What is Tokenization?

Imagine you have a pizza you want to share with your friends. The simplest way to divide it is by cutting it into slices, with each slice representing a share of the whole. Tokenization works the same way, but instead of pieces of pizza, it divides real-world assets into digital portions. In blockchain terms, this answers the question “what is token in blockchain?” — it’s a digital unit that represents ownership, value, or rights linked to something bigger.

With tokenization, an asset is broken down into digital tokens, each acting like a claim to a specific part of that asset. It’s like assigning every pizza slice a unique identifier and saying, “This token represents this exact slice.” The same idea applies to much larger and more complex assets.

One of the strongest examples today is tokenization in real estate. Instead of needing large amounts of money to own property, tokenization allows a building or land to be divided into hundreds or thousands of digital tokens. Each token represents a fractional share, making real estate investment more accessible, flexible, and tradable—much like sharing a pizza, but on a far larger financial scale.

In essence, tokenization transforms physical or financial assets into digital tokens on a blockchain, making ownership easier to divide, track, and transfer.

How Does Tokenization Work?

Tokenization involves several steps to transform physical assets into digital tokens:

- Asset Selection: An asset, such as a house, a piece of art, or even intellectual property rights, is chosen to be tokenized.

- Asset Valuation: The asset is appraised or evaluated to determine its value. This step helps in setting the parameters and understanding the worth of the digital tokens.

- Token Creation: Once the value is determined, digital tokens are created on a blockchain platform. These tokens contain information about the asset they represent, like ownership details and any rights or benefits.

- Legal and Compliance: Depending on the jurisdiction, regulatory requirements and legal agreements may need to be fulfilled. This ensures that the tokenization process adheres to the applicable laws and regulations.

- Token Offering: The newly created tokens are then made available for sale or distribution. Interested individuals can purchase these tokens, becoming owners of a fraction or a whole of the underlying asset.

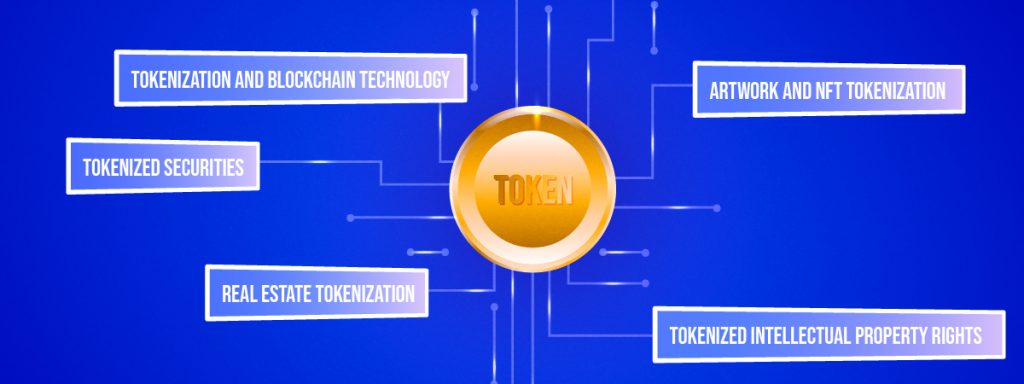

What are the Different Types of Tokenization?

Tokenization is a versatile concept that can be applied to various assets. Let’s explore some common types of tokenization:

Financial Asset Tokenization

Financial assets, such as stocks, bonds, or commodities, can be tokenized. By converting them into digital tokens, it becomes easier to trade and transfer ownership. Tokenized financial assets offer fractional ownership, allowing smaller investors to access markets that were previously limited to large institutions.

Real Estate Tokenization

Real estate assets such as homes, commercial buildings, and land can also be converted into digital tokens, a process often referred to as tokenization in real estate. This approach broadens access to the property market by enabling fractional ownership, lowering entry barriers, and making ownership transfers faster and more flexible.

Art and Collectibles Tokenization

Tokenization has revolutionized the art market. Artworks and collectibles can be tokenized, creating digital representations of the physical objects. These tokens provide proof of ownership and can be bought, sold, or traded on digital platforms. It also allows art enthusiasts to invest in art pieces they believe in.

Intellectual Property Tokenization

Intellectual property rights, such as patents, trademarks, or copyrights, can be tokenized. By converting these rights into digital tokens, creators can monetize their intellectual property more efficiently. Tokenization enables the fractional sale or licensing of intellectual property, making it accessible to a wider range of individuals or businesses.

Read more: Tokenization vs. Encryption

Benefits of Tokenization

Increased Liquidity

Tokenization improves liquidity by enabling fractional ownership. Instead of needing a large sum of money to buy an entire asset, people can buy smaller portions of it through tokens. This opens up investment opportunities and allows assets to be traded more easily.

Enhanced Accessibility

Tokenization makes traditionally illiquid assets, such as real estate or artworks, more accessible. It allows a wider range of investors to participate and benefit from asset ownership, promoting financial inclusion.

Transparency and Security

Blockchain technology, often used in tokenization, provides transparency and security. Each transaction and ownership transfer is recorded on the blockchain, ensuring a trustworthy and immutable record of ownership. This reduces fraud and enhances the security of the assets.

Fractional Ownership

Tokenization enables fractional ownership, meaning that multiple individuals can own a fraction of an asset. This flexibility allows for smaller investments and diversification across multiple assets, reducing risk.

What are Some Tokenization Examples?

Let’s explore a few examples of tokenization in different sectors:

Tokenized Securities

Traditional stocks and bonds can be tokenized, allowing investors to own fractional shares or bonds. This makes it easier for individuals to invest in companies or participate in fundraising activities. One example of such a platform is Polymath.

Real Estate Tokenization Case Studies

Tokenization in real estate has become increasingly popular as properties are now being divided into digital tokens that represent fractional ownership. Imagine a commercial building split into many such tokens, allowing multiple investors to buy a share of the property and earn rental income based on the portion they hold. Platforms like Propy make this process seamless by automating property transfers and enabling these tokenized ownership stakes to be managed more efficiently.

Artwork and NFT Tokenization

Non-Fungible Tokens (NFTs) have become a hot topic in recent years. NFTs represent virtual assets like art, music, or virtual land. These tokens enable artists to monetize their creations and provide collectors with proof of ownership. Maecenas is a platform that allows investors to buy fractional ownership of fine art.

Tokenized Intellectual Property Rights

Creators can tokenize their intellectual property, such as patents or copyrights. This allows them to license or sell fractions of their rights, generating revenue and expanding their reach. IPwe is one such example that automates the process of transferring patents.

Tokenization and Blockchain Technology

Tokenization often goes hand in hand with blockchain technology. Blockchain provides the infrastructure for creating, managing, and trading digital tokens. Its decentralized and transparent nature ensures the security and integrity of tokenized assets.

Future of Tokenization

The future of tokenization is set to expand dramatically as digital infrastructure becomes stronger and more widely adopted. As more people begin to understand what is token in blockchain systems and how these tokens represent real ownership, a broader range of assets is expected to move on-chain. This shift has the potential to reshape traditional finance by opening investment opportunities to anyone with internet access, reducing dependence on intermediaries, and creating more transparent markets. With growing regulatory interest and government support, tokenization is steadily evolving into a powerful ecosystem that could redefine how wealth is created, managed, and exchanged in the years ahead.

Conclusion

Tokenization is the process of turning real-world assets into digital tokens on a blockchain, helping people better understand what is token in blockchain and how it represents ownership or rights to an underlying asset. It brings major advantages such as higher liquidity, easier access, greater transparency, and the ability to own fractions of high-value items. This approach is already being applied to financial instruments, artwork, intellectual property, and especially tokenization in real estate, where properties can be divided into smaller, tradable units. As blockchain technology continues to advance, tokenization is poised to reshape how assets are bought, sold, and invested in, opening the door to a more inclusive and efficient financial system.

In the grand scheme of things, ZebPay blogs are here to provide you with crypto wisdom. Get started today and join 6 million+ registered users to explore endless features on ZebPay!

FAQs on Tokenization

How does tokenization work in blockchain?

Tokenization works by converting a real-world asset into digital tokens on a blockchain. Each token represents a share or specific right to the asset. The blockchain records ownership, ensures transparency, and allows these tokens to be traded securely without intermediaries.

What is the difference between tokenization and traditional digitization?

Traditional digitization simply turns physical information into digital files, like scanning a document. Tokenization, however, creates blockchain-based tokens that represent ownership or value tied to an actual asset. These tokens can be traded, divided, and transferred, something digitization alone cannot offer.

How does real estate tokenization work?

Real estate tokenization divides a property—such as a house, apartment, or commercial building—into digital tokens. Investors buy these tokens to own a fraction of the property. They may receive rental income proportionate to their share, and they can sell their tokens easily without needing to sell the entire property.

How does tokenization make investing more accessible?

Tokenization breaks large, expensive assets into smaller, affordable units. This allows more people to invest in opportunities that were once limited to high-net-worth individuals. It also increases liquidity and lowers entry barriers, making investing more flexible and inclusive.

What is one example of tokenization?

A common example is tokenized artwork. A valuable painting can be divided into hundreds or thousands of digital tokens. Each token holder owns a fraction of the artwork, allowing more people to invest without needing to buy the entire piece.