A notable breakthrough has been made in the crypto world with the approval of the first Ethereum (ETH) Exchange-Traded Funds (ETFs) by the U.S. Securities and Exchange Commission (SEC). This approval represents a significant achievement for the crypto industry, showcasing Ethereum’s increasing recognition and promise as a mainstream investment option. In this blog post, we will explore the implications of this approval for investors, the crypto market, and the wider financial system.

The Significance of SEC Approval

The approval of Ethereum ETFs by the SEC is a significant milestone in the cryptosphere. In the past, the SEC had hesitations about greenlighting crypto ETFs, referring to worries about market manipulation, liquidity, and protecting investors. Nevertheless, Ethereum’s approval for ETFs could not be avoided after Bitcoin’s earlier success. This action indicates the regulatory agency’s growing trust in the stability and development of the crypto market. Ethereum, the crypto ranked second by market capitalization, has always been popular with investors due to its strong blockchain technology and ability to execute smart contracts. Approval of Ethereum ETFs enables conventional investors to access ETH without directly buying the digital asset.

What Are Ethereum ETFs?

It is an investment fund that mirrors the price of Ethereum and is listed on regular stock markets as an Ethereum ETF. Investors can purchase and trade ETF shares similarly to how they would buy and sell stocks. The price of the ETF shares changes based on the Ethereum price, allowing investors to invest in ETH without the need to deal with the challenges of owning the crypto directly.

Advantages for Investors:

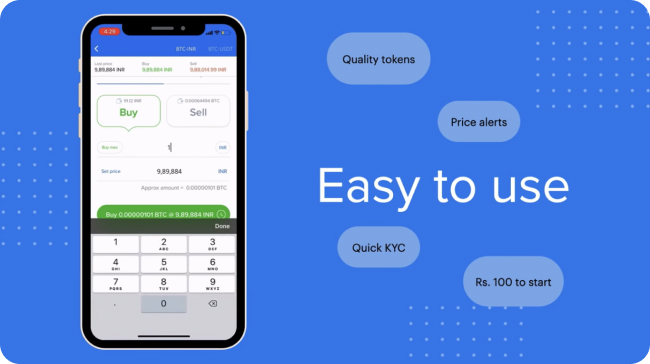

Accessibility: Ethereum ETFs offer a convenient way for beginners to invest in crypto. Purchasing ETF shares using conventional brokerage accounts is easier than creating a crypto wallet and dealing with exchanges.

Controlled Environment: ETFs, being regulated financial tools, provide investors with a sense of security and transparency that is attractive.

Diversification: Ethereum ETFs provide investors with the opportunity to diversify their portfolios by gaining access to the growing crypto market. At a time when digital assets are more and more considered as a protection against inflation and economic uncertainty, this can be especially appealing.

Impact on the Crypto Market

Crypto enthusiasts feel that the introduction of Ethereum ETFs will have a favourable influence on the overall crypto market. Here are some possible results:

- Greater Liquidity: The presence of ETFs may result in more trading activity and enhanced liquidity in the Ethereum market. This can aid in stabilizing prices and decreasing volatility, thus increasing Ethereum’s appeal as an investment choice.

- Increased utilization: With more investors being introduced to Ethereum via ETFs, a wider acceptance of the crypto and its foundational technology is likely. This has the potential for innovation and growth in the Ethereum ecosystem, such as with DeFi projects and smart contract applications.

- Market Authenticity: SEC approval enhances the credibility of Ethereum and the wider crypto market. This may inspire other regulatory agencies globally to grant comparable approvals, nurturing a more supportive regulatory atmosphere for crypto.

Future Prospects

The acceptance of Ethereum ETFs paves the way for a variety of potential opportunities. Other crypto assets, like Solana and Ripple, could follow Ethereum’s path, resulting in a wide range of crypto financial products. Also, the advancement of more complex ETF arrangements, like leveraged and inverse ETFs, may provide investors with fresh opportunities to benefit from market fluctuations.

Conclusion

The crypto market takes a significant leap with the SEC’s endorsement of Ethereum ETFs. It offers investors a controlled, easy, and safe method to invest in Ethereum, which could lead to more liquidity, wider acceptance, and market validation. As the crypto market evolves, Ethereum ETFs may create new investment opportunities, connecting traditional finance with the digital asset world.

Stay tuned to Zebpay’s blog for more updates on this exciting development and other trends in the crypto market.