What’s in store for you?

With several high-performance features, ZebPay’s Perpetual Futures enable you to level up your Crypto trading. With immense liquidity on Bitcoin and Altcoin Futures, you can now make the most of your capital at the click of a button.

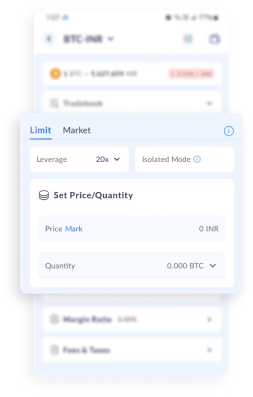

Up to 75x leverage

Elevate your trading game with up to 75x leverage and enhance the potential of your capital.

Quick Trade vs Open Order Book

EUR-Crypto &

Crypto-Crypto Trading

Instant order placements

Place your orders with a 0-time delay. Whether it is a buy order or a sell order, your settlements happen instantly.

Elevate your Trading Process

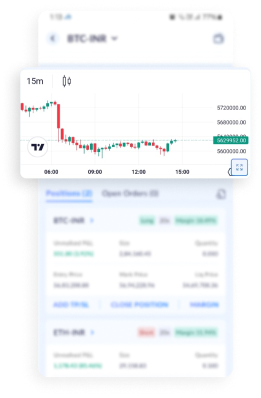

100+ indicators at your fingertips to perform in-depth technical analysis for your trades.

Quick Trade vs Open Order Book

EUR-Crypto &

Crypto-Crypto Trading

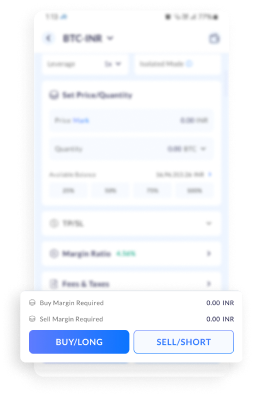

Market and Limit Orders

Place orders at the Market price or your desired price using Limit orders. Make your trades work for you as you see fit.

How to trade Crypto Perpetual Futures on ZebPay?

1. Create an account on ZebPay

2. Complete your KYC and Bank Verification process

3. Log in to ZebPay’s Mobile or Web platform

4. Deposit INR funds to your ZebPay Fiat wallet

5. Transfer funds from your Fiat wallet to the Futures wallet and begin trading!

Start your Crypto Perpetual Futures

trading journey today

Frequently Asked Questions

01 What are Perpetual Futures?

Perpetual Futures are crypto derivative contracts that allow you to take positions on the price movements of crypto assets without an expiration date. You can open long or short positions and keep them open as long as you want, subject to funding and margin requirements.

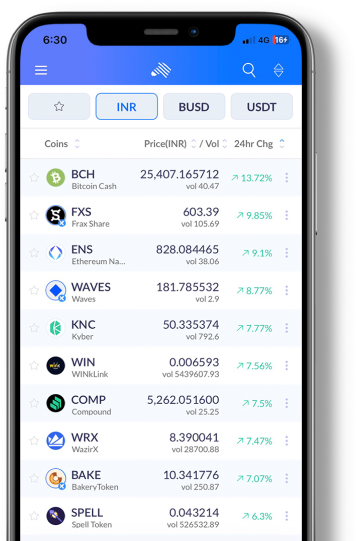

02 Which trading pairs are available for Perpetual Futures on ZebPay?

ZebPay offers futures trading on popular crypto-INR and crypto-USDT pairs such as BTC-INR, ETH-INR, BTC-USDT, and ETH-USDT. With 200+ tokens available, users have access to a wide range of trading options.

03 What is the maximum leverage offered?

ZebPay offers up to 75x leverage, allowing you to amplify your position size significantly with a relatively small capital outlay.

04 What type of orders can I place?

You can place both Market Orders (executed immediately at the best available price) and Limit Orders (executed only at your specified price or better)

05 Are there any advanced trading tools available?

Yes, ZebPay provides access to 100+ technical indicators and interactive charting tools to help you analyze the market and make informed decisions.

06 How do I start trading Perpetual Futures on ZebPay?

- Complete your KYC and sign in

- Deposit funds into your ZebPay wallet

- Transfer the desired amount into your Futures wallet

- Choose your trading pair, set leverage, and place your order

07 What is the Futures Wallet and how is it different?

The Futures Wallet is a separate wallet on ZebPay used exclusively for trading perpetual futures. You must transfer funds into this wallet to start trading. Both INR and USDT balances are displayed within the Futures Wallet.

08 Can I access Perpetual Futures on mobile?

Yes, the feature is available on both ZebPay’s web and mobile platforms, giving you the flexibility to trade on the go.

09 How fast are orders executed on Perpetual Futures?

ZebPay enables instant order placements with zero delay. Whether you’re placing a buy or sell order, your trades are executed and instantly settled.

10 Is this feature available for all users?

Perpetual Futures trading is available to KYC-verified users who meet the eligibility criteria.

11 How are “orders” different from “positions” in trading?

- Orders are instructions to buy or sell an asset at a specific price.

- Positions represent the actual holdings after an order is executed. Example: Placing a buy order creates a long position if filled.

12 How can I set Take Profit (TP) and Stop Loss (SL) levels, and can they be modified after opening a position?

TP and SL levels can be set while placing an order or added after a position is opened. Yes, both can be modified or canceled at any time before the position is closed.

13 What does Margin Ratio mean in crypto futures trading?

Margin Ratio = (Used Margin/Total Account Equity) x 100

It indicates how much of your equity is tied up in active trades. A higher ratio means you’re closer to liquidation.

14 What are long and short positions, and how do you choose which one to take?

- Long: When you enter a new position by buying an asset, you are taking a long position. You should take a long position when you expect prices to rise.

- Short: When you enter a new position by selling an asset, you are taking a short position. You should take a short position when you expect prices to fall.

Choose based on market analysis: bullish = long, bearish = short.

15 How to calculate tax on crypto futures trading in India?

Earnings from crypto futures are considered part of speculative business income and are taxed according to your personal income tax slab.

16 In what ways is crypto futures trading different from spot trading?

- Ownership: Spot = real asset; Futures = contract.

- Leverage: Available in futures, not in spot.

- Risk/Reward: Higher in futures due to leverage.

17 How does liquidation occur in crypto futures trading, and what triggers it?

Liquidation happens when your margin balance falls below the maintenance margin, triggered by adverse price movements that reduce your equity beyond allowed limits.

18 What is the distinction between maker and taker fees in crypto futures trading?

- Maker Fee: Charged when you add liquidity (e.g., place a limit order). Lower when you are placing a buy order & Higher when you are placing a sell order

- Taker Fee: Charged when you remove liquidity (e.g., place a market order).