Introduction

Digital assets have become increasingly important in our modern world. They offer new ways to handle money and make transactions online. In this article, we will explore the differences between Central Bank Digital Currency (CBDC) and crypto, and understand how they impact our financial systems.

What is Central Bank Digital Currency (CBDC)?

CBDC is a type of digital currency issued and controlled by a country’s central bank, like the Federal Reserve or the Reserve Bank of India. It works just like traditional money but in a digital form. Central banks are responsible for managing and regulating the country’s money supply.

CBDC is designed to be used within the existing financial system. It has the same value as the physical money we use every day. The goal of developing CBDC is to improve the efficiency and security of financial transactions.

Crypto

Crypto is a type of digital asset that is not controlled by any central authority like a government or a bank. It operates on a technology called blockchain, which is like a digital ledger that keeps track of all the transactions.

One of the key features of crypto is decentralization. This means that no single entity has control over it. Popular crypto assets like Bitcoin and Ethereum are examples of decentralized digital currencies. They can be used for various purposes, such as buying goods and services, investing, or even creating new digital assets.

Read more: Crypto Investing vs Crypto Trading

CBDC vs Crypto: Key Differences

Issuing authority and control

CBDC is issued and controlled by central banks, while crypto is not controlled by any central authority.

Centralization vs Decentralization

CBDC is centralized, meaning it operates within the control of a central authority, whereas crypto is decentralized, meaning it operates without a central authority.

Read more: CEX vs DEX

Legal tender status and acceptance

CBDC is considered legal tender, just like physical money, and is widely accepted. crypto assets, on the other hand, are not legal tender in most countries, and acceptance varies.

Stability and price volatility

CBDC is designed to have a stable value, similar to traditional money. crypto assets, however, can have high price volatility, meaning their value can change rapidly.

Privacy and anonymity

CBDC transactions can be tracked and monitored to some extent, ensuring compliance with regulations. crypto transactions can offer enhanced privacy features, but concerns exist about their potential use in illicit activities.

Regulatory Framework and Compliance

CBDC operates within existing financial regulations and is subject to anti-money laundering measures. crypto assets are still evolving in terms of regulations and pose challenges for compliance.

CBDC vs Crypto: Use Cases and Objectives

CBDC: Enhancing monetary policies and financial stability

CBDC aims to improve existing monetary policies and ensure stability in the financial system. It can provide governments with better tools to manage the economy and respond to financial crises.

Read more: Role Of CBDC In Ensuring Economic Stability

Crypto: Facilitating decentralized transactions and digital assets

crypto assets enable peer-to-peer transactions without the need for intermediaries like banks. They also facilitate the creation and exchange of digital assets, opening up new possibilities for innovation and decentralized applications.

Transaction Mechanisms

CBDC: Centralized transaction validation and clearing

CBDC transactions are validated and cleared by central banks and traditional financial institutions. This ensures that transactions are secure and comply with regulations.

Crypto: Decentralized peer-to-peer transactions

Crypto transactions occur directly between individuals or entities through the use of blockchain technology. The decentralized nature of crypto assets eliminates the need for intermediaries.

Technology Infrastructure

CBDC: Utilizing existing banking infrastructure

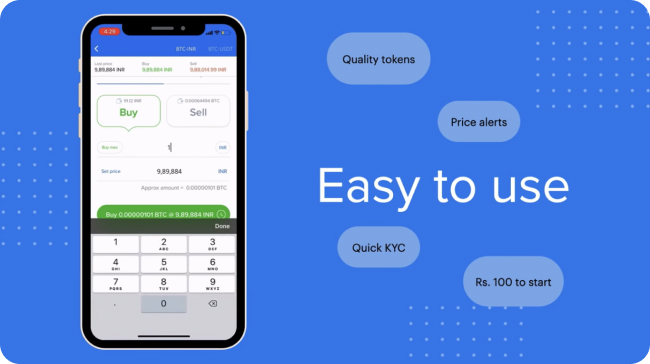

CBDC leverages the existing infrastructure of banks and financial institutions. It can be accessed through mobile apps, online platforms, or even special cards.

Crypto: Reliance on blockchain technology

crypto assets rely on blockchain technology, a distributed ledger system that ensures transparency, security, and immutability. Users need digital wallets to store and manage their crypto assets.

Monetary Policy Implications

CBDC: Influence on money supply and interest rates

CBDC provides central banks with more direct control over the money supply and interest rates. They can adjust these factors to manage inflation, stimulate economic growth, or stabilize the economy.

Crypto: Limited impact on traditional monetary policies

crypto assets operate independently of traditional monetary policies. They are not influenced by interest rates or inflation rates set by central banks.

User Privacy and Anonymity

CBDC: Balance between privacy and regulatory requirements

CBDC offers a balance between user privacy and the need for regulatory oversight. Transactions can be tracked to ensure compliance with laws, but personal data protection measures are also implemented.

Crypto: Enhanced privacy features but concerns over illicit activities

crypto assets provide enhanced privacy features through pseudonymous transactions. However, this anonymity can raise concerns about illicit activities, such as money laundering or financing terrorism.

Regulatory Framework and Compliance

CBDC: Compliance with financial regulations and anti-money laundering (AML) measures

CBDC operates within existing financial regulations, including anti-money laundering measures. This ensures that transactions are transparent and traceable, helping to prevent illegal activities.

Crypto: Evolving Regulations and compliance challenges

Crypto assets face evolving regulations, as governments and financial authorities work to establish frameworks for their use. Compliance with regulations can be challenging due to the global nature of crypto assets.

Crypto vs CBDC: Advantages and Disadvantages

CBDC: Enhanced financial inclusion and stability, but potential surveillance concerns

CBDC can improve financial inclusion, making financial services more accessible to everyone. It also offers greater stability compared to crypto assets. However, concerns exist about potential surveillance and data privacy.

Read more: Pros and Cons of CBDC

Crypto: Decentralisation and borderless transactions, but price volatility and regulatory uncertainties

Crypto assets provide decentralized transactions, allowing people to send money across borders quickly. They also offer new opportunities for innovation. However, price volatility and regulatory uncertainties remain challenges.

Future Perspectives and Coexistence

Potential integration and collaboration between CBDC and Crypto

In the future, we might see integration and collaboration between CBDC and crypto assets. This could combine the advantages of both systems and create new opportunities for financial services.

Coexistence within the digital economy

CBDC and Crypto assets can coexist in the digital economy, serving different purposes and meeting different needs. They offer alternatives to traditional money and promote innovation in the financial sector.

Read more: Road to CBDC Implementation

Conclusion

To summarize, Crypto and CBDC comparison reveal distinct characteristics and roles in our financial systems. CBDC is issued and controlled by central banks, operating within existing regulations and aiming to enhance stability. Crypto assets, on the other hand, are decentralized and offer borderless transactions, but their price volatility and regulatory uncertainties remain challenges. Understanding these differences helps us navigate the evolving landscape of digital currencies and their impact on our daily lives.

You can read more about Crypto, Blockchain and Web 3.0 on ZebPay Blogs. Click on the button below and join the millions trading on ZebPay Singapore.