What is Proof of Reserves

In light of the recent events in the crypto industry, it could be hard for one to trust the safety of their assets. Proof of Reserves is a method which addresses the transparency concerns on assets held on exchanges. It is a much-required vetting technique to ensure that crypto is backed by real assets. Proof of Reserves uses the technique of Merkle trees, a data structure designed to encrypt blockchain data securely.

The recent events in the industry have dragged down the crypto market. Several tokens have dropped by more than 10%. At a time when investor sentiment is low and the market is showing evident fears, Binance CEO Changpeng Zao announced that they will employ a Proof of Reserves audit to ensure complete transparency of asset management. This method has swiftly drawn a lot of investor attention garnering widespread support.

How does the Proof of Reserves Audit work

A Proof of Reserves audit means that an exchange is partnering with a third-party crypto auditor to ensure that it has assets on its balance sheet and balances the customer holdings. This is to ensure that customer holdings are not misused and there are real assets backing the cryptos held. These third-party reports are cryptographically reconciled ensuring privacy and security. Merkle tree technique is deployed to conduct the entire process. Here is how it happens in brief.

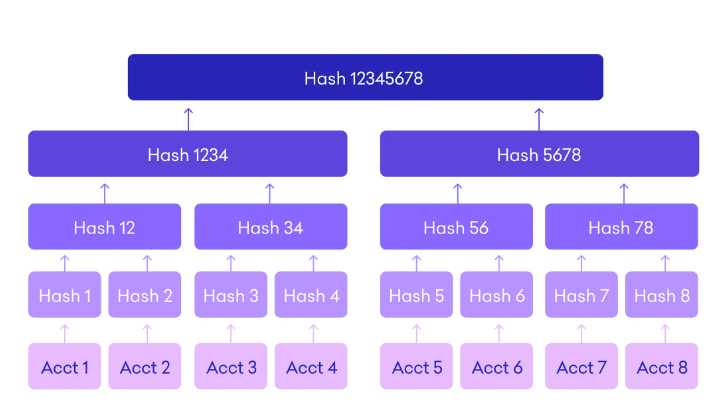

- The data of all the balances held is taken by the third party in the form of a Merkle tree

- A Merkle root is then obtained, which uniquely identifies and sums up the balances of all the accounts taken

- These balances are then verified on public blockchains where assets are held using the digital signatures provided by the exchange

- The data of the balances and the details of the assets on the public blockchains are verified. These numbers should balance, thus ensuring consistency

- Systems will also be set up for customers to check if the assets they hold are verified

- Any changes in data will affect the Merkel root indicating possible tampering with assets

Benefits of Proof of Reserve Audit

In a decentralised space like Crypto where systems are preferably designed to not have a single point of failure, it is imperative to have checks and balances in place.

There have been instances of bankruptcies in the case of traditional financial institutions as well. But in most cases, these institutions were bailed out by governments. Crypto institutions do not have the advantage of government institutions bailing them out in case of bankruptcy. Thus, the concept of Proof of Reserve brings in the best of both worlds which is the transparency of asset management and the privacy of customer assets.

In the case of Centralised Crypto exchanges, user assets are stored in a centralised database, and the Proof of Reserves method ensures that these assets are stored efficiently using the Merkel tree technique and that reliable third parties can audit and verify the data. It helps in the prevention of any misuse of funds.

Limitation of Proof of Reserve

Proof of reserve does ensure transparency in auditing and verification of funds. But at the same time, it has a few shortcomings.

- While Proof of Reserve does prove control over on-chain data and the funds being held, it cannot verify the exclusive ownership of a private key

- There is a possibility of collusion between the auditor and an auditee. But the responsibility to ensure transparency weighs on both sides

- Loss of Keys and stolen funds can reflect inconsistencies during the verification and the Proof of Reserves process cannot ascertain if funds have been borrowed by an exchange to pass an audit.

Conclusion

Initiatives like the Proof of Reserves will help restore confidence in the market. Though it comes with its own set of implementation challenges, it’s certainly a method which is for the greater good. While future developments can make the method better, it is a good place to start for helping the markets recover.

You can read more about the latest developments in crypto on ZebPay blogs. Level up your trading experience using ZebPay’s all-new upgraded interface.