Bitcoin price seems to be on the downside but this could offer trading opportunities in altcoins like MATIC, ATOM, and CHZ. US stock markets plummeted on August 26th after Powell’s speech in which he restated the aggressive stance of the central bank to fight an inflationary environment. Bitcoin (BTC) and crypto markets continued their correlation with the stock market and also saw a sharp sell-off on August 26th. The flagship crypto is down by 14% this month. The volume is down by around 4.6% and the dominance of BTC is at 39.7%.

At the time of writing, BTC was trading at $19,812.

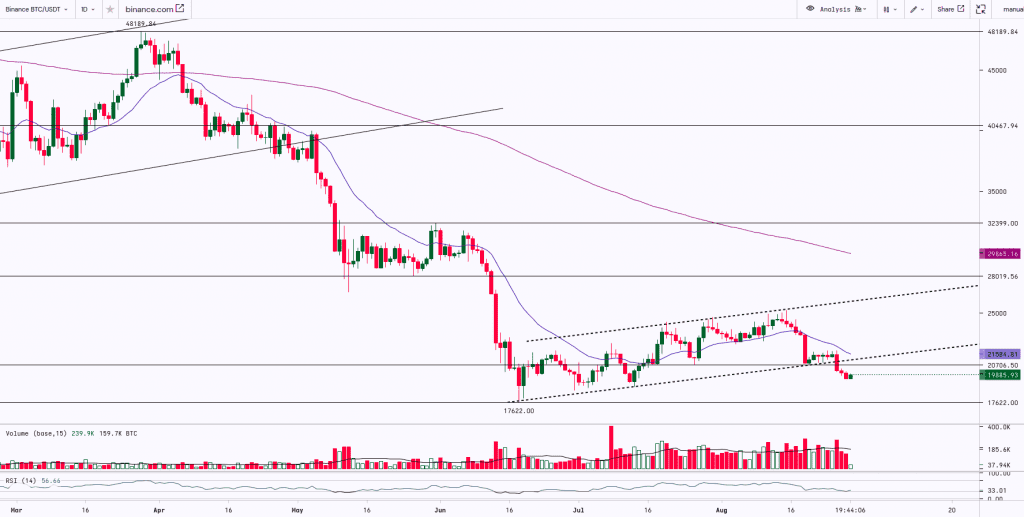

Bitcoin witnessed a sharp correction and the prices fell almost 22% from the recent high of $25,211 to $19,520. On a daily time frame, the asset was trading in an ‘Ascending Channel’ pattern, it resisted at the upper trendline of the channel and finally gave a breakout on the downside this weekend. BTC has support at $18,500, if it breaks the support then the prices can further drop and test the previous bottom of $17,622 whereas $20,500 will act as a strong resistance. Downsloping Moving Averages and RSI below 50 indicate a bearish stance for the asset.

Key Levels:

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $15,500 | $17,500 | BTC | $20,500 | $24,500 |

Disclaimer: This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in cryptos viz. Bitcoin, Bitcoin Cash, Ethereum, etc. are very speculative and are subject to market risks. The analysis by the Author is for informational purposes only and should not be treated as investment advice.