The Crypto market was trading lower on Friday, with the global crypto market cap falling 0.48% over the past 24 hours to $920.23 billion. In addition, the total trading volume decreased by 15% to $45.2 billion. Earlier in the day, Bitcoin fell below $19,000, down 1.5%. Yesterday(20th October) Ripple, Solana, Cardano, and Terra Classic fell more than 10%. Sell-offs occurred as investors worried about fresh real estate data and macroeconomic uncertainty. The lack of a key catalyst and the strength of the US Dollar Index (DXY) has kept the rally in risky assets in check. Bitcoin is stuck in a tight range looking for that elusive breakout. The longer Bitcoin is in this range, the larger the eventual breakout will be. Short-term uncertainties in crypto assets do not appear to have changed the long-term perspective of institutional investors.

BTC price is struggling to sustain a marginal 0.23% gain on Oct. 20, but overall crypto prices are falling across the board and the broader market remains in a strong downtrend. Bitcoin’s price continues to trade below $20,000, a level that many investors believe to be a psychologically significant level of support and resistance. Given the high correlation between the crypto and stock markets, Bitcoin’s price action tends to follow the direction of the S&P 500 and the Dow, and a series of economic events in mid-October could continue to put pressure on crypto prices. Several large US companies are due to release their quarterly results this week and the mix of results is causing volatility in stock markets. Shares of Tesla (TSLA) fell 6.2% because the estimates missed its third-quarter profit target, with the electric vehicle maker citing manufacturing and supply issues. BTC/USD was stuck in a range of around $19,000 overnight, moving just $400 up or down. The concentration was more on the UK, where the pound reacted to the news that Liz Truss had stepped down as Prime Minister. Chart data circulating on social media at the time of writing showed that the volatility of the pound and the BTC had become virtually identical, the latter in the least volatile period since 2020.

The Ethereum merge dominated the crypto world in September with the promise of faster transaction times, improved security and a 99% reduction in power consumption. ETH again ventured into the symmetrical triangle pattern on October 17, but the bulls failed to sustain the rally. The price fell on Oct 18 and the bears are trying to push the price to $1263. The gradual falling 20-day EMA ($1,320) and the RSI in negative territory suggest that the bears have a marginal advantage. If the price drops below $1,263, the ETH/USDT pair could drop to $1,190. The withdrawal of staked ether (sETH) and cheaper gas fees are some of the expected developments in the next critical upgrade of the Ethereum network, the Shanghai upgrade. The testnet version called Shandong is now available. Developers can now start working on deployments. a process expected to last until September 2023. This is the first major update since switching Ethereum to Proof of Stake (PoS) in September following the split of mainnet and Beacon chains.

On the macro side of things, concerns about the US Federal Reserve’s “lack of progress” in curbing high inflation is likely at the root of the ongoing volatility in crypto prices. On October 20, Philadelphia Fed President Patrick Harker indicated that higher interest rates had not been effective in containing inflation and concluded that “we’re going to keep raising rates for a while.” September Consumer Price Index (CPI) showed that consumer prices increased by 0.4%. Compared to a year ago, consumer prices are now 8.2% higher, according to data from the Bureau of Labor Statistics. Fed rate hikes are expected to cool the economy and curb high inflation, so the better-than-expected Oct. 13th report is likely to result in another round of 75 basis points increase in the coming months. In addition to these upcoming events, the strength of the US dollar and what appears to be a serious escalation in the conflict between Ukraine and Russia continue to weigh in on all markets.

Technical Outlook:

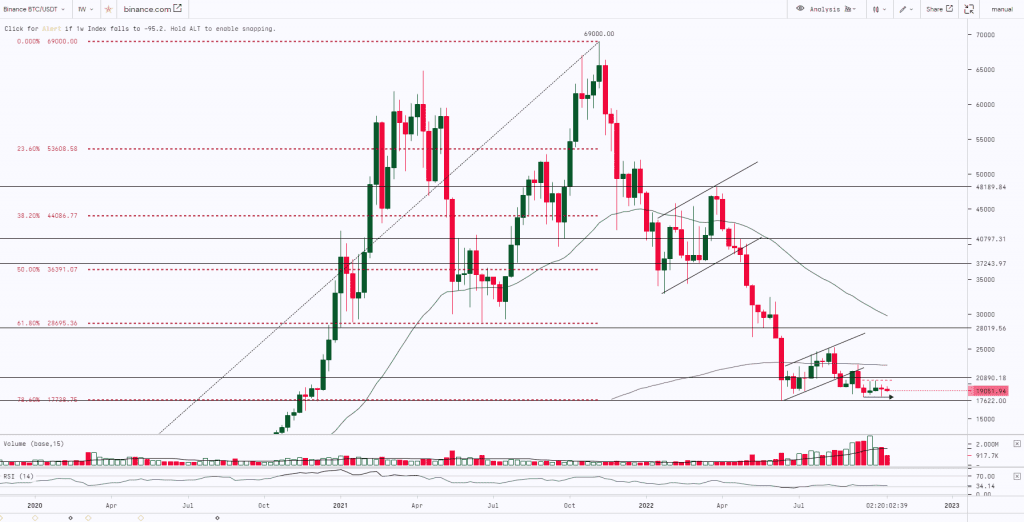

BITCOIN:

BITCOIN after making the recent bottom of $17,622 gave a relief rally up to $25,211. However, bulls failed to manage their grip on the asset and the prices dropped to $18,190. Post this move, the asset is trading in a narrow range from $18,000 to $20,550. On a weekly time frame, BTC is consolidating and taking support at the key level of $17,738 (78.6% Fibonacci Retracement Level). A break or close below the previous low of $17,622 will lead to further downfall whereas to witness a rally the prices need to break and close above $22,500.

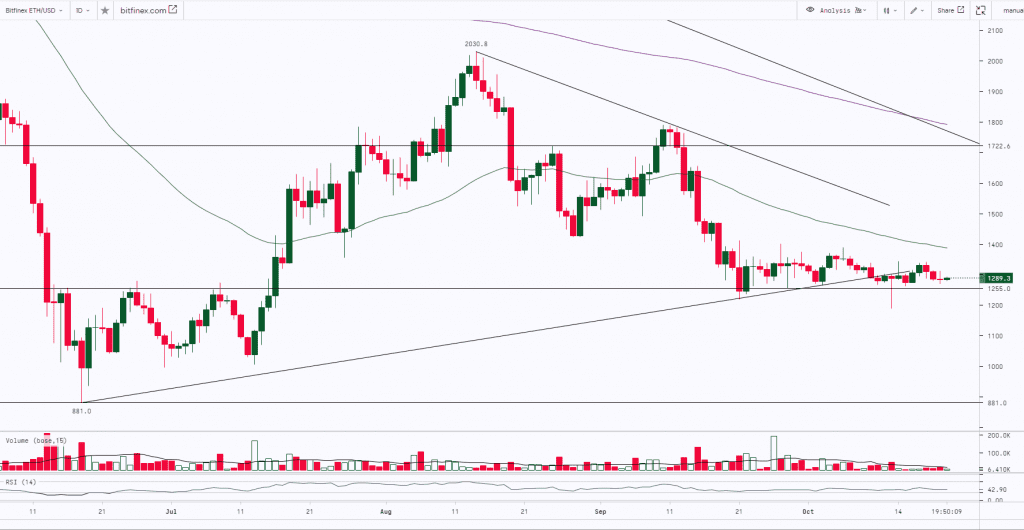

ETH:

ETH has been consolidating and trading below its 50-day moving average in a range from $1,200 to $1,400 over the past few weeks. The asset gave a breakout on the downside of the range and made a low of $1,190 last week. However, it failed to sustain at the lower levels and gave the daily closing above the support of $1,250. Technically, on a daily time frame, ETH has made a ‘Hammer’ candle (Bullish Candle). If the prices break and close above $1,450 then we can expect it to further rally up to $1,750 and $2,000 levels whereas a close below $1,200 will lead to further downfall.

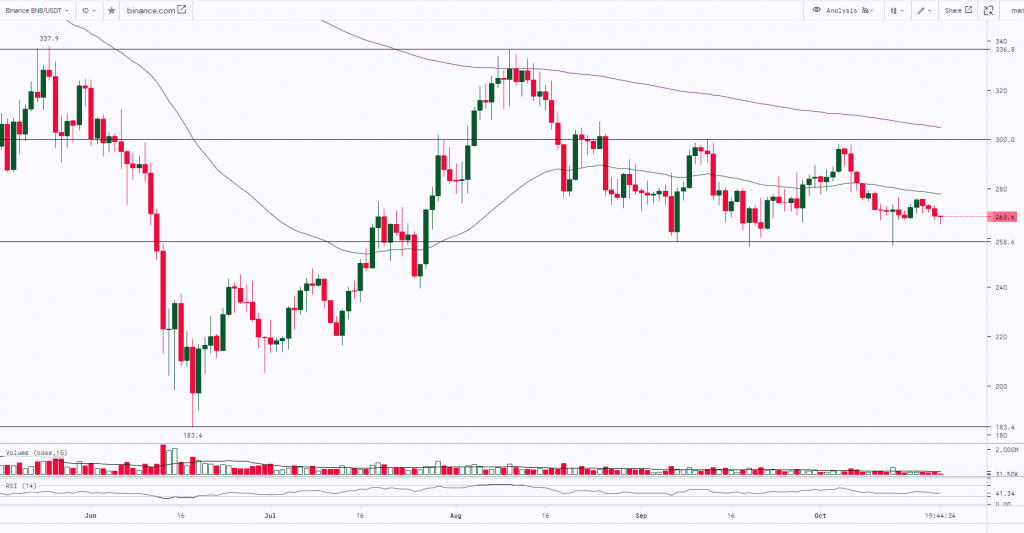

BNB:

BNB after making the high of $298.1 witnessed a correction. The prices fell almost by 14% and made the weekly low of $256.1. Technically, on a daily time frame, the asset is trading sideways in a range from $255 to $300 with low volumes. Breakouts on either side of the range with good volumes will further decide the trend for the asset.

Weekly Snapshot:

| USD ($) | 13 Oct 22 | 20 Oct 22 | Previous Week | Current Week | |||

| Close | Close | % Change | High | Low | High | Low | |

| BTC | $19,383 | $19,053 | -1.70% | $20,041 | $18,319 | $19,667 | $18,971 |

| ETH | $1,288 | $1,283 | -0.38% | $1,359 | $1,209 | $1,340 | $1,268 |

| BNB | $271.85 | $269.27 | -0.95% | $286.96 | $257.97 | $275.84 | $267.86 |

| crypto | 1w – % Vol. Change (Global) |

| BitCoin (BTC) | -5.43% |

| Ethereum (ETH) | -1.06% |

| Binance Coin (BNB) | 23.00% |

| Resistance 2 | $28,500 | $2,000 | $1.20 | $335 |

|---|---|---|---|---|

| Resistance 1 | $22,500 | $1,750 | $1.00 | $300 |

| USD | BTC | ETH | Matic | BNB |

| Support 1 | $17,500 | $1,250 | $0.75 | $255 |

| Support 2 | $15,000 | $1,000 | $0.63 | $215 |

Market Updates:

- Tesla’s Q3 report, released Oct. 19, shows that $218 million worth of “digital assets” remains on its balance sheet, with no reported losses in the value of its holdings. Based on current prices, it’s estimated that Tesla still holds around 9,720 BTC.

- Fidelity Digital Assets, the crypto wing of $4.5 trillion asset manager Fidelity Investments, is set to offer Ether custody and trading services to its institutional clients later this month.

- On Oct. 19, Kraken sent out email statements to its Russian clients to announce that the exchange is halting services to its Russian customers.

- The BitBTC bridge bug was highlighted by L2 network Abirtrum tech lead Lee Bousfield in an Oct. 18 Twitter post, warning that “BitBTC’s Optimism bridge is trivially vulnerable.”

Disclaimer: This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation, or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness, or reliability of the information, opinions, or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in crypto assets viz. Bitcoin, Bitcoin Cash, Ethereum, etc are very speculative and are subject to market risks. The analysis by the Author is for informational purposes only and should not be treated as investment advice.