When it launched in 2008, Bitcoin was the only crypto coin available in the market. Today, there are thousands of options to choose from. However, Bitcoin remains the largest and most influential coin in the entire crypto space. Its size and popularity have also been found to impact crypto market trends – sometimes referred to as Bitcoin dominance. So what is Bitcoin dominance and how can you use it in your trading activities?

Definition of Bitcoin Dominance

There are several coins to choose from in the crypto market. One of the easiest ways to determine their value is to look at their “market capitalization”. This is calculated by multiplying the number of tokens by their price. It gives us an idea of how much money the entire supply of tokens is worth.

How is BTC dominance calculated? Bitcoin dominance is defined as the ratio between Bitcoin’s market cap and the entire crypto market’s capitalization.

The History of Bitcoin Dominance

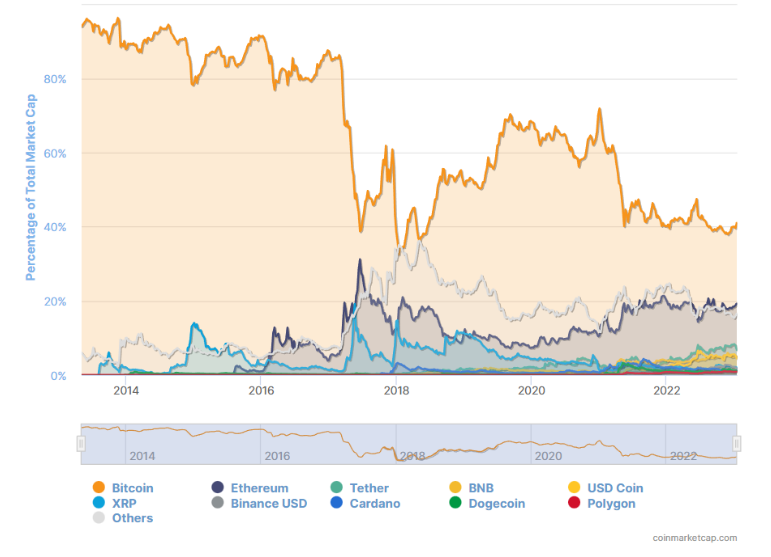

Early in crypto’s history, investors were not very enthusiastic about coins other than Bitcoin. This was reflected in how Bitcoin dominance reached 94% in 2013, as alternatives were not appealing to individuals.

Altcoins gained popularity with the Initial Coin Offering (ICO) boom of 2017. This is when Bitcoin dominance emerged as a compelling index of market performance. But it only became a mainstream metric with the rapid growth of the crypto market in 2021. It is now regularly used by price-tracking platforms as a measurement tool.

Factors that Influence Bitcoin Dominance

Many events in the market may affect Bitcoin’s dominance.

- Features of Altcoins – Most altcoins before 2015 served very simple purposes – improving on some aspects of Bitcoin. There were no additional features added. This changed with the advent of Ethereum and smart contracts, which revolutionized what was possible with blockchains. Now, crypto tokens are used everywhere from DeFi to gaming and art, which has reduced BTC dominance.

- Stablecoins – Stablecoins are crypto tokens that eliminate price variability in favour of easier transactions. As more and more individuals use stablecoins for trading and transactions, the crypto market gains value without any change in Bitcoin. This can reduce BTC dominance.

- Market Cycles – Bull or bear markets can have uncertain effects on Bitcoin’s dominance. These days, Bitcoin is considered a relatively safe asset in the crypto space. Thus, in a bear market, BTC dominance will be expected to increase. In a bull market, however, investors would choose to move their funds to riskier alternatives, reducing BTC dominance.

Read more: What is Crypto Trading Bot

How Does BTC Dominance Work?

BTC Dominance works because of Bitcoin’s visibility in the media. Most individuals first learned of Bitcoin when its price almost hit $20,000 in the bull run of 2017. This led to many stories of individuals who suddenly became millionaires or billionaires thanks to BTC’s rapid rise.

Investors soon figured out that calculating Bitcoin’s “power” or dominance in the market could allow them to measure market performance and sentiments. It is essentially Bitcoin’s share in the crypto market, from which you can draw insights for your investment strategy.

Read more: Bitcoin Price Prediction

Understanding Bitcoin Dominance Charts

Now that you know how BTC dominance works, it is important to understand how to read its price charts.

How to Read Bitcoin Dominance Charts

This is a typical crypto dominance chart used by many platforms. Here, the X-axis tracks the time. The Y-axis is what determines a coin’s “dominance”. It calculates the market cap of a token as a percentage of the whole crypto market’s capitalization. As you can see, until the beginning of 2017, BTC dominance remained above 80%. Today, this value is closer to 40%.

Interpreting Changes in Bitcoin Dominance

Changes in dominance can occur due to many reasons. For example, a bear market means declining prices of all assets. Investors may feel their money is more secure in Bitcoin and shift their funds to it, leading to a rise in Bitcoin dominance.

On the other hand, suppose there is a network upgrade to Bitcoin that makes it much more appealing to investors. Bitcoin’s price will rise along with its popularity. This situation would also lead to BTC dominance. However, the causes are different. Thus, it is crucial to look at all aspects of the market to draw meaningful conclusions from BTC dominance data.

Comparing Bitcoin Dominance to Other Metrics

Why do we use Bitcoin dominance? There are simpler metrics like market capitalization that can be used. The problem is that market cap is an absolute measure. BTC dominance relates Bitcoin’s capitalization to the entire market – thus forming a more statistically relevant metric.

Imagine if a token ABC has an increase in its market capitalization by 100% – doubling its value. However, its dominance may rise from 0.1% to 0.2%. The dominance metric allows us to contextualize the gains in a coin.

Implications of Bitcoin Dominance

The Relationship Between Bitcoin Dominance and the Overall Crypto Market

Diversity in the market is a good indicator of market breadth. Market breadth is important for individuals who wish for variety in investment opportunities. If Bitcoin’s dominance reduces in the long run, investors will benefit from a larger pool of investments to choose from.

The Impact of Bitcoin Dominance on Altcoins

As mentioned above, more choice is usually preferred in a financial market. If Bitcoin continues to be the dominant investment, altcoins will not have the opportunity to succeed. They must get the funds and attention required to innovate in the crypto space.

Potential Implications for Investors and Traders

Diversity in both the market and your portfolio reduces risk while allowing for competitive returns. Traders and investors are sure to benefit from lower Bitcoin dominance, as it makes it easier to diversify your portfolio.

Predictions for the Future of Bitcoin Dominance

Factors that Could Affect Bitcoin Dominance in the Future

Decentralized Finance and decentralized applications are rapidly growing fields within crypto. Unfortunately, Bitcoin is not a part of this growth as it does not support dApps. As these new features gain more users and popularity, Bitcoin’s dominance in the market will inevitably reduce.

Expert Opinions on the Future of Bitcoin Dominance

Experts believe that Bitcoin dominance will continue to be a relevant metric in some cases. As of now, every token in the market is compared to Bitcoin. But more relevant comparisons are to those that serve the same purposes – as a P2P transaction system and store of value. In such cases, Bitcoin dominance may still be important to your investment decisions.

How to Trade Crypto Using BTC Dominance?

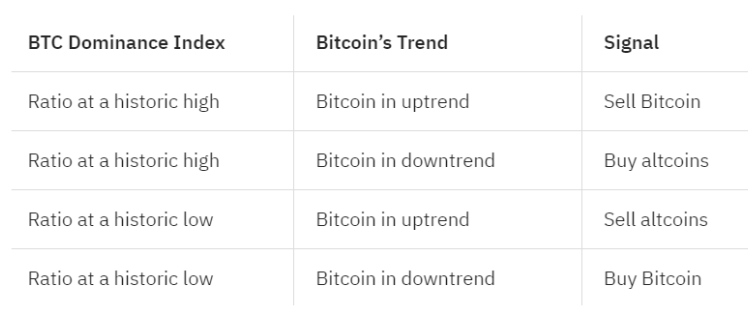

This table by ByBit presents a good general strategy for using BTC dominance for investments. Comparing the movements of the index with Bitcoin’s trend can give meaningful insights into what your investments should target.

Conclusion

Recap of Key Points

Bitcoin dominance is the ratio between BTC’s market cap and the entire crypto market’s capitalization. This metric shows Bitcoin’s power to influence the market. It can be used by investors to decide their investment strategy in the crypto market.

Read more: Crypto Investing vs Crypto Trading

Future outlook for Bitcoin Dominance

Bitcoin dominance may be losing relevance as a general metric with time. It is expected that other tokens like Ethereum and Solana are going to gain more power in the market in the future.

You can read more about crypto on ZebPay blogs. Begin you crypto trading journey today using ZebPay.

FAQs on What is BTC Dominance

What Happens When BTC Dominance Drops?

Generally, BTC dominance drops when the market is bullish or there are new tokens that draw investor attention. Depending on the situation, shifting your investment to altcoins may give you higher returns.

What Happens When BTC Dominance Goes Up?

This happens when the market is bearish or Bitcoin becomes a more attractive investment opportunity. You may benefit by shifting your investments into BTC.

Why Use BTC Dominance While Trading Crypto?

Since BTC is the largest token in the market, it has the potential to influence general crypto trends. Understanding the impact of BTC is important for effective crypto trading strategies.