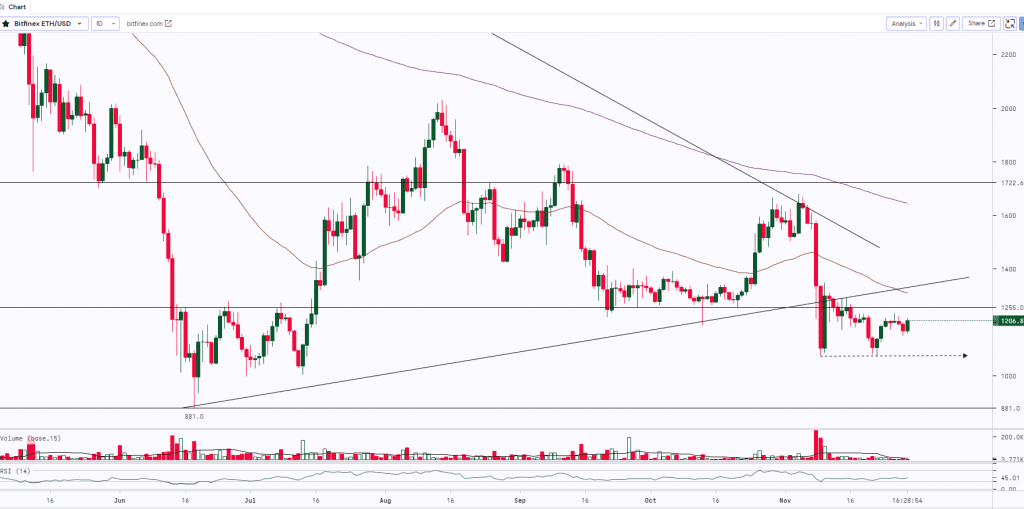

The Turmoil in China and BlockFi’s financial bankruptcy filing are all weighing on crypto markets this week. Ether reached the 20-day EMA ($1,233) on Nov. 26 however the bulls couldn’t propel the rate above it. This indicates that the bears keep guarding the 20-day EMA strongly. Sellers may try to push the price down to the support line which is close to the psychologically critical $1000 level. Buyers are likely to defend this level by all means with their power, but they need to clear the upper hurdle at the 20-day EMA to start a sustained rally. The price of the asset is up by almost 3% while volume has risen by 21.3%.

At the time of writing, ETH was trading at $1,206.

ETH Continues to trade sideways in a narrow range of $1,225 to $1,075 with low volumes. Breakouts on either side of the range with good volumes will further decide the trend for the asset. $1,000 can act as strong support while $1,350 – $1,400 will be the major hurdle for the bulls. A break or close below $1,000 will lead to further downfall. Downsloping Moving Averages and RSI below 50 indicate that the bears still have the upper hand.

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $880 | $1,000 | ETH | $1,250 | $1,450 |

Disclaimer: This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in crypto assets viz. Bitcoin, Bitcoin Cash, Ethereum etc. are very speculative and are subject to market risks. The analysis by the Author is for informational purposes only and should not be treated as investment advice.