The Tron Foundation created and released TRON (TRX), a decentralised blockchain-based operating system, in 2017. Initially released on Ethereum as ERC-20-based tokens, TRX tokens were eventually migrated to their own network. The overinflation of Tron-related tokens follows a Nov 10th agreement that allows holders of assets such as TRX, BTT, JST, and SUN to withdraw funds. This has resulted in traders on FTX bidding up the price of Tron-related tokens in order to recoup their locked funds. The price of the token has risen by a marginal percentage of 1.13 while the volume is up by 13.15%.

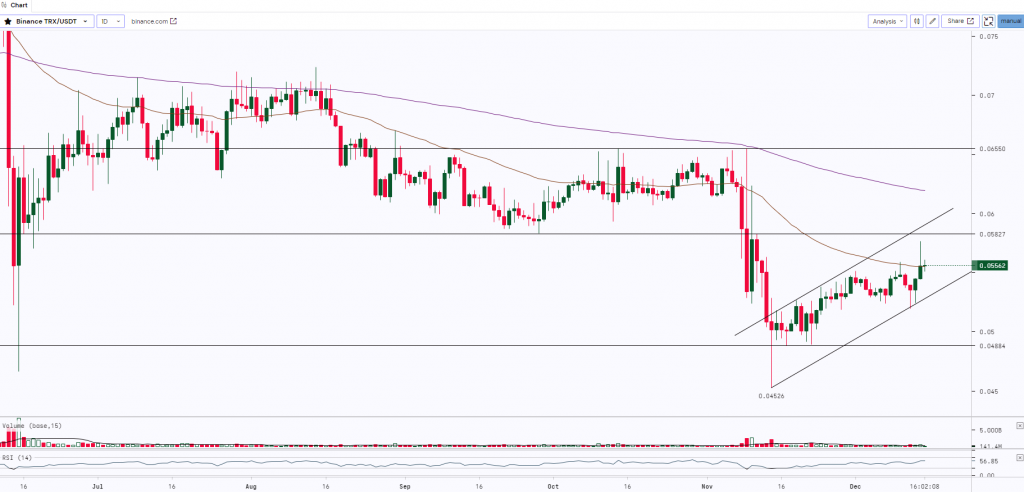

At the time of writing, TRX was trading at $0.055

TRX after making the low of $0.04526 started trading in an ‘Ascending Channel’ and made the high of $0.0545. However, the bulls failed to push the prices above the key resistance of $0.0582, and the higher longer shadow indicates selling at these levels. Once the resistance is breached with good volumes we can expect the asset to rally up to the $0.065 mark. The lower uptrend line will act as strong support for TRX.

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $0.048 | $0.051 | TRX | $0.0582 | $0.0655 |

Disclaimer: This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in cryptos viz. Bitcoin, Bitcoin Cash, Ethereum etc. are very speculative and are subject to market risks. The analysis by Author is for informational purposes only and should not be treated as investment advice.