In a fast-evolving financial system, crypto is emerging as a transformative force, challenging traditional banking systems and making its way into the finance field. Crypto offers a new approach to financial services, extending opportunities to the unbanked and underbanked populations worldwide. In this blog, we explore more about the role of crypto in advancing financial inclusion, highlighting its benefits, challenges, and potential future.

Understanding Financial Inclusion

Financial inclusion is the process of ensuring that individuals and businesses have access to useful and affordable financial products and services. Services like transactions, payments, savings, credit, and insurance are included and delivered responsibly and sustainably. Except for the advancements in the financial sector, a significant part of the global population still needs to be included in the formal financial system. According to the World Bank, around 1.4 billion adults worldwide are unbanked, lacking access to essential financial services.

Challenges with Traditional Banking Systems

Traditional banking systems face several challenges that interfere with financial inclusion:

- Geographical Barriers: Many rural and remote areas lack physical bank branches, making it difficult for residents to access financial services.

- High Costs: Low-income individuals resist bank fees and minimum balance requirements.

- Limited Financial Literacy: A lack of understanding about banking products and services adds to the exclusion.

The Promise of Crypto

Crypto, powered by blockchain technology, offers several advantages that can tackle the limitations of traditional banking systems:

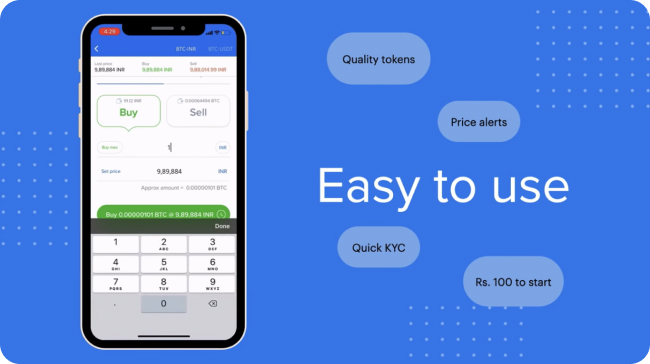

- Accessibility: Crypto can be accessed via the internet, eliminating the need for physical bank branches and making financial services available to anyone with a smartphone or computer.

- Low Transaction Costs: Crypto transactions often involve lower fees than traditional banking, making them more affordable for low-income users.

- Decentralization: The decentralized nature of crypto reduces dependence on central authorities, empowering individuals to manage their finances independently.

- Global Reach: Crypto facilitates global transactions, enabling seamless international transactions and reducing the dependency on costly intermediaries.

Cross-Border Transactions and Remittances

One of the biggest effects of crypto on financial inclusion is its ability to completely transform cross-border transactions and remittances. Conventional money transfer services are typically both costly and slow, characterized by high fees and unfavourable currency conversion rates. On the flip side, crypto provides a quicker, more affordable, and more transparent option. For example, a migrant worker could use crypto, such as Bitcoin, to send money to their family in a different country with low fees and quick processing times. This not only guarantees that a larger portion of the earnings goes to the receiver but also promotes increased financial security for families in underdeveloped and developing nations around the world.

Financial Empowerment and Ownership

Crypto empowers individuals by giving them direct control over their finances. Unlike traditional banking systems, where intermediaries manage funds, crypto enables users to store, send, and receive money without needing a bank account. This financial independence is particularly valuable in regions with unstable banking systems or where trust in financial institutions is low.

Additionally, blockchain technology, which underpins crypto, offers transparency and security. Every transaction is recorded on a public ledger, reducing the risk of fraud and corruption. This transparency can build trust among users and encourage greater participation in the financial system.

The Future of Crypto in Financial Inclusion

The future of crypto in financial inclusion looks promising, with several developments on the horizon:

- Stablecoins: Stablecoins are pegged to stable assets like fiat currencies, offering a solution to the issue of volatility and providing a reliable store of value.

- Decentralized Finance (DeFi): DeFi platforms offer financial services such as lending, borrowing, and earning interest without traditional intermediaries. This innovation can further expand access to financial services.

- Central Bank Digital Currencies (CBDCs): Many central banks are exploring the issuance of digital versions of their national currencies. CBDCs can combine the benefits of crypto with the stability and trust associated with central banks.

Conclusion

Crypto has the potential to play a vital role in advancing financial inclusion by offering accessible, affordable, and secure financial services to underserved populations. By addressing the limitations of traditional banking systems and empowering individuals with financial support, crypto can drive economic growth and improve livelihoods globally. However, realizing this potential requires addressing regulatory, security, and educational challenges to create an inclusive and sustainable financial ecosystem. As the crypto landscape continues to grow, it holds the promise of a much better financial future for all.

Send this blog to other like-minded crypto enthusiasts if you’ve enjoyed reading this article. Click on the button below to begin your crypto journey on ZebPay.