it becomes easier to trade and transfer ownership. Tokenized financial assets offer fractional ownership, allowing smaller investors to access markets that were previously limited to large institutions.

Real Estate Tokenization

Real estate, like houses, buildings, or land, can also be tokenized. This opens up investment opportunities in the real estate market to a broader audience. Tokenized real estate enables fractional ownership, reduces barriers to entry, and allows for easier transferability of ownership.

Art and Collectibles Tokenization

Tokenization has revolutionized the art market. Artworks and collectibles can be tokenized, creating digital representations of the physical objects. These tokens provide proof of ownership and can be bought, sold, or traded on digital platforms. It also allows art enthusiasts to invest in art pieces they believe in.

Intellectual Property Tokenization

Intellectual property rights, such as patents, trademarks, or copyrights, can be tokenized. By converting these rights into digital tokens, creators can monetize their intellectual property more efficiently. Tokenization enables the fractional sale or licensing of intellectual property, making it accessible to a wider range of individuals or businesses.

Read more: Tokenization vs Encryption

Benefits of Tokenization

Increased Liquidity

Tokenization improves liquidity by enabling fractional ownership. Instead of needing a large sum of money to buy an entire asset, people can buy smaller portions of it through tokens. This opens up investment opportunities and allows assets to be traded more easily.

Enhanced Accessibility

Tokenization makes traditionally illiquid assets, such as real estate or artworks, more accessible. It allows a wider range of investors to participate and benefit from asset ownership, promoting financial inclusion.

Transparency and Security

Blockchain technology, often used in tokenization, provides transparency and security. Each transaction and ownership transfer is recorded on the blockchain, ensuring a trustworthy and immutable record of ownership. This reduces fraud and enhances the security of the assets.

Fractional Ownership

Tokenization enables fractional ownership, meaning that multiple individuals can own a fraction of an asset. This flexibility allows for smaller investments and diversification across multiple assets, reducing risk.

What are Some Tokenization Examples?

Let’s explore a few examples of tokenization in different sectors:

Tokenized Securities

Traditional stocks and bonds can be tokenized, allowing investors to own fractional shares or bonds. This makes it easier for individuals to invest in companies or participate in fundraising activities. One example of such a platform is Polymath.

Real Estate Tokenization Case Studies

Real estate tokenization has gained popularity, with properties being divided into digital tokens. For example, a commercial building could be tokenized, allowing multiple investors to own a portion of the property and receive rental income accordingly. This can be done through a platform called Propy, which allows you to automate the transfer of properties.

Artwork and NFT Tokenization

Non-Fungible Tokens (NFTs) have become a hot topic in recent years. NFTs represent virtual assets like art, music, or virtual land. These tokens enable artists to monetize their creations and provide collectors with proof of ownership. Maecenas is a platform that allows investors to buy fractional ownership of fine art.

Tokenized Intellectual Property Rights

Creators can tokenize their intellectual property, such as patents or copyrights. This allows them to license or sell fractions of their rights, generating revenue and expanding their reach. IPwe is one such example that automates the process of transferring patents.

Tokenization and Blockchain Technology

Tokenization often goes hand in hand with blockchain technology. Blockchain provides the infrastructure for creating, managing, and trading digital tokens. Its decentralized and transparent nature ensures the security and integrity of tokenized assets.

Future of Tokenization

The future of tokenization looks promising. As technology evolves, more assets are likely to be tokenized. Tokenization has the potential to disrupt traditional financial systems, democratize investments, and provide new avenues for wealth creation and ownership. Additionally, government and regulatory support are sure to make tokenization a thriving industry.

Conclusion

Tokenization is the process of converting traditional, real assets into crypto tokens. It offers benefits such as increased liquidity, enhanced accessibility, transparency, and fractional ownership. Tokenization can be applied to various assets, including financial assets, real estate, artwork, and intellectual property rights. With the rise of blockchain technology, the future of tokenization holds great potential in revolutionizing the way we buy, sell, and invest in assets.

Invest in crypto with ZebPay Singapore and join the millions of traders already on the platform.