Introduction to Bitcoin Investment

Bitcoin has become one of the most sensational investment opportunities in recent years. You may have heard people talking about making a lot of money by investing in Bitcoin. But sometimes, you may wonder, “When is the best time to buy Bitcoins?”. It’s a crucial question, and this blog will explore different factors that can help you with your investment decision.

Evaluating the Current Market Conditions

Before investing in Bitcoin, you must evaluate the current market conditions. The price of Bitcoin is influenced by various factors, including supply and demand, investor sentiment, and market trends. By understanding these factors, you can gain insights into when it might be a good time to buy.

Market Analysis and Expert Opinions to Buy Bitcoin

Insights from Market Analysts and Crypto Experts

Market analysts and crypto experts closely follow Bitcoin and provide valuable insights into its potential future performance. They analyze historical data, market trends, and news events to make predictions about Bitcoin’s price movement. It can be helpful to listen to their opinions and consider their expertise when deciding whether to buy Bitcoin.

Technical Analysis and Price Predictions

Technical analysis is another approach used by experts to predict Bitcoin’s price. They examine charts, patterns, and indicators to identify trends and potential buying opportunities. Here are some technical analysis methods you can use to time Bitcoin:

- Moving Averages: Moving averages are used to identify trends and potential buy or sell signals. They calculate the average price of Bitcoin over a specific period, such as 50 days or 200 days. The moving average line smooths out price fluctuations and helps identify whether the trend is bullish or bearish.

- Support and Resistance Levels: Support levels are price levels at which Bitcoin has historically had difficulty falling below, indicating a potential buying opportunity. Resistance levels are price levels at which Bitcoin has historically had difficulty rising above, suggesting a potential selling opportunity.

- Trendlines: Trendlines are lines drawn on a price chart to visually represent the direction and strength of a trend. An uptrend is represented by a line drawn along the successive higher lows, while a downtrend is represented by a line drawn along the successive lower highs.

- Relative Strength Index (RSI): RSI is an oscillator metric that calculates the momentum of price movements. It ranges from 0 to 100 and indicates whether Bitcoin is overbought (above 70) or oversold (below 30).

Read more: Guide To Crypto Technical Analysis

Understanding Market Cycles and Patterns

Bitcoin, like many other assets, goes through cycles of ups and downs. Understanding these market cycles can help you identify when it might be a good time to buy. Typically, after a significant price increase, there may be a period of consolidation or correction before the next upward movement. Buying during these consolidation phases can be a strategy to consider.

Fundamental Factors Impacting Bitcoin’s Value

Apart from market analysis, fundamental factors can also impact Bitcoin’s value:

- Global Adoption: Bitcoin’s value is influenced by the level of global adoption and acceptance it receives. As more individuals, businesses, and institutions embrace Bitcoin as payment, the demand for Bitcoin increases.

- Regulatory Developments: Regulatory developments play a crucial role in shaping the value of Bitcoin. Governments around the world are continuously exploring ways to regulate crypto assets to ensure consumer protection. This is also intended to reduce the risk of money laundering and illegal activities.

- Institutional Interest: The involvement of large financial institutions and corporations in Bitcoin has a significant impact on its value. Institutional investors entering the crypto market bring increased liquidity and a higher level of credibility.

- Macroeconomic Conditions: Bitcoin’s value can be influenced by broader macroeconomic factors such as inflation, monetary policies, and geopolitical events. Bitcoin can be a hedge against inflation as its limited supply can protect against the erosion of value.

Read more: Fundamental Analysis In Crypto

Timing Strategies and Dollar-Cost Averaging

Dollar-Cost Averaging Methodology

Timing the market perfectly is challenging, even for experienced investors. One strategy that can help mitigate this challenge is dollar-cost averaging. Instead of investing a lump sum, you invest a fixed amount regularly over time. This way, you buy Bitcoin at different price points, averaging out the overall cost. Dollar-cost averaging in crypto reduces the impact of short-term price fluctuations and allows you to benefit from long-term growth.

Systematic Approach to Investing in Bitcoin

Another timing strategy is to take a systematic approach to investing in Bitcoin. Instead of trying to time the market based on short-term fluctuations, you can establish a plan to invest a certain amount at regular intervals, such as monthly or quarterly. By sticking to your plan, you remove the need to make emotional decisions based on market volatility.

Read more: What is Crypto SIP

Conclusion

In conclusion, determining the best time to buy Bitcoins can be challenging. It requires evaluating current market conditions, considering expert opinions, understanding market cycles, and staying informed about fundamental factors. Timing strategies like dollar-cost averaging and a systematic approach can help mitigate the challenges of timing the market perfectly. Remember, investing in Bitcoin or any other asset carries risks, and it’s important to do thorough research and seek advice before making any investment decisions.

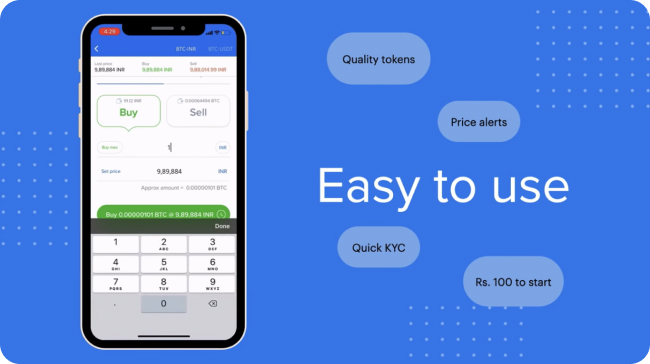

Invest in crypto with ZebPay Singapore and join the millions of traders already on the platform.