Bitcoin is moving towards retesting its lower levels, and this could help some altcoins like UNI and AAVE have a breakout. Over the weekend, the asset has lost its ground as investors remain cautious about US consumer inflation data due July 13. Analysts expect CPI in June to be above May’s 8.6% level. Due to macro uncertainty, investors are not confident that the correction is over. Readings from the Reserve Risk, which measures long-term investor sentiment, fell to a new record low in July. BTC’s dominance is around 42.8%, trading over a 7% increase.

At the time of writing, BTC was trading at $20650.

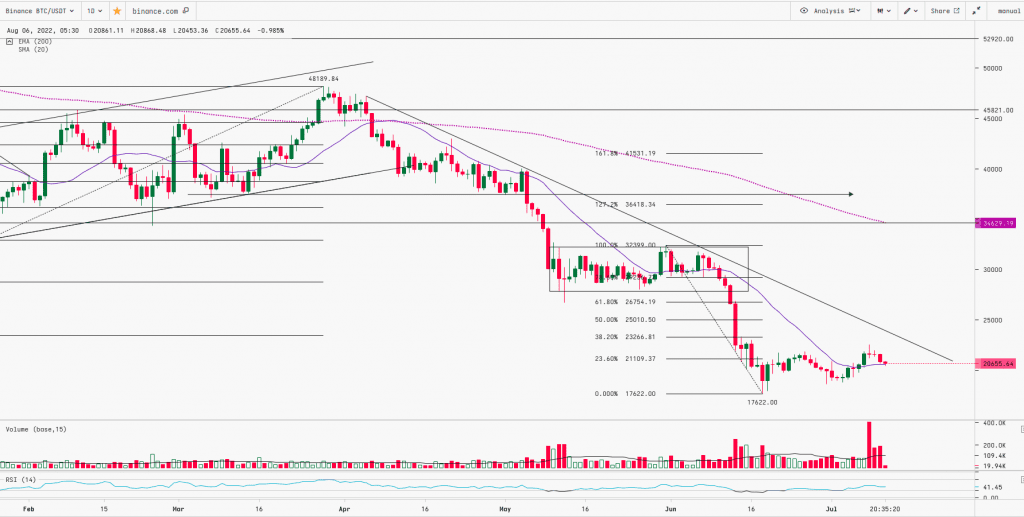

BITCOIN made double Doji candles at $19,000 and started to move up with low volumes and made a weekly high of $22,527. The asset faced stiff resistance at $23,000 and again made two back-to-back Doji candles around the resistance indicating indecision in the trend. Bitcoin has strong support at $17,000 whereas $23,000 will act as a strong resistance. Breakouts on either side of the range will decide the further trend for the asset. A flat Moving Average and RSI around 50 indicate a neutral stance for the asset.

Key Levels:

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $15,500 | $17,000 | BTC | $23,000 | $28,000 |

Disclaimer: This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in cryptocurrencies viz. Bitcoin, Bitcoin Cash, Ethereum etc. are very speculative and are subject to market risks. The analysis by the Author is for informational purposes only and should not be treated as investment advice.