Crypto trading is gaining popularity every day, offering users the potential for high returns with markets accessible at their fingertips. To get started, all you need is a crypto exchange to trade your funds. However, with so many platforms available today, choosing the right one can be challenging. This is where understanding CEX meaning and DEX meaning becomes important before you begin your crypto journey.

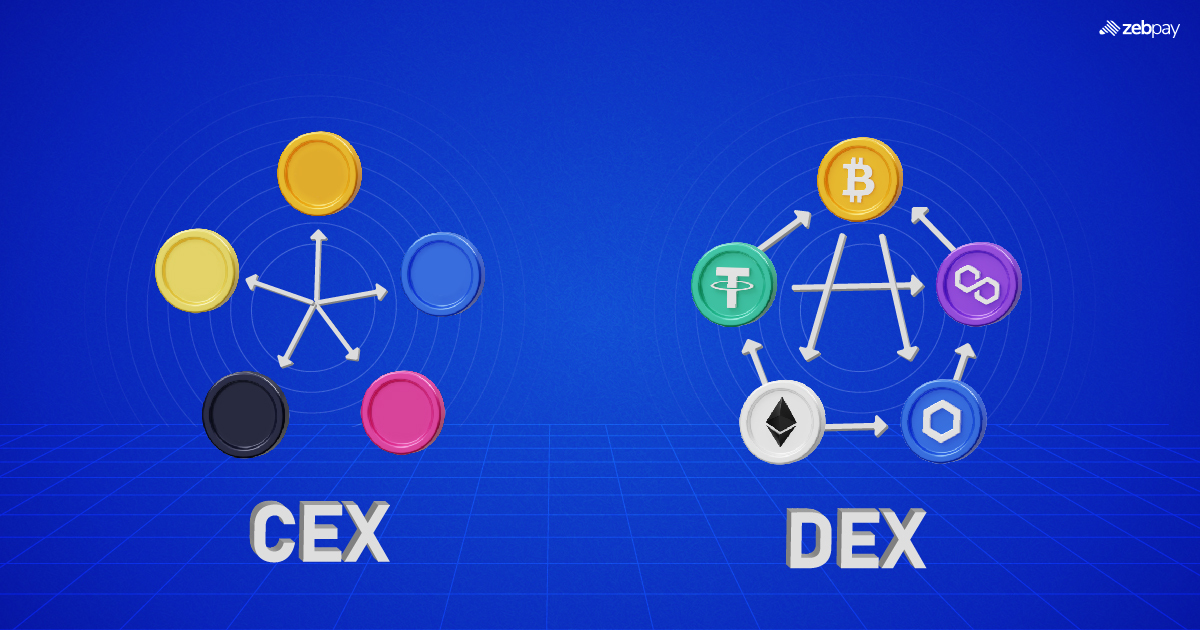

Crypto exchanges are broadly divided into two categories: centralised crypto exchanges and decentralised crypto exchanges. A centralised crypto exchange is operated by an organisation that acts as an intermediary, managing order execution, liquidity, and often user funds to provide a smooth trading experience. In contrast, DEX meaning refers to a decentralised crypto exchange that operates on blockchain technology, enabling users to trade directly from their wallets without relying on a central authority.

When comparing CEX and DEX, the right choice depends on what you value most as a trader. Centralised platforms often offer ease of use, higher liquidity, and customer support, while decentralised platforms prioritise transparency, self-custody, and greater control over assets. Understanding the differences between CEX and DEX can help you choose an exchange that aligns with your trading goals and risk appetite.

What is a Centralized Exchange (CEX)?

A centralized exchange is a platform where all transactions are managed by a central authority, and users deposit their funds into the exchange’s centralised wallet. This type of exchange operates like a traditional stock exchange, where a third party manages the trades and keeps custody of the assets.

How Do CEXs Work?

To understand CEX meaning, it refers to platforms operated by a central organisation that facilitates crypto trading by managing order books, liquidity, and trade execution. Users deposit funds on the exchange, which temporarily holds assets to ensure smooth and efficient transactions.

Advantages of CEXs

One of the significant advantages of CEXs is their user-friendly interface, making them accessible even to new traders. Additionally, CEXs offer faster transaction times, higher liquidity and a wide range of trading pairs. These exchanges also have robust customer support, making them more accessible to beginners who might need help navigating the trading process.

Disadvantages of CEXs

However, centralised exchanges also have few disadvantages. Firstly, CEXs are vulnerable to hacks and thefts since they hold users’ funds in a central location. Secondly, they are often subjected to strict regulations and government interventions, leading to potential downtime or restrictions.

Why Do Traders Choose CEXs?

When comparing CEX and DEX, many traders prefer centralised crypto exchanges for their user-friendly interfaces, deeper liquidity, and access to customer support. These advantages make CEXs a reliable choice for both beginners and experienced traders.

What is a Decentralized Exchange (DEX)?

A decentralized exchange is a platform where users can trade crypto directly without the need for an intermediary or central authority. These exchanges are based on blockchain technology, enabling peer-to-peer transactions, and are often powered by smart contracts.

How Do DEXs Work?

To understand DEX meaning, decentralised crypto exchanges operate on blockchain networks through smart contracts that automate trades without intermediaries. Unlike centralised platforms, users retain custody of their funds and trade directly from their wallets, highlighting a key difference when comparing CEX and DEX.

Advantages of DEXs

One of the significant advantages of DEXs is their high level of security since user funds are not stored in a centralised location. They are instead distributed across the blockchain, making them more resilient to hacks and thefts. Additionally, DEXs offer users greater privacy since they do not require KYC checks or personal information to trade. Finally, DEXs are more decentralised and less susceptible to government interventions or shutdowns.

Disadvantages of DEXs

However, DEXs are still relatively new and have several disadvantages. Firstly, they are not as user-friendly as CEXs, making them more challenging for beginners to use. Secondly, DEXs often have lower liquidity since they rely on users to provide liquidity through smart contracts. Finally, transaction times on DEXs can be slower, leading to potential delays and higher transaction fees.

Types of DEXs (AMM, Aggregators, Order-Book DEXs)

Decentralised crypto exchanges come in several forms, including automated market makers (AMMs) that rely on liquidity pools, DEX aggregators that scan multiple platforms for the best prices, and order-book DEXs that match buy and sell orders in a decentralised setup. Understanding these models further clarifies DEX meaning and how decentralised crypto exchanges differ from centralised alternatives in the CEX and DEX comparison.

CEX vs DEX: A Comparison

Here is a simple CEX vs DEX comparison that breaks down their main features:

| Factors | CEX | DEX |

| Centralization | Centralised | Decentralised |

| Privacy | KYC/AML required | Anonymous trading |

| Security | Centralised, more prone to hacks | Decentralised, less prone to hacks |

| Liquidity | High liquidity | Lower liquidity |

| Fees | Higher fees | Lower fees |

| Speed | Faster transaction times | Slower transaction times |

| User Experience | User-friendly interface | Complex. Requires interaction with smart contracts |

| Trading | Buying and selling facilitated by the exchange | Peer-to-peer trading |

| Regulatory Framework | Subject to regulation and licensing | Not always regulated or licensed |

CEX vs DEX for KYC and Privacy

When comparing CEX and DEX for compliance, CEX meaning typically involves mandatory KYC processes where users submit identity details to access trading features. In contrast, DEX meaning reflects decentralised crypto exchanges that usually allow wallet-based access without KYC, offering higher privacy. This distinction is a key factor for users deciding between centralised crypto exchanges and decentralised crypto exchanges.

CEX vs DEX for Asset Custody

In the CEX and DEX comparison, asset custody is a major differentiator. Centralised crypto exchanges hold user funds on their platform, which simplifies trading but requires trust in the exchange’s security framework. Decentralised crypto exchanges, as explained by DEX meaning, allow users to retain full control of their assets through self-custody wallets.

CEX vs DEX for Accessibility

From an accessibility standpoint, CEX meaning highlights platforms designed for ease of use, often supporting fiat deposits, intuitive interfaces, and customer support. DEX meaning, on the other hand, involves decentralised crypto exchanges that require users to connect wallets and interact with blockchain networks, which may present a learning curve when comparing CEX and DEX.

CEX vs DEX for Token Availability

When evaluating token availability in the CEX and DEX debate, centralised crypto exchanges usually list well-established assets after thorough vetting. Decentralised crypto exchanges often provide earlier access to new or niche tokens, reflecting DEX meaning and their permissionless nature. This difference allows traders to choose between stability and early-stage opportunities when comparing CEX and DEX.

CEX vs DEX for Security

CEXs are generally considered less secure than DEXs since they are centralised and hold users’ funds in a central location. CEXs are often targeted by hackers, leading to theft and losses for users. In contrast, DEXs offer greater security since they do not store user funds in a central location, reducing the risk of hacks and thefts. However, this is also subject to which centralised exchange we are taking into consideration. For example: ZebPay has state of the art security and has never been hacked till date. Our robust security systems keep customer assets safe at all times.

CEX vs DEX for Liquidity

CEXs offer higher liquidity since they have more trading pairs, making it easier to buy and sell crypto assets. Additionally, CEXs often offer margin trading, further increasing liquidity. DEXs, on the other hand, have lower liquidity since they rely on users to provide liquidity through smart contracts.

CEX vs DEX for Fees

CEXs often charge higher fees than DEXs, with fees ranging from 0.1% to 0.5% per trade. Additionally, CEXs may charge additional fees for depositing, withdrawing, or trading certain currencies. In contrast, DEXs often have lower fees, with some platforms offering zero trading fees, but they may charge network fees for transactions. In the CEX vs DEX for fees comparison, DEXs come out ahead.

CEX vs DEX for User Experience

CEXs are generally considered more user-friendly than DEXs since they have a simple and intuitive user interface. CEXs often offer a range of tools and features, making it easier for users to buy and sell crypto. DEXs, on the other hand, are more complex and require users to interact with smart contracts.

Can You Use Both CEX and DEX Together?

Yes, many traders actively use both when comparing CEX and DEX. CEX meaning involves centralised crypto exchanges that are useful for fiat onboarding and high liquidity, while DEX meaning refers to decentralised crypto exchanges designed for wallet-based, self-custody trading. Using both allows users to balance convenience, access, and control.

Do I Need a Crypto Wallet to Use a CEX?

In most cases, you do not need an external wallet, as CEX meaning includes platforms that hold assets on behalf of users. Centralised crypto exchanges manage custody internally, making onboarding easier for beginners. This highlights a key difference when comparing CEX and DEX.

Can I Buy Crypto With Fiat on a DEX?

Generally, decentralised crypto exchanges do not support direct fiat purchases, which is central to DEX meaning. When comparing CEX and DEX, centralised crypto exchanges stand out by offering fiat on-ramps such as bank transfers or cards. Users often purchase crypto on a CEX before transferring it to a DEX.

Which Is Cheaper: CEX or DEX?

The cost comparison between CEX and DEX depends on multiple factors, including fees and network conditions. CEX meaning involves structured trading fees, while DEX meaning includes variable blockchain gas fees. Understanding these costs helps users make informed decisions when comparing CEX and DEX.

Which Is Safer for Beginners?

For beginners, CEX meaning often translates to easier onboarding, customer support, and recovery mechanisms. Centralised crypto exchanges reduce technical complexity, making them more approachable when comparing CEX and DEX. Decentralised crypto exchanges require greater familiarity with wallets and blockchain interactions.

What Are the Risks of Using a DEX?

Understanding DEX meaning also means being aware of potential risks such as smart contract flaws, low liquidity, and fraudulent tokens. Decentralised crypto exchanges place full responsibility for security and transactions on the user. These risks are important to consider when comparing CEX and DEX, especially for new traders.

Which is Better: CEX or DEX?

The answer to this question depends on several factors, such as the user’s trading experience, preference for privacy, and security concerns. If you’re a new trader, a CEX might be a better option since it’s more user-friendly and offers higher liquidity.

Another factor to consider is transaction fees, where DEXs often have lower fees than CEXs. However, this is not always the case, and some DEXs might have higher network fees, making it more expensive to trade crypto.

Finally, when it comes to speed and transaction times, CEXs are generally faster than DEXs. This is because CEXs have a centralised system, which enables faster transactions, while DEXs are decentralized, which can result in slower transaction times.

Read more: Crypto Trading Strategies

Conclusion: Choosing the Right Exchange

In conclusion, choosing between a CEX or a DEX depends on your trading needs and preferences. If you’re a new trader, a CEX might be a better option due to its ease of use and higher liquidity. However, if you’re concerned about privacy, a DEX might be a better option since it’s more decentralized and offers greater privacy.

It’s essential to consider the factors discussed in this article, such as security, liquidity, fees, user experience, and speed when choosing an exchange. Ultimately, you should choose an exchange that best suits your trading needs and provides the necessary features and tools for a seamless trading experience.

In the grand scheme of things, ZebPay blogs are here to provide you with crypto wisdom. Get started today and join 6 million+ registered users to explore endless features on ZebPay!

FAQs on CEX vs DEX

What Is The Difference Between a CEX and a DEX?

A CEX is centralised, which means that it is controlled by a central authority that manages the exchange’s operations. In contrast, a DEX is decentralized, operating on a decentralized platform that does not rely on a central authority.

What are Some of the Best CEX and DEX Platforms?

Some of the best CEX platforms are Coinbase, Binance, and ZebPay, while some popular DEX platforms include Uniswap, PancakeSwap, and SushiSwap. It’s important to do your research and compare different exchanges before choosing one to trade on.

Do I Need To Provide Personal Information To Trade On a DEX?

No, DEXs often allow users to trade anonymously without the need for KYC or AML checks. This is because they are decentralized and do not require a central authority to manage user accounts.

Which is better for a new trader, a CEX or a DEX?

CEXs are generally considered more user-friendly than DEXs, making them a better option for new traders. Additionally, CEXs often have higher liquidity, making it easier for traders to buy or sell crypto tokens.