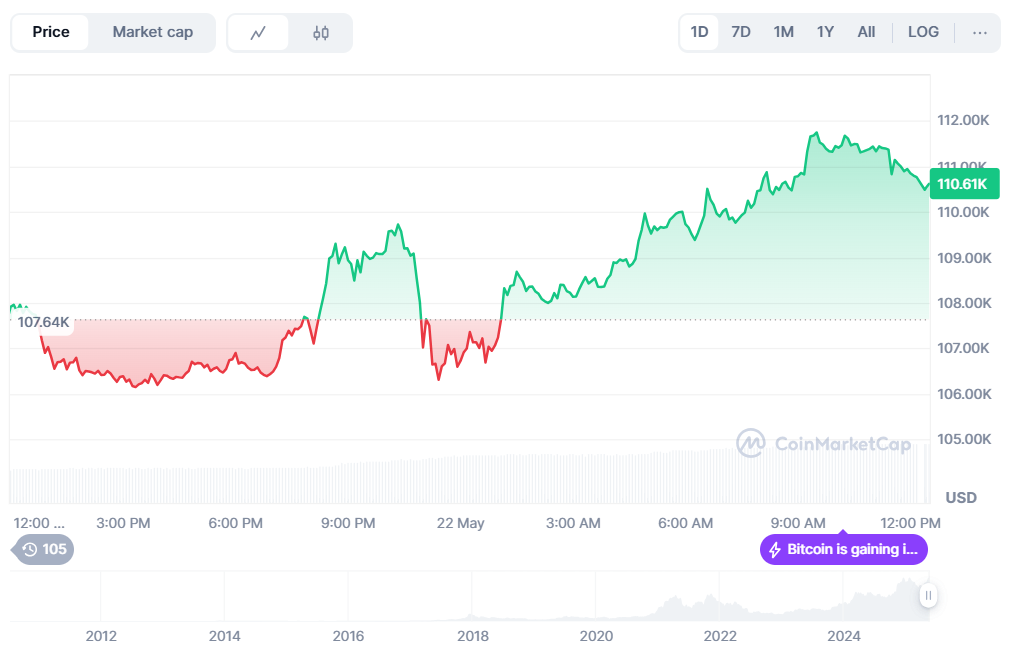

Bitcoin has recently soared to an unprecedented all-time high of over $110,000, marking a significant milestone in its 15-year journey. This surge is fueled by a confluence of factors, including easing macroeconomic concerns, substantial capital inflows into U.S.-based spot Bitcoin exchange-traded funds (ETFs), and growing institutional adoption.The achievement underscores Bitcoin’s maturation into a significant asset class, signaling a broader shift towards the acceptance and integration of digital assets into mainstream finance. As confidence in crypto assets strengthen, this development marks a pivotal moment for investors and the evolving digital economy. As of 22nd May, 2025 (12:13 PM IST), Bitcoin was trading at around $110,830, having a $2.2 trillion worth market capitalization and $91.09 billion worth market capitalization.

The Current State of Bitcoin

Price Trajectory Leading to the All-Time High

- In May 2025, Bitcoin achieved a new all-time high, surpassing $110,000, reflecting a significant upward trend from earlier this year.

- This ascent was marked by consistent weekly gains, indicating strong market momentum and investor confidence.

Key Factors Contributing to the Rally

- Institutional Investment: Major financial institutions and corporations have increased their exposure to Bitcoin, viewing it as a viable asset class. Institutional adoption of Bitcoin is accelerating, led by moves like JPMorgan Chase enabling client investments and major players like MicroStrategy and BlackRock, among others, deepening their involvement.

- ETF Inflows: The introduction and popularity of Bitcoin ETFs have facilitated greater access for investors, contributing to increased demand.

- Macroeconomic Conditions: Global economic uncertainties and currency fluctuations have led investors to consider Bitcoin as a hedge, further driving its demand.

- Technical Indicators: Analysts have observed bullish patterns, such as ‘golden cross,’ suggesting potential for continued upward movement.

Regulatory Developments Impacting Bitcoin

- U.S. Regulatory Clarity: The advancement of crypto-related legislation in the U.S., including stablecoin regulations, have provided a more defined framework for digital assets. On that note, passed in May 2025, the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) introduces federal oversight for stablecoins, setting standards for reserves, issuer transparency, and anti-money laundering compliance.

- Banking Sector Involvement: Regulatory authorities have affirmed that banks can offer crypto custody services, integrating digital assets into traditional financial systems. Regulators in both the U.S. and EU are opening doors for crypto services—while the U.S. Office of the Comptroller of the Currency (OCC) permits national banks to offer crypto custody, the EU’s MiCA framework allows financial institutions to provide similar services under a unified regulatory regime.

- Global Regulatory Trends: Other countries are also moving towards clearer crypto regulations, influencing global adoption and market stability. For example, in May 2025, Hong Kong introduced a landmark stablecoin law, creating a licensing system for issuers of fiat-referenced stablecoins. Under this framework, any entity issuing stablecoins in Hong Kong or pegged to the Hong Kong dollar must secure approval from the Hong Kong Monetary Authority (HKMA).

These developments collectively signify Bitcoin’s growing integration into the global financial landscape, with increased institutional participation, supportive regulatory environments, and favourable market conditions contributing to its recent performance.

Conclusion

Bitcoin’s historic surge past $110,000 is more than a price milestone—it’s a defining moment in the evolution of digital finance. This achievement reflects growing institutional confidence, maturing regulatory frameworks, and a broader market shift toward embracing decentralized assets. As Bitcoin cements its role as a core part of the financial ecosystem, its impact extends beyond price charts—driving innovation, encouraging regulatory clarity, and expanding access to alternative forms of value. For investors, this all-time high reinforces Bitcoin’s long-term potential and signals the continued rise of a more open, inclusive, and digitally driven financial future.

In the grand scheme of things, ZebPay blogs are here to provide you with crypto wisdom—get started today and join 6 million+ registered users to explore endless features on ZebPay!