Ether price surged to its highest level since September, but data shows whales have no appetite for leveraged longs. On October 29th, another rally of 10.3% to $1,650 occurred, triggering another $270 million in short seller liquidations in ETH futures contracts. A total of $840 million in leveraged short positions were liquidated in three days, representing over 9% of total open interest in ETH futures. The formation of a bullish buying and selling pattern shows that the ETH/BTC pair may be at the edge of a reversal. The asset price had less than a 1% marginal fall while the global volume was up by more than 27%.

At the time of writing, ETH was trading at $1,588.

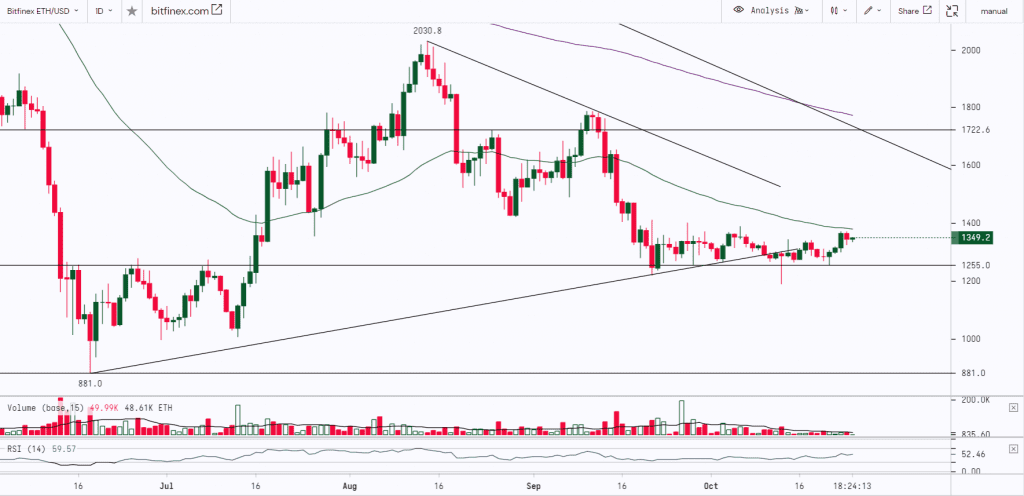

ETH was consolidating and trading in a range from $1,200 to $1,400. The asset finally gave a breakout above the range and rallied almost by 19% making a high of $1,666. Post this move, ETH is consolidating between $1,550 to $1,625. The downsloping Trendline and the Horizontal Trendline at $1,750 will act as strong resistance and to further rally it needs to break and close above these levels whereas $1,400 and $1,200 will act as strong support for ETH.

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $1,200 | $1,400 | ETH | $1,750 | $2,000 |

Disclaimer: This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in crypto assets viz. Bitcoin, Bitcoin Cash, Ethereum etc. are very speculative and are subject to market risks. The analysis by the Author is for informational purposes only and should not be treated as investment advice.