SOL, the native token of the Solana network, is a popular asset with a market capitalization of $13.6 bn. The asset dipped under the 20-day EMA ($40) this Tuesday and fell to the 50-day SMA ($37) yesterday. The reason for this dip might be due to the negative publicity it got over the $8 Million user fund having been taken out by unknown hackers from the Solana-based hot-wallets which included TrustWallet, Phantom, and Slope. This made the Solana ecosystem the biggest victim of the crypto asset hack.

Read more: Solana Ecosystem Under Attack

At the time of writing, SOL was trading at $39.7.

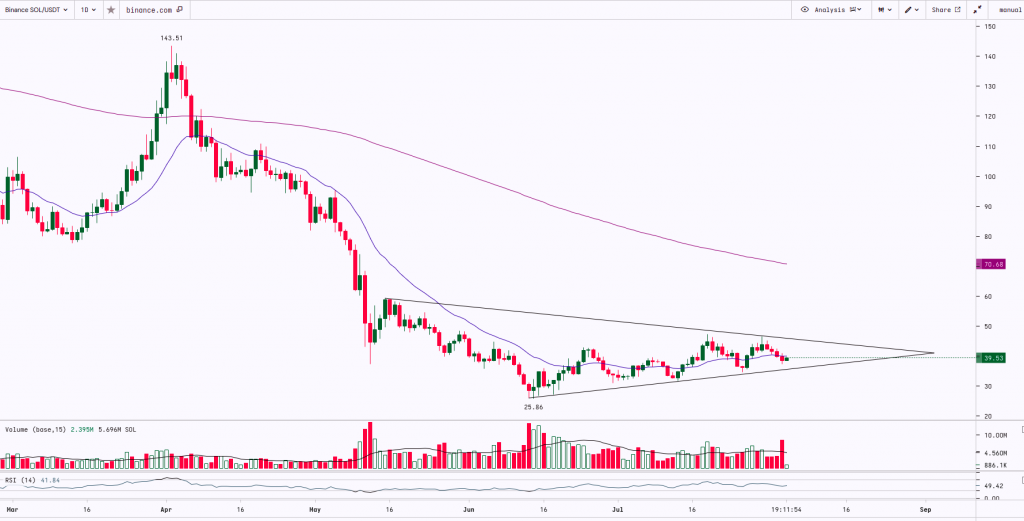

SOL made a ‘Shooting Star’ (Bearish) candle on 2nd April at $143 and plunged by almost 81% within three months making the low of $25.86. Post this move, the asset made a ‘Tweezer Bottom’ pattern at the low and rallied up to $47.36. Currently, on a daily time frame, SOL is trading in a ‘Symmetrical Triangle’ pattern where the ascending trendline acts as a support and the descending trendline acts as a strong resistance. Breakouts on either side of the pattern with good volumes will further decide the trend for the asset.

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $25 | $32 | SOL | $48 | $60 |

Disclaimer: This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation, or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness, or reliability of the information, opinions, or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in crypto assets viz. Bitcoin, Bitcoin Cash, Ethereum, etc are very speculative and are subject to market risks. The analysis by the Author is for informational purposes only and should not be treated as investment advice.