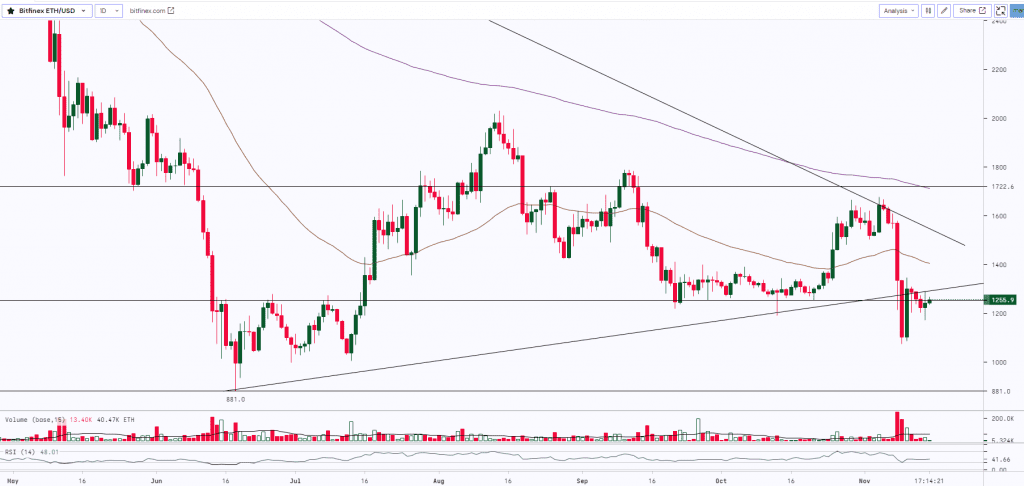

The price of Ether noticed a 22 per cent fall this week in spite of ETH becoming deflationary for the first time since the official Merge. Over 8,000 ETH have been burned within the remaining seven days, bringing the yearly supply rate to -0.354%. In addition to the FTX debacle hampering the asset’s price, a massive number of futures sell-offs led the price to hit a monthly low of $1070 this week. Traders using leverage were surprised when the price action caused the biggest shock on derivatives exchanges since August 18th. The price level of $1070 on November 9th was the lowest since July 14th, marking a 44% correction in three months. At present, ETH is trading at around 6% higher and volume is also up by almost 18% over the past 24 hours.

At the time of writing, ETH was trading at $1,255.

ETH faced stiff resistance at the downsloping trendline (drawn from an all-time high) and witnessed a sharp fall. The prices plunged almost by 36% making the low of $1,074. The asset broke the uptrend line and the long-held support of $1,200 and gave a weekly closing below that. Currently, on a daily time frame, ETH is hovering around the key level of $1,200-$1,250. If the bulls manage to push prices above $1,400 then we can see some up-side move whereas if it sustains below $1,200 then it can lead to further downfall.

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $1,000 | $1,200 | ETH | $1,400 | $1,750 |

Disclaimer: This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in crypto assets viz. Bitcoin, Bitcoin Cash, Ethereum etc. are very speculative and are subject to market risks. The analysis by the Author is for informational purposes only and should not be treated as investment advice.