25 January 2023 | ZebPay Trade-Desk

Capitulation means yielding. In financial terms, this reflects a hard selling period when the last few bulls surrender to become bears.

Suppose a crypto falls 30% overnight, an investor has two options: hold or sell to take losses. If most investors decide to take losses, there will be a sharp fall in price. Also, this selling pressure could lead to a price bottom if the bears run out of coins to sell. But while a capitulation is very difficult to predict and identify, there are some recurring market signals that can help traders prepare for it.

Some of those signals include

- Rapidly falling prices

- Large trading volumes

- Oversold conditions

- High volatility

- A significant drop in the number of major shareholders

- Negative market fundamentals

For example, the sudden collapse of FTX token FTT, the native asset of the defunct crypto exchange FTX, in November 2022 saw the most signs of capitulation as shown in the chart below.

Crypto assets, especially those with extremely low market caps and liquidity, will always experience increased volatility during capitulation. But crypto market caps aren’t always bad for investors. Rather, they provide a period of maximum profit opportunities when the asset price bottoms.

Read more: 4 Ways to Calculate Crypto Profit and Loss

For example, Bitcoin and Ether (ETH) have seen multiple market capitulation events over the years, accompanied by large sell volumes and floor prices. One such event was the

market crash in March 2020.

Many seasoned traders and investors see crypto market capitulation as an indicator of an imminent price bottom. As a result, they prefer to accumulate during a bearish market, thereby absorbing sell-side pressure and setting the stage for a potential bullish reversal.

In addition, a crypto market cap usually eliminates short-term sellers. Gradually shifting momentum to companies with long-term bullish prospects, as almost everyone who wanted to sell has already done so.

Read more: Crypto Trading Strategies

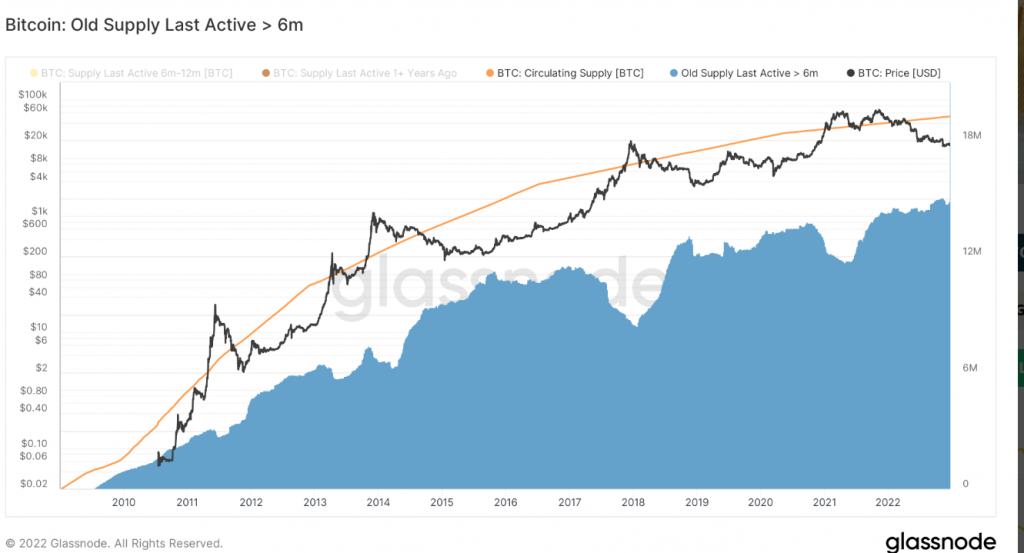

This is usually reflected in a steady increase in the supply of BTC held by addresses dubbed “old coins” for more than six months.

According to research, these coins are less likely to be issued on any given day. Old coins typically increase in volume during market downtrends, reflecting a net transfer of currency assets from new investors and speculators, back to patient long-term investors (HODLers).

Finally, finding a market bottom during a capitulation event is extremely difficult as the process can take months if not years, as it did with BTC from 2014 to 2016. Traders rely on historical data and past market lows to anticipate potential capitulation events using various metrics and indicators.