Bitcoin, after trading near $20,000 for several days, pulled back sharply, falling below $19,000 on September 6th. The decline wasn’t limited to cryptocurrency markets as US stock markets also closed lower on September 6. Bitcoin and select altcoins have fallen to critical support levels and the strength of the upleg is not strong enough, raising the risk of a further decline. The asset has taken the price to its lowest level in 80 days. The move not only completely wiped out all 32% gains accumulated from July through August 15, but also wiped out $246 million in leveraged long (buy) futures contracts. Bulls need to push the price above $20,000 on September 9th to avoid a potential loss of $130m. On the other hand, the bears’ best-case scenario sees a slight boost below $18,000 to maximise their gains. Bitcoin bulls just liquidated $246 million leveraged long positions in two days , so they may have less margin needed to raise the price.

Ether (ETH) rallied above the moving averages on Sep 6, but the bulls failed to clear the overall hurdle of $1700. The bears sold aggressively, sinking the price below the 20-day EMA ($1597). The asset is up 0.88% on the day on above-average volume. ETH also fell on Powell’s comments and rose thereafter. ETH’s 30-day correlation with BTC remains strong at 0.9. While the so-called “flip,” an event in which Ethereum’s market cap dwarfs that of Bitcoin, may not yet have occurred, ETH’s price has performed fairly well against BTC since mid-June. This uptrend is already priced into the merge: Ethereum’s upcoming transition from Proof of Work to a Less power-consuming Proof of Stake.

On the macro front, Inflationary pressures and fears of a global recession have diverted investors away from riskier assets. This protective measure sought refuge in cash positions, primarily in the dollar itself, and has caused the US 5-year Treasury yield to hit 3.38%, nearing its highest level in 15 years. By demanding a higher premium for holding government bonds, investors are signalling a lack of confidence in current inflation controls. Data released on September 7th shows China’s exports fell 7.1% in August after rising 18% in July. Also, order data from industry in Germany on September 6 showed a 13.6% year-on-year decline in July. Therefore, until some decoupling from traditional markets, there is not much hope for a sustained uptrend for Bitcoin. Risk assets have come under selling pressure over the past few days as investors fear the Federal Reserve may continue its aggressive policy of tightening. CME’s FedWatch tool shows that the probability of a 75 basis point rate hike at the September meeting rose to 80% from 69% the previous week. This extended the rise of the US Dollar Index (DXY), which closed above 110 on September 6.

Technical Outlook:

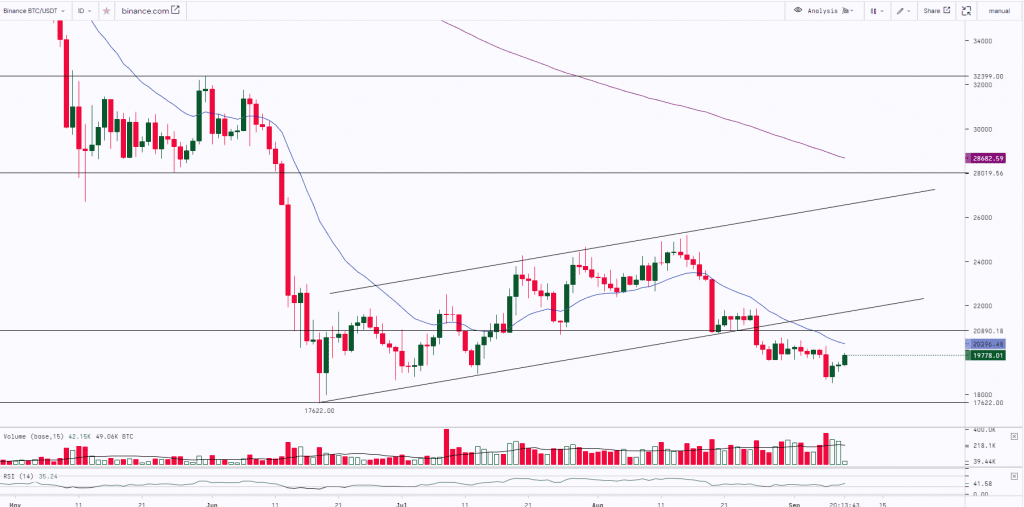

BITCOIN:

BITCOIN was trading in a ‘Rising Channel Pattern’ and after facing stiff resistance at the upper trendline of the pattern it witnessed a sharp correction and broke the pattern on the downside making the weekly low of $18,510. Though BTC gave a breakout on the downside it did not test the previous bottom of $17,622 and reversed from $18,510. The asset is showing signs of recovery and has been trading in green over the past three days. $20,750 and $22,000 will act as a strong resistance and for Bitcoin to continue to move up has to break and close above the resistance level.

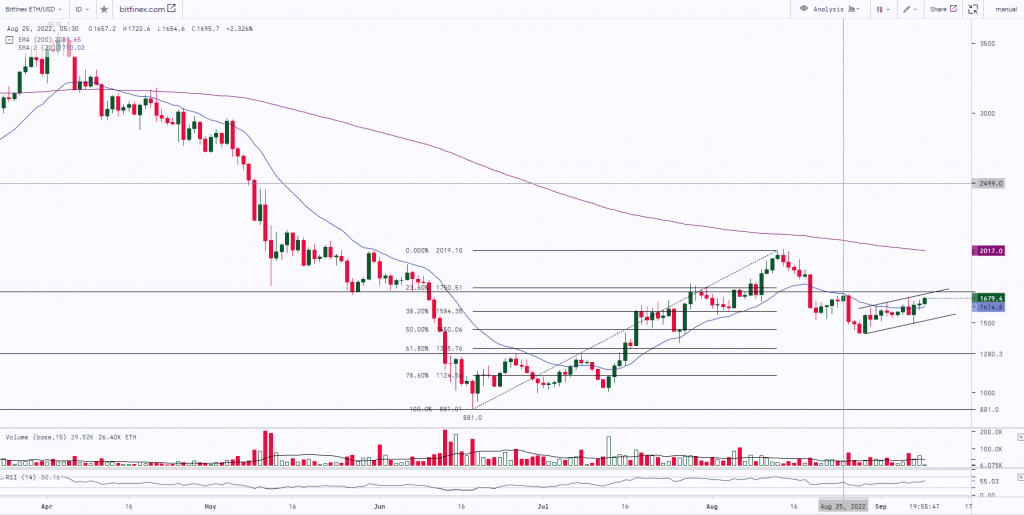

ETH:

ETH after making the recent top of $2,030 witnessed a sharp correction and the prices fell almost by 29% and made the weekly low of $1,422. Post this move, the asset made a ‘Tweezer Bottom & Bullish Engulfing’ pattern at the recent low and started moving up. ETH has a strong resistance zone from $1,700 to $1,750 (Horizontal trendline & 23.6% Fibonacci Retracement Level). Once these resistances are broken with good volumes then we can expect it to further rally upto $2k mark. Currently on a daily time frame, the asset is trading in an ‘Ascending Channel’.

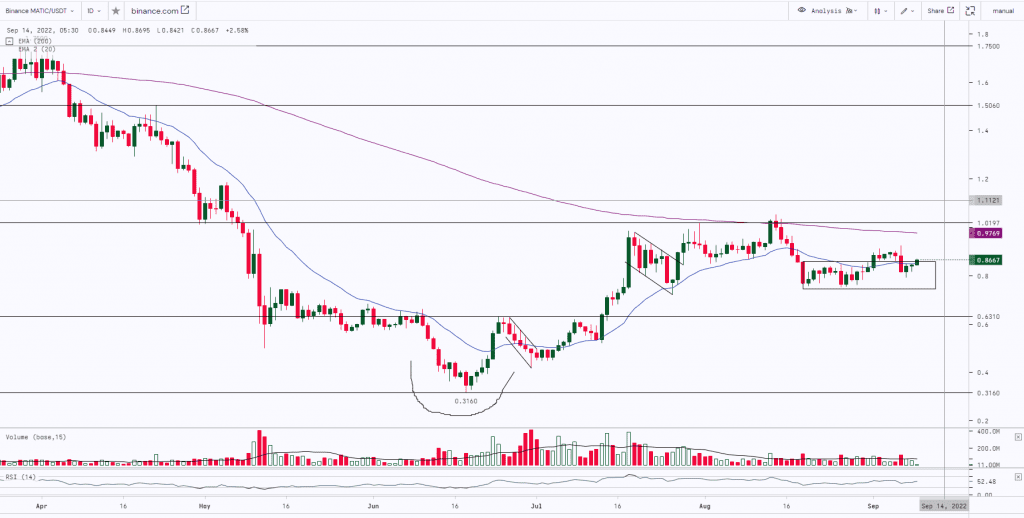

MATIC:

Matic made a ‘Cup and Handle’ pattern with the neckline of $0.63 and rallied up to $1.05. Post this move, the asset faced multiple resistance at $1 (Horizontal Trendline &200 Day Moving Average) and witnessed a correction of almost by 28% and dropped to $0.7582. On a daily time frame, Matic was consolidating sideways in a range from $0.765 to $0.835. The asset gave a breakout above the range and made the weekly high of $0.924. However, the bulls were unable to break the resistance zone from $0.95 to $1. To further rally it needs to break and close above the resistance. Matic has a strong support of $0.75.

Weekly Snapshot:

| USD ($) | 01 Sep 22 | 08 Sep 22 | Previous Week | Current Week | |||

| Close | Close | % Change | High | Low | High | Low | |

| BTC | $20,127 | $19,330 | -3.96% | $21,804 | $19,600 | $20,402 | $18,703 |

| ETH | $1,586 | $1,635 | 3.10% | $1,699 | $1,428 | $1,697 | $1,534 |

| MATIC | $0.89 | $0.84 | -4.65% | $0.89 | $0.76 | $1.05 | $0.76 |

| Cryptocurrency | 1w – % Vol. Change (Global) |

| BitCoin (BTC) | -4.27% |

| Ethereum (ETH) | -18.73% |

| Polygon (MATIC) | -20.60% |

| Resistance 2 | $25,000 | $2,000 | $1.05 | $0.60 |

|---|---|---|---|---|

| Resistance 1 | $20.750 | $1,750 | $0.95 | $0.45 |

| USD | BTC | ETH | Matic | BAT |

| Support 1 | $17,500 | $1,500 | $0.75 | $0.33 |

| Support 2 | $15,000 | $1,275 | $0.63 | $0.25 |

Market Updates:

- Richard Fuller, the Economic Secretary to the Treasury, said the government wants the United Kingdom to be the “dominant global hub for crypto technologies.”

- American music giant Sony Music Entertainment has signalled intentions to utilise non fungible tokens (NFTs) after filing a trademark application covering music and artists under the Columbia Records logo.

- ETC Group officially announced on Wednesday the launch of a new Ethereum ETP in response to the upcoming Ethereum Merge. It will utilise the forked PoW Ethereum chain, representing a group of miners opposing Ethereum’s switch to PoS.

- Avalanche-based lending protocol Nereus Finance has been the victim of a crafty hack that saw a user’s net worth of $371,000 USD Coin (USDC) exploited. The scammer deployed a custom smart contract, leveraging a $51 million flash loan to manipulate the AVAX/USDC Trader Joe LP pool price for a single block.

Disclaimer: This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation, or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness, or reliability of the information, opinions, or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in cryptos viz. Bitcoin, Bitcoin Cash, Ethereum, etc. are very speculative and are subject to market risks. The analysis by the Author is for informational purposes only and should not be treated as investment advice.