Crypto assets are the newest addition to an array of asset classes available today. With several institutional investors stepping into the Digital Asset space, retail investors are the next to follow. Crypto trading involves a trader taking a buy or a sell position for a short period in anticipation of price appreciation. The fundamentals of the asset class usually take a back seat when trading Cryptos. There are several different methods using which one can trade Cryptos. This article comprehensively details most of the available trading methods.

Trading vs Investing in Crypto

Trading and investing are often used interchangeably but are two very different strategies used to accrue wealth. Trading is anticipating a short-term price movement using a reliable technical indicator. Traders usually buy and sell in less than a year. Some trades are for as short as a day.

Crypto investing on the other hand is buying an asset and holding it for a long period. Usually more than a year. Although at what price one buys an asset is important, valuation usually takes a back seat while making investment decisions. The logic is that over a long period, a fundamentally strong asset appreciates and gives handsome returns. For example, Bitcoin and Ethereum are two examples of Cryptos which have given handsome returns to investors over a long period.

Read more: Crypto Investing vs Crypto Trading

Crypto Trading Methods

While the list of trading strategies is endless, we have listed key techniques used by traders. These strategies should help one decide the risk-reward dynamics of trading.

Crypto Day Trading

Intra-day trading involves buying and selling an asset on the same day. It’s purely dependent on the buy-sell market forces which impact the price on that particular day. Retail investors benefit during intra-day trading by shadowing institutional traders whose positions have an impact on the price of the asset. For example: When a large institutional investor takes a position in a coin like Bitcoin or Ether, the price of the asset shoots up. Retail traders can benefit from these market movements if they are quick to act in such situations.

Read more: How To Pick Crypto For Day Trading?

What Is Swing Trading in Crypto

Swing trading is when the asset is bought and usually sold after a week or a month depending on the price movements. Unlike Intra-Day trading, swing trading requires price monitoring for a longer period. Swing trading is also a combination of fundamental and technical analysis of the asset. Example: The Ethereum Merge event which recently took place saw a lot of traders using the swing trading strategy to enter and exit the market. Historical analysis of the asset is also key when Swing trading is deployed.

Arbitrage in Crypto

Arbitrage is a strategy used by traders to buy and sell assets over multiple exchanges. For example: If Bitcoin is trading at $ 17,500 on one exchange and $ 17,700 on another exchange, the trader buys the asset on one exchange and transfers the assets to the other exchange and sells it there, thereby making a profit. In the case of Arbitrage, the trader must pay commissions to each of these exchanges.

Crypto Futures Trading

Future trading involves getting into an agreement to buy an asset at some future date for a specific price. The contract binds the agreement. Future trading involves having a knack for making good predictions about price movements.

High-Frequency Trading

It involves trading using Algorithmic methods which scan the markets based on pre-defined conditions. High-Frequency trading enables bots to place orders on your behalf when conditions are met. It requires a trader to be well versed in programming and financial modelling. It is often seen as a strategy more suitable for experienced market traders.

Range Trading in Crypto

Range trading involves price monitoring in a certain range. Traders should be well aware of concepts such as Support and Resistance lines to profit through range trading. Support and Resistance points are Technical indicators which are indicative of trend reversals. Historical backdating is also a key to making accurate inferences from technical charts. For example: If Ether is trading in a range of $ 900 to $ 1100, it is an opportunity for a trader to buy low and sell high within this range.

Scalping in Crypto

Crypto Scalping involves making gains over several trades over a short period. These gains could be less on a per-trade basis, but when all the transactions are consolidated, the gains result in a sizable amount.

Since it involves placing orders at a high speed, traders prefer highly liquid assets. There should be a market which is ready to buy the orders at any given point in time to ensure successful scalping. Traders should have a good understanding of volumes, price points, news and any other technical indicators to capitalize on scalping opportunities.

Trend-Based Trading in Crypto

Trend-based trading involves taking market signals and developments on a macroeconomic level to anticipate price appreciation. For eg: If a new Metaverse token based on a game is launched and if the game witnesses a surge of downloads and an increasing user base over a period, then the price of the coin could appreciate. Trend-based trading involves a trader being vigilant of everyday happenings in the market.

Advantages and Disadvantages of Crypto Trading

| Advantages | Disadvantages |

| Volatile market opportunities can help traders make profits | Understanding the market takes time and effort |

| Trading is open 24 hours-365 days unlike other markets | Users should ensure that they are well aware of all the security risks and trade on secure platforms |

| Algorithmic methods can eliminate manual interventions | Several techniques often confuse newbies on what to follow |

| Instant settlements | Few low-volume tokens can have liquidity issues |

| Decentralised Exchanges enable peer-to-peer transactions | Lack of resource material to guide traders |

Conclusion

Crypto trading presents opportunities to amass wealth. But it also comes with its risks just like any other market. Traders should ensure that they are armed with strategies and contingency plans. A well-researched approach is a key to performing better than the market.

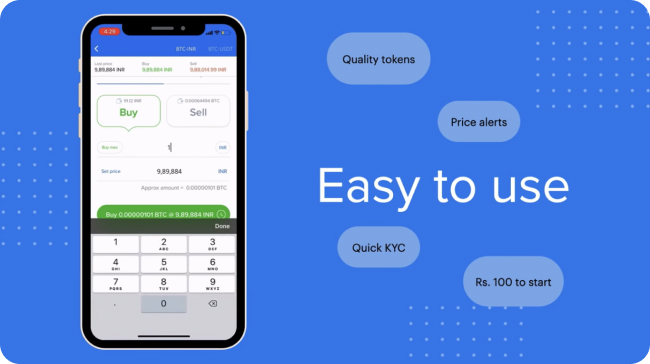

You can now buy 100+ Cryptos on ZebPay Singapore securely. Begin your Crypto trading journey today.