Decentralised finance, or DeFi, consists of many financial products and services easily accessible to anyone from anywhere in the world. DeFi allows crypto users greater control over their funds. New Decentralised projects are added weekly, making it a hotbed for innovation.

Getting Started with DeFi Investments

It is vital to do your due diligence and research about the various aspects of a DeFi protocol. It is essential to educate yourself about DeFi as there are several risks associated with it. Risks such as rug pull scams, fake projects, exit scams, and others, so do your research before investing in any DeFi protocol. It is best to invest in DeFi projects that have already been audited. Here are some of the steps to get started with DeFi:

Set up a Crypto Wallet

Crypto wallets are digital wallets that allow you to store crypto and interact with various DeFi protocols. Usually, there are two types of digital wallets: cold and hot wallets. Choose a crypto wallet that best serves your financial interests and goals.

Acquire Crypto Coins

Similar to stocks, where you need cash to invest, you need to acquire crypto coins to participate in and interact with various DeFi protocols. Some wallets are on crypto exchanges, where you can purchase crypto coins. Most protocols are built on the Ethereum platform, so it is advisable to start with ERC-20 tokens.

How to Identify DeFi Investment Opportunities?

Now that we know the first steps to getting started with DeFi, let’s look at some protocols that make it popular for investments.

Staking

One of the most common crypto investment options is staking. It is essentially a buy-and-stake investment strategy to earn profits in the long run. It involves locking up crypto tokens to validate transactions in the DeFi protocol. You can earn profits from transactions made within the protocol you help validate. Some Crypto staking options can make you more money than traditional savings accounts. It is a good option if you have a large amount of crypto sitting in your wallet and want to put it to good use. Most popular crypto exchanges offer staking services, which can prove profitable, especially now as millions of dollars are being put into new blockchain protocols.

DeFi Lending

Similar to traditional lending, crypto users can earn interest by lending their crypto to borrowers. Decentralised applications, or dApps, connect borrowers to lenders based on loan size and crypto collateral.

Read more: How Does DeFi Lending Work

DeFi Trading

You can also earn by trading various Defi related crypto on popular crypto exchanges like ZebPay, Binance, and Coinbase.

Interest in Savings Accounts

Another investment option in DeFi is to create a crypto savings account. You can earn interest by transferring crypto sitting idle in your wallets to a crypto savings account. DeFi savings accounts can offer higher yields compared to traditional savings accounts. For example, Aqru, a crypto savings account provider, offers flexibility to users by not putting conditions on locking their crypto and allowing them to withdraw whenever they wish.

DeFi Yield Farming

Crypto yield farming is a more complex version of staking, and the term comes from how farmers maximize their yield by switching from one crop to another. Similarly, DeFi yield farming is about rotating your crypto investments to different yield farms. This DeFi protocol uses smart contracts to lock crypto tokens and pay interest.

What are the Risks and Mitigation Challenges in DeFi Investment?

Failure among start-ups is common, so new companies using DeFi technology may not succeed, resulting in a loss of funds. Additionally, DeFi protocols do not provide insurance like traditional institutions in case of theft or if you become a victim of a crypto scam.

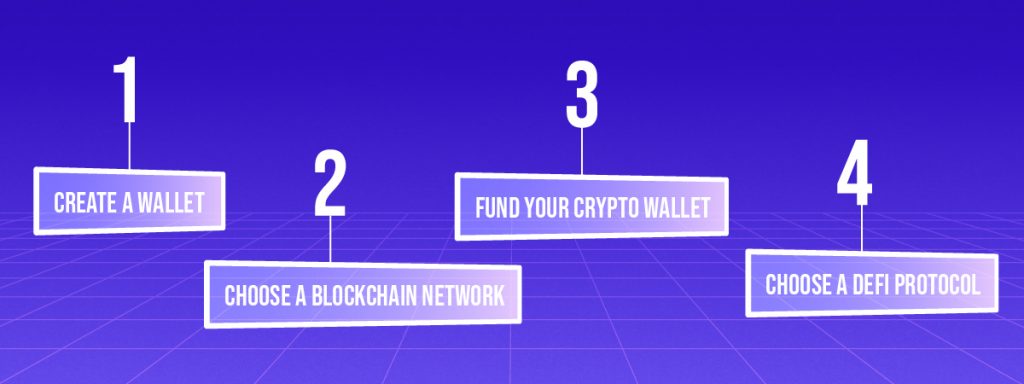

Steps to Invest in DeFi: A Step-by-Step Guide

Create a Wallet

You have to create a crypto wallet to start investing in various DeFi protocols. Hot and cold wallets are the two main types of crypto wallets. Choose a crypto wallet that best suits your financial interests and goals.

Choose a Blockchain Network

Choose a primary network for your DeFi investment after you have set up your crypto wallet. For example, Ethereum is the leading blockchain for DeFi protocols.

Fund your Crypto Wallet

Next, purchase native crypto tokens of the blockchain of your choice, such as ETH for Ethereum. You can buy crypto tokens from either a centralised or Decentralised crypto exchange.

Choose a DeFi Protocol

Choose a protocol to start your DeFi investment journey by staking or lending crypto tokens. You can also invest in liquidity pools to diversify your crypto portfolio.

Conclusion

DeFi protocols offer similar services as conventional financial institutes, such as lending, savings accounts, and trading, but they are Decentralised and enable users to have better control over their funds. This article lists ways to get started with DeFi investments. There are several investment opportunities in DeFi, such as yield farming, staking, and savings accounts. DeFi has become a popular method to invest in crypto. However, there are some risks, just like any other investments. So it is vital to do your research and understand the various aspects of a DeFi protocols before investing.

You can buy popular Defi related crypto on ZebPay Singapore! Click on the button below and begin trading.