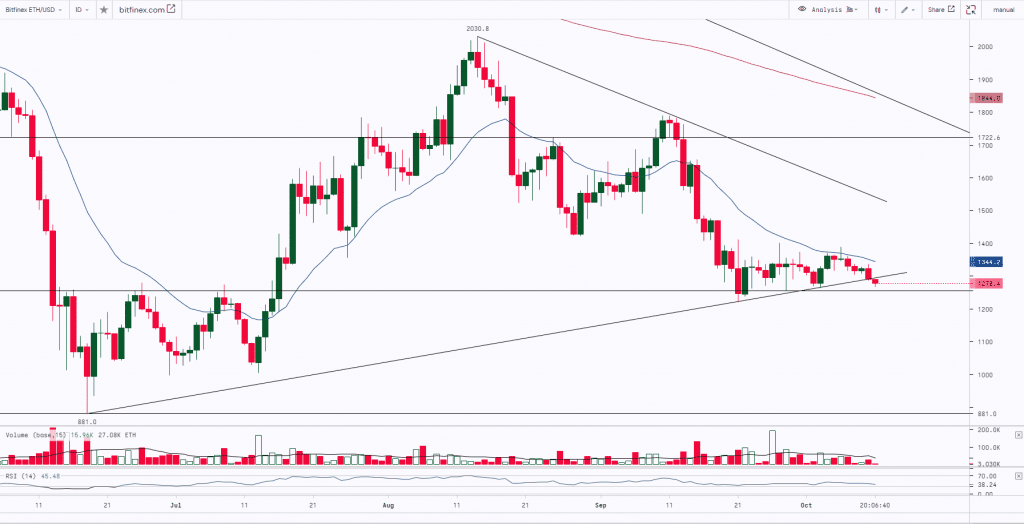

Ether is struggling to break the 20-day EMA ($1,351). This suggests that the bears will sell on the rallies and attempt to push the price down to the strong support at $1,220. The gradual downtrend of the 20-day EMA and the RSI in the negative territory are indicating an advantage for the bears. Eyes will be on the US September CPI data, due out on October 13th, as it could influence the Fed’s decision on the rate hike at the next November meeting. The asset price is trading low at 3.2% down while the global volume is up by 63.8%.

At the time of writing, ETH was trading at $1,278.

ETH has been consolidating and trading below its 20-day moving average in a range from $1,250 to $1,400. Technically on a daily time frame, the asset was trying to take support at the upsloping trendline. Today it broke the uptrend line on the downside. However, the horizontal trendline at $1,250 will act as strong support. Breakouts on either side of the range will further decide the trend for the asset. If the prices break and close above $1,500 then we can expect it to further rally up to $1,750 and $2,000 levels, whereas a break below $1,250 will lead to further downfall.

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $1,000 | $1,250 | ETH | $1,750 | $2,000 |

Disclaimer: This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in crypto assets viz. Bitcoin, Bitcoin Cash, Ethereum etc. are very speculative and are subject to market risks. The analysis by the Author is for informational purposes only and should not be treated as investment advice.