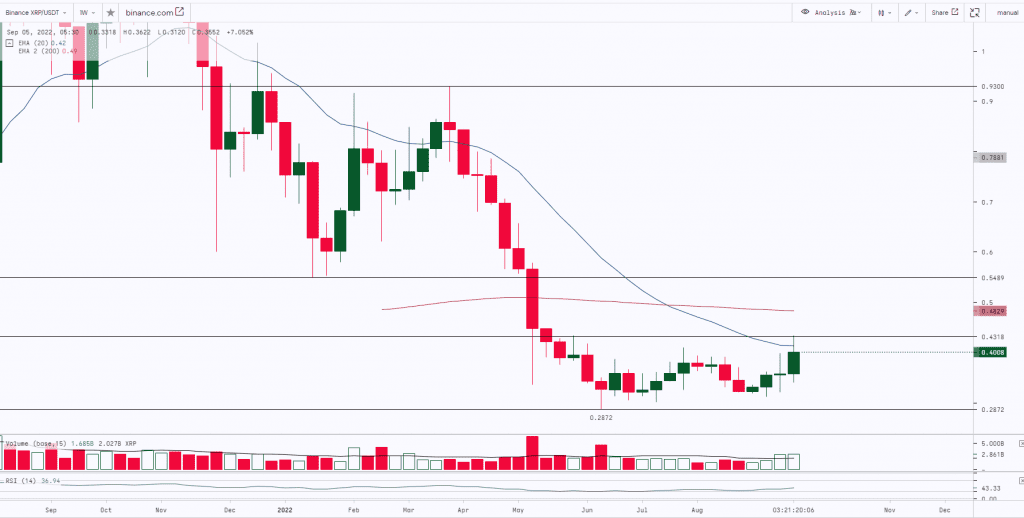

Ripple (XRP) seems to be quite an interesting asset to look out for this week and there has been a lot of conversation about it on Twitter lately. Members of the XRP army have suggested that if XRP wins its case with the SEC and is not considered collateral, the price could “go to the moon”. Essentially, there is a pre-bullish precedent of a long period of consolidation within a rounded bottom similar to what we can see over the past 137 days. Though volume has fallen by around 8%, the price has broken a long-term descending trendline that has historically served as resistance. The price increased by around 2.6%, and from the perspective of XRP’s HTF market structure, one could conclude that a price floor has been discovered.

At the time of writing, XRP was trading at $0.4003.

XRP witnessed a sharp fall and the prices plunged almost by 69% from $0.93 to $0.2872 (28th March 2022 to 13th June 2022). Post this move the asset is trying to make a base at $0.3 to $0.28 levels and is consolidating in a broad range from $0.305 to $0.407 with low volumes. XRP has a strong resistance zone from $0.41 to $0.43 (Horizontal trendline and 20 Week Moving Average). Once the asset closes and sustains above the resistance with good volumes then we can expect it to further rally up to $0.55 levels.

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| 0.287 | 0.325 | XRP | 0.41 | 0.43 |

Disclaimer : This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in cryptos viz. Bitcoin, Bitcoin Cash, Ethereum etc. are very speculative and are subject to market risks. The analysis by Author is for informational purposes only and should not be treated as investment advice.