When you think of crypto gains and losses, high risk and high reward are what come to mind. But what if you could do away with the complicated trading strategies and earn an income passively? This is where crypto lending can help you. So read on to explore how crypto lending works, with some of the best platforms to get started.

How Does Crypto Lending Work?

Crypto lending is the process of giving out your crypto holdings to other users for a fee. Borrowers can use these funds for various purposes, such as trading, investing, or paying bills. As a lender, you earn interest on your loaned funds. Crypto lending platforms facilitate the process of matching lenders and borrowers, as well as managing the loans and collateral.

The Role of Smart Contracts in Crypto Lending

Smart contracts are self-executing codes that run on blockchain technology. They enable automated and transparent transactions without the need for intermediaries, such as banks or lawyers. Smart contracts play a crucial role in crypto lending by ensuring that the loan terms and conditions are met, and the collateral is secure. They also enable borrowers to retrieve their collateral once they repay their loans and interest.

The Benefits and Risks of Crypto Lending

Some of the most important crypto lending benefits include:

- High returns: Crypto lending rewards include higher interest rates than traditional savings accounts or bonds. The interest rates vary depending on the platform, the crypto token and the loan term.

- Low barriers to entry: Anyone with a crypto wallet and internet access can participate in crypto lending, regardless of their location, income or credit score.

- Diversification: Crypto lending enables investors to diversify their portfolios by allocating a portion of their assets to crypto lending. This can provide a hedge against market volatility.

However, crypto lending risks must also be considered, such as:

- Volatility: A crypto token’s price can fluctuate rapidly, affecting the collateral’s value and the borrower’s ability to repay the loan.

- Security: Crypto lending security is dependent on the platform you choose. Protocols may be vulnerable to hacking, fraud, or other security breaches, which can result in the loss of funds and data.

- Lack of regulation: Crypto lending is a relatively new and unregulated industry. The standard operating procedures on lending are still under development.

Regulatory Challenges and the Future of Crypto Lending

Crypto lending faces several regulatory challenges, as governments and financial institutions struggle to keep up with the rapid growth of crypto. Some countries, such as the United States, have imposed strict regulations on crypto lending platforms, while others have yet to develop a clear regulatory framework.

However, despite these challenges, the future of crypto lending looks promising. As more people adopt crypto as an asset class, the demand for crypto lending will increase. Moreover, the development of DeFi and blockchain technology will likely improve the efficiency and security of crypto lending, making it more attractive to investors.

Read more: What is DeFi Lending

Conclusion: Crypto Lending as a Promising Investment Opportunity

Crypto lending offers a unique investment opportunity for those looking to earn passive income on their crypto assets. While it involves certain risks, it also offers high returns, low barriers to entry, and diversification. Moreover, with the increasing popularity of crypto and the development of DeFi technology, the future of crypto lending looks bright. Be sure to do your research before trusting a platform with your funds.

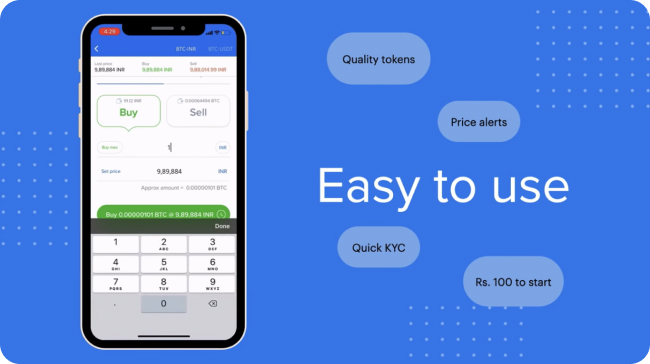

You can read more about Web 3.0, Crypto Lending and blockchain on ZebPay blogs. Join the millions already using ZebPay Singapore.

FAQs on Crypto Lending

Is Crypto Lending Better For Long-Term Or Short-Term Investments?

Most platforms offer greater returns when participating in long-term lending. However, crypto lending for short-term investing is always an option if you prefer a more liquid portfolio.

How Do I Choose A Crypto Lending Platform?

When choosing a crypto lending platform, it’s important to consider several factors. These include interest rates, fees, loan terms, security measures and compliance. You should also research and compare different platforms to find the one that best fits your needs and goals.

Is Crypto Lending Safe?

Crypto lending platforms employ various security measures, such as multi-factor authentication, cold storage and auditing. However, crypto lending involves certain risks, and users should carefully consider their risk profile before participating.

How Do I Get Started With Crypto Lending?

To get started with crypto lending, you’ll need a crypto wallet and an account on a crypto lending platform. You can then deposit your crypto assets into your account, choose a lending option, and start earning interest on your funds. Be sure to read and understand the platform’s terms and conditions before participating.