Say goodbye to cumbersome document submissions. Our latest product enhancement revolutionises KYC with a seamless, doc-free onboarding process. Discover how you can effortlessly complete your KYC requirements, setting a new standard for user-friendly compliance. Stay ahead with this exciting innovation!

KYC Powered by Digi Locker

With Digi Locker, your KYC process can be completed in a breeze. This effortless onboarding process aims to save time and has robust compliance protocols to ensure that you have the best possible experience on ZebPay. Below is the KYC process in brief.

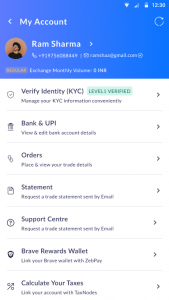

- Head to the “ My Account” section on your ZebPay App, and click on the “ Verify Identity(KYC)” tab to begin your KYC process.

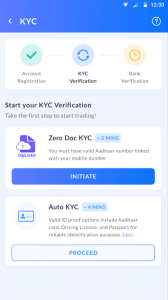

- Begin your Zero Doc KYC process through Digilocker by clicking on “ Initiate”.

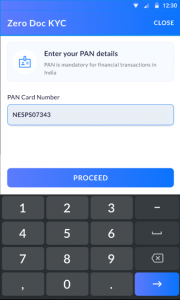

- Enter your Valid PAN details to proceed further. Digilocker will fetch your documents based on your PAN details.

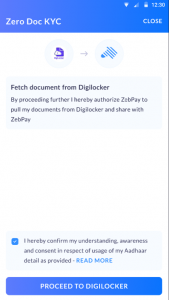

- Confirm the dialogue box and proceed to fetch the documents from DigiLocker.

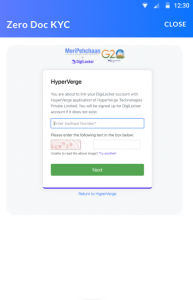

- You will be redirected to the Hyperverge screen which will enable you to proceed with registration. Enter your Aadhar number in the provision mentioned.

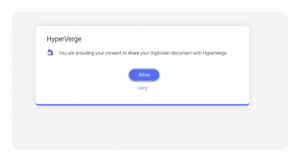

- Provide consent for Hyperverge to access your DigiLocker.

- Proceed to the selfie capture stage and capture a well-lit selfie. Images of photographers will be rejected. Please ensure that the selfie is taken live and the face is clearly visible within the frame.

- Head to the declaration section after the Selfie capture is completed and provide valid information in all the provisions. Click on submit and verify KYC after all the details are filled.

- Once you submit and verify your KYC, a confirmation screen will be displayed if your KYC is processed.

- In case your KYC has not been processed, the reasons for the same will be displayed on the screen. You can head back to a specific section and re-verify.

Auto KYC

You can also opt for the Auto KYC option to complete your KYC verification process. This process involves manually uploading your documents with the approximate time required to complete your KYC being less than 4 minutes. Ensure that you have your PAN card and your Address proof ( Aadhar Card/ Driving License/Passport) handy. Also, ensure that you capture your selfie in a well-lit area with a clear background. Once all your document uploads are completed, you can proceed to the “Declaration” section where you can enter all the required details. Your KYC will be instantly verified as shown in the example below. In case your KYC is rejected, the reasons for the same will be mentioned and you can re-verify as guided by the process.

Note: 1) Please note that the new KYC process has been enabled for ZebPay’s Web platform as well. 2) To use all ZebPay services, you must also ensure that your bank details are verified.