Crypto markets found some ground on Friday, but major tokens traded sideways with minor changes after the FTX fallout. Bitcoin marched to $17,000 levels. Ethereum remained slightly under pressure. As investor confidence in crypto assets wanes following the collapse of the Sam Bankman-Fried FTX exchange, the total digital token market cap has fallen below $800 billion Dollars this month, a level not seen since early 2021. Major crypto tokens traded on a mixed note. Solana is down more than 3% while Tron is down 2%. XRP is up more than 2%, while Bitcoin is also posting similar gains. The global crypto market cap traded higher at around $841 billion, most recently up around %1 in 24 hours. However, the total trading volume fell by more than 12% to $52.62 billion.

BTC hovered around $16,500 on Nov. 17 as markets digested the latest events surrounding the FTX exchange. BTC/USD saw only mild volatility on Wall Street. The pair has appeared accustomed to events surrounding the FTX bankruptcy, recently including the revelations that Alameda Research was trading on the platform during that time. United States lawmakers intend to hold a dedicated hearing on FTX next month, while Bankman-Fried is reportedly subject to extradition from the Bahamas. BTC price action has nonetheless managed to shake off related volatility in reaction to news of contagion impacting the crypto lending arm of Genesis Trading. CME’s BTC Futures have been trading below Bitcoin’s spot price on regular exchanges since November 9, a situation technically called a lag. While this suggests a bear market structure, there are several factors that can cause temporary distortions. The FTX fiasco stunned traders, liquidating more than $290 million in leveraged buyers over a 48-hour period. Open interest for the November 18 weekly options expiration is $600 million, but the actual figure will be lower as bulls have been overly optimistic. These traders missed the mark, placing bearish bets of $18,000+

Ether is stuck between $1,170 and $1,350 for Nov.10 to now, which is a relatively tight 15% range. During this time, investors continue to digest the negative impact of the FTX exchange’s November 11 Chapter 11 filing for bankruptcy. Meanwhile, ether’s total daily market volume was up 57% from the previous week at $4.04 billion. This data is even more relevant given the collapse of Alameda Research, the market-making and arbitrage firm controlled by FTX founder Sam Bankman-Fried. On a monthly basis, the current price of Ether stood at $1250. While contagion risks have caused investors to exhaust their wallets on centralized exchanges, this move has prompted a rebound in activity on decentralized exchanges (DEX). Uniswap, 1inch Network and SushiSwap have all seen active addresses increase by 22% since November. 8.

The Sentiment briefly returns to the global macro outlook with lower than expected Producer Price Index (PPI) and a weakening US dollar. Crypto markets and equity markets reacted to the PPI data showing that wholesale prices are up 0.2% this month and 8% year-on-year. That’s less than the expected monthly estimate of 0.4% and the annual increase of 8.4% in the previous month. The news sent the Nasdaq up 2.5% and the S&P 500 up 1.4%.

Technical Outlook:

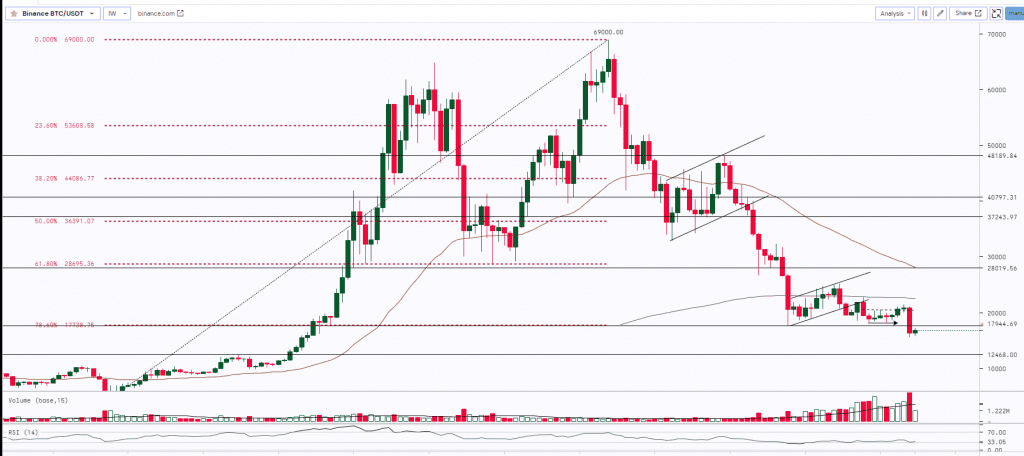

BITCOIN:

BTC was taking multiple supports around $17,500 to $18,000 (78.6 % Fibonacci level) and was showing good signs of recovery. However, the bulls struggled to break the key resistance of $22500 and after the FTX news, BTC witnessed a sharp correction and broke the long-held support making the weekly low of $15,588 and giving the weekly closing below the support. Post this move, On a daily time frame, BTC is making an ‘Inside Bar’ pattern which indicates some consolidation or lower price volatility ( a series of inside days can set up indicators for trend reversals in technical analysis). $17,500-$18,000 will act as a strong resistance whereas $15,000 will act as a strong support. If it breaks or closes below the support then it can lead to the further downfall and can test the $12,000 level.

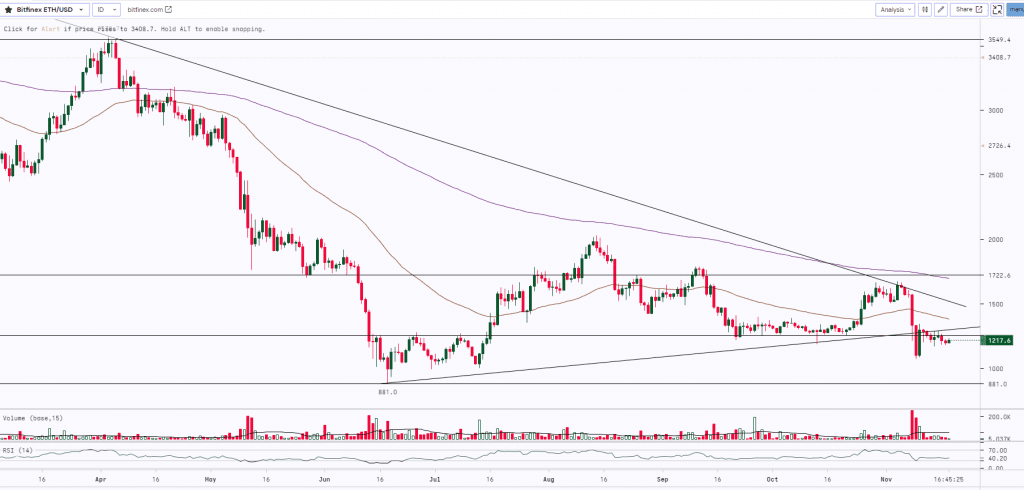

ETH:

ETH faced stiff resistance at the downsloping trendline (drawn from the time high) and witnessed a sharp fall. The prices plunged almost by 36% making the low of $1,074. The asset broke the uptrend line and the long-held support of $1,200 and gave a weekly closing below that. Currently, on a daily time frame, ETH is consolidating and trading around the key level of $1,200-$1,250. If the bulls manage to push prices above $1,400 then we can see some up-side move whereas if it sustains below $1,200 then it can lead to further downfall.

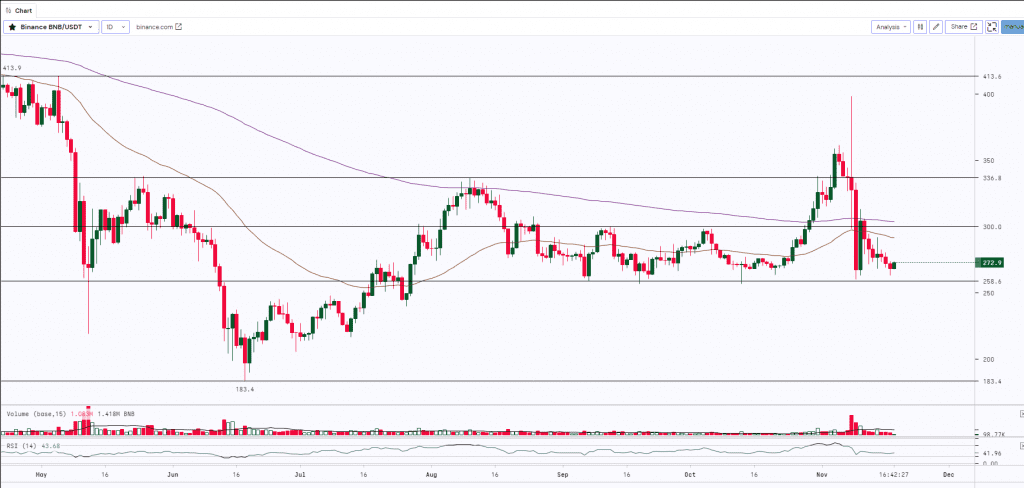

BNB:

BNB was very volatile last week. From the high of $398 the prices corrected almost by 34% and plunged to $260.2. The asset took support at $255 and gave a relief rally up to $313. However, it failed to give a daily closing above the 200 Day Moving Average and yet again dropped to $260. BNB has strong support at $255. If it holds and sustains above these levels then we can expect the bulls to resume the up-move. A break or close below $255 can lead to further downfall.

Weekly Snapshot:

| USD ($) | 10 Nov 22 | 18 Nov 22 | Previous Week | Current Week | |||

| Close | Close | % Change | High | Low | High | Low | |

| BTC | $17,587 | $16,688 | -5.11% | $21,447 | $15,683 | $17,109 | $15,873 |

| ETH | $1,299 | $1,201 | -7.59% | $1,661 | $1,083 | $1,288 | $1,178 |

| BNB | $304.08 | $267.91 | -11.89% | $388.72 | $261.73 | $290.72 | $264.40 |

| crypto | 1w – % Vol. Change (Global) |

| BitCoin (BTC) | -47.37% |

| Ethereum (ETH) | -45.85% |

| Binance Coin (BNB) | -52.29% |

| Resistance 2 | $22,500 | $1,750 | $1.20 | $380 |

|---|---|---|---|---|

| Resistance 1 | $17,500 | $1,400 | $1.05 | $300 |

| USD | BTC | ETH | Matic | BNB |

| Support 1 | $15,000 | $1,200 | $0.75 | $255 |

| Support 2 | $12,000 | $1,000 | $0.62 | $215 |

Market Updates:

- A fresh bankruptcy filing from FTX chief restructuring officer John Ray III highlights that Sam Bankman-Fried received $1 billion in loans from FTX-related silo companies (Almeda Research).

- Ether staking withdrawal schedule removal faces harsh criticism. Twitter users called out the removal of the ETH staking timeframe and with one describing staked ETH as a “non-redeemable” investment.

- Major crypto exchanges like Binance, OKX, Bybit continue to carry out measures in the aftermath of FTX collapse, now halting deposits in Solana-based Tether and USD Coin.

- The United States Securities and Exchange Commission, or SEC, has extended its window to decide on whether shares of ARK 21Shares’ Bitcoin exchange-traded fund (ETF) could be listed on the Chicago Board Options Exchange (BZX Exchange) on January 2023.

Disclaimer: This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation, or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness, or reliability of the information, opinions, o