BTC price action erases every trace of the week’s volatility as investors and traders wait for the excitement to return. The asset remained rigidly tied to $19,000 through the weekly close on Oct 16th as analysts warned that volatility was long overdue. After US economic data triggered a series of significant false events during the week, Bitcoin returned to its original position, showing no marginal change in price. But the volume is up by around 17% and dominance is at 40.03%

At the time of writing, BTC was trading at $19,281.

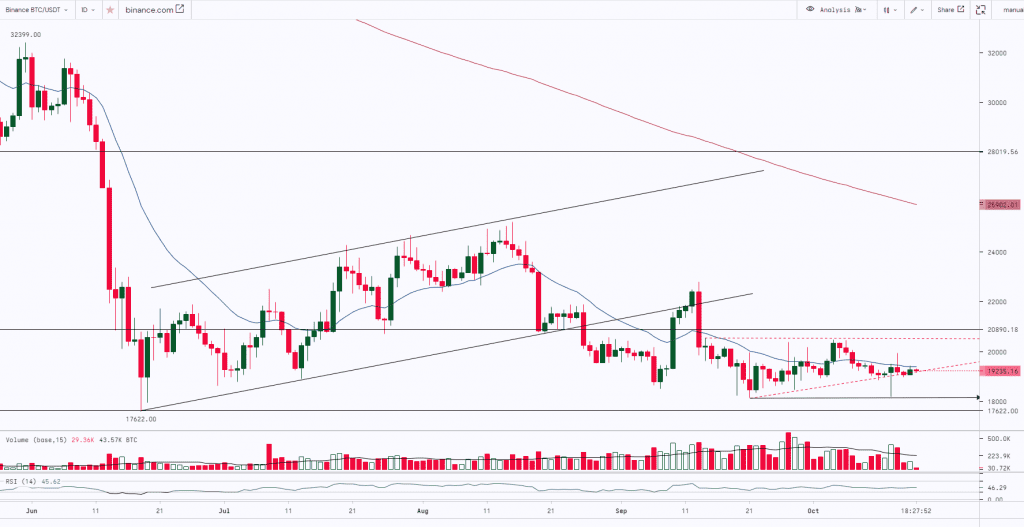

BITCOIN continues to trade sideways in a range from $18,000 to $20,500. The asset is forming an ‘Ascending Triangle’ pattern. It broke the pattern on the downside and made the weekly low of $18,190. However, the prices reversed from the support at the lower horizontal trendline and gave a daily closing inside the pattern. The lower longer shadow indicates that the bulls are buying the dip. BTC has a strong support zone from $18,000 to $17,500 ($17,622 Previous Bottom) whereas $20,750 and $22,500 are acting as strong resistance levels. Breakouts on either side of these levels with good volumes will further decide the trend for the asset. Flat Moving Averages and an RSI around 50 indicate a neutral stance for the asset.

Key Levels:

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $15,000 | $17,500 | BTC | $22,500 | $28,500 |

Disclaimer: This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors in consultation with a professional advisor when deciding if an investment is appropriate. The Company has prepared this report based on information available, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in cryptos viz. Bitcoin, Bitcoin Cash, Ethereum etc. are very speculative and are subject to market risks. The analysis by Author is for informational purposes only and should not be treated as investment advice.