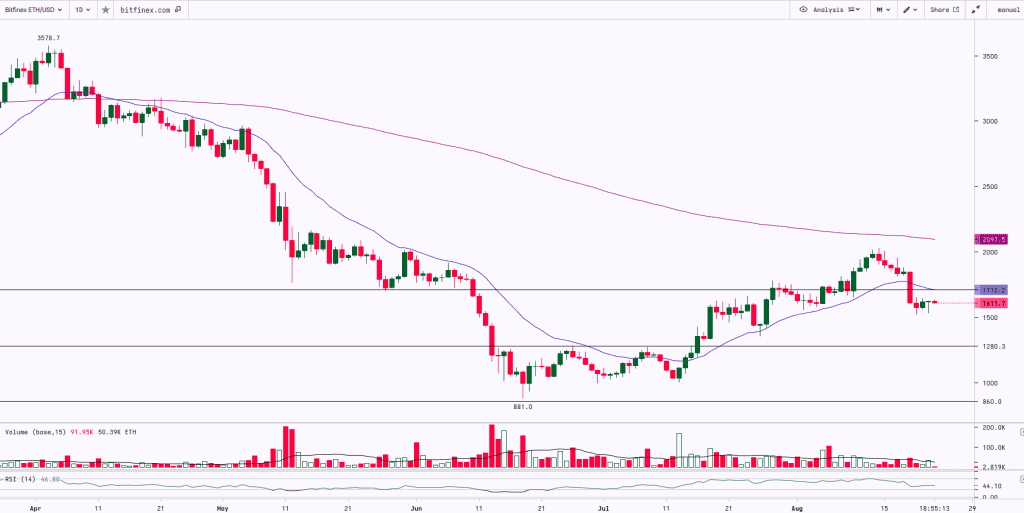

Price action in ETH, bitcoin and stocks reflects investor concerns over the Federal Reserve’s rate hike plans, a moderating bear market rally, and this week’s Jackson Hole Economic Symposium. ETH is currently down by around 1.4% since yesterday. Ether (ETH) plunged below the 20-day EMA ($1,718) and the breakout level of $1,700 on Aug. 19. The fall in price might have been a cause of the swelling of the volume by almost 20% or that traders who had purchased at lower levels were exiting their positions. At present the market dominance for Ether is around 19.1%.

At the time of writing, ETH was trading at $1,610.

ETH saw a sharp rally and surged almost by 130% from the lows of $881 to the recent high of $2,030. Post this move, the asset faced stiff resistance around the psychological level of $2k and witnessed a correction and the prices dropped to $1,523.6. On a daily time frame, ETH is consolidating and trading in a narrow range from $1,530 to $1,630 over the past four days with low volumes. The asset has a strong support at $1,500. If it holds and sustains above the support then we can expect the bulls to resume the up-move whereas a break below the support can lead to further downfall.

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $1,275 | $1,500 | ETH | $1,750 | $2,000 |

Disclaimer: This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in crypto assets viz. Bitcoin, Bitcoin Cash, Ethereum, etc. are very speculative and are subject to market risks. The analysis by the Author is for informational purposes only and should not be treated as investment advice.