Crypto markets remained flat during early trading in Asian markets on Friday, even after a sharp rally in global stock markets. Bitcoin clung to $17,000 mark, while Ethereum traded above $1,200 amid jittery sentiment for the digital token market. The major cryptos tokens traded mixed, with minor changes. Polkadot gained 1.53%, followed by Shiba Inu, Litecoin, and Cardano. Dogecoin and Cardano led the winners. The global cryptocurrency market cap traded flat and hovered around $810 billion. Total trading volume decreased by more than 25% to $25.57 billion.

Bitcoin slipped as Wall Street opened on Dec. 22 as US stocks pared earlier gains. The pair remained a striking mimic of equities as the S&P 500 swung around. At the time of writing, the Nasdaq Composite Index was down 1.8%. The weakness appeared to be in response to stronger-than-expected US gross domestic product (GDP) growth in the third quarter, data released ahead of the opening. Although in theory a sign of recovery, concerns centred on the US Federal Reserve continuing its tightening economic policy on the assumption that the economy would be able to sustain the Resisting action. This would theoretically take the form of more sustainable action. rate hikes, and analysts have already argued that a ‘pivot’ in monetary policy is unlikely until 2024 at the earliest. As such, risky assets saw no relief from the GDP numbers, leaving further disappointing traders awaiting Santa Claus meetings .

Ether bounced off the support near $1150 on December 20th, suggesting that lower levels are attracting buyers. The relief rally has touched the 20-day EMA of $1,233 where the bears can mount a strong defence. Consequently, investors believe that Ethereum prices are below $1,000 could check as the Dollar Index (DXY) is losing strength as US 10-year Treasury yields show increased demand for hedging. Derivatives traders continue to use more leverage for short (bearish) positions as the ether futures premium remains negative. However, the lack of buyer demand for leverage does not mean traders are anticipating less favourable price action. Delta bias increased after December 15th from a daunting 14% versus protective put options’ current 20%. This move suggested options traders were even less comfortable with downside risk. The 60-day delta bias indicates that whales and market makers are reluctant to offer downside protection, which seems natural given the three-week descending channel. In short, both the options and futures markets suggest that professional traders do not trust the recent bounce above $1200. The current trend favours ether bears as the chances are high that the Federal Reserve will stick to its balance sheet reduction program, which is destructive for risk markets.

On the macro front Japan’s central bank effectively raised interest rates much later than their global counterparts. The unexpected move made analysts more pessimistic about risky assets, including cryptocurrencies.But the most pressing issue is regulation. On December 19, the U.S. The House Financial Services Committee introduced new legislation to create Innovation Offices Within government agencies that deal with financial services. Meanwhile, the main beneficiary of the GDP pull was the US dollar, which saw a safe rebound in strength.

Technical Outlook:

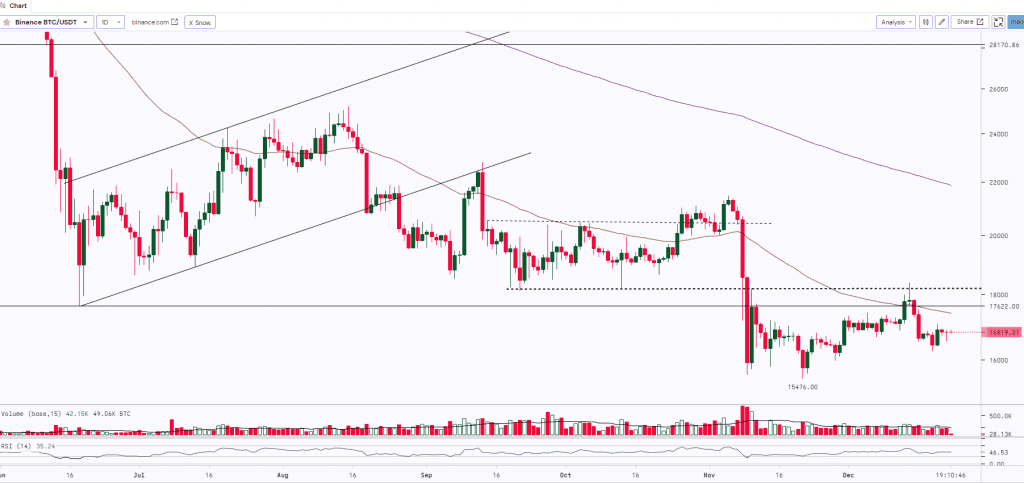

BITCOIN:

BTC after making the low of $15,476 started consolidating in a range between $17,250 and $16,000. The asset gave a breakout on the upside after the CPI data and made the high of $18,387. However, the bulls failed to manage the grip on the asset and it witnessed profit booking at higher levels and the prices dropped to $$16,527. The longer upper shadow indicates that bears are selling around $18k levels. Bitcoin has a strong support around $15,500 (recent low of $15,476). If it breaks the support then we can expect it to fall further and test the next support which is around $12k whereas to witness a rally it needs to break and sustain above $18k. RSI around 50 indicates a neutral stance for the asset.

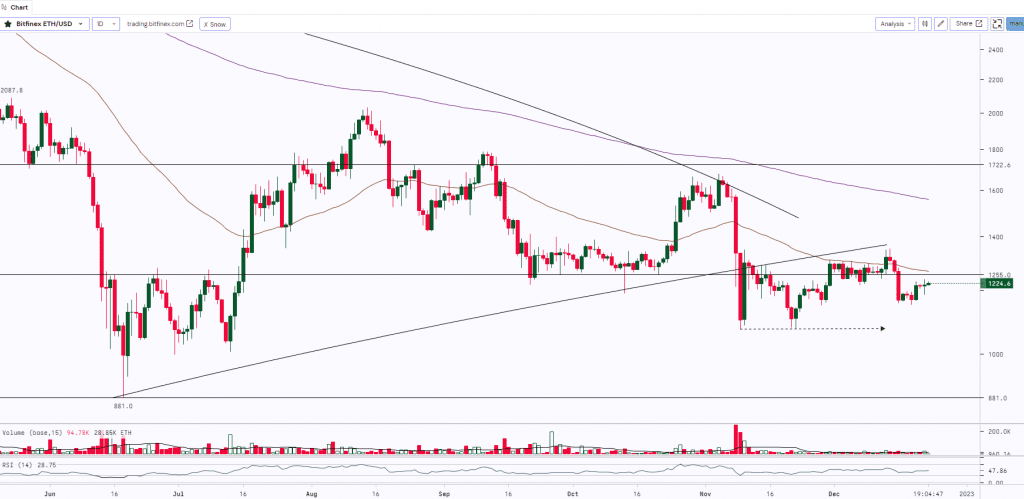

ETH:

ETH continues to consolidate sideways in a tight range between $1,150 to $1,250 this week. On a broader time scale the prices are trading in a big range from $1,000 to $1,400. Last week, the asset showed signs of upward momentum and rallied up to $1,352, however, the bulls failed to push the prices above the resistance of $1,400. Breakouts above $1,400 or below $1,000 with good volumes will further decide the trend for the asset.

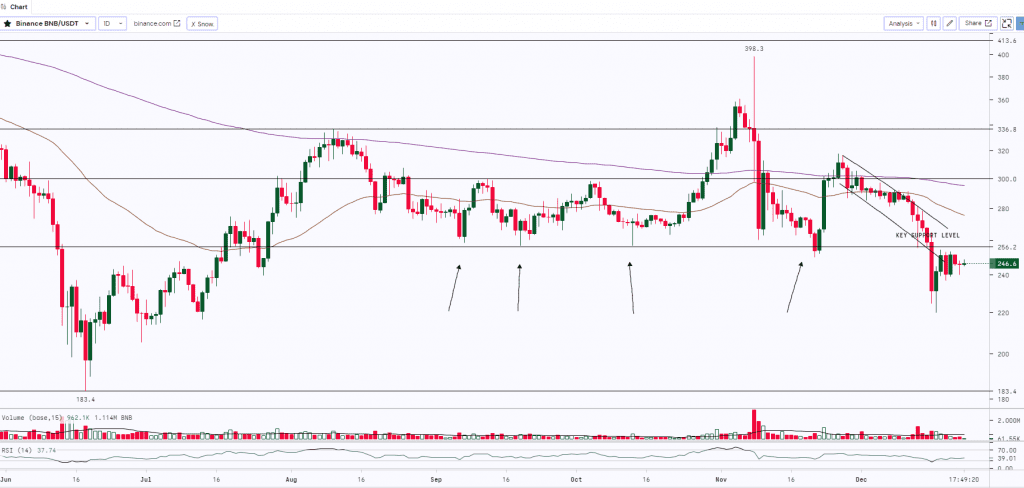

BNB:

BNB after taking multiple support at $255 it went up to $317.8. Post this move, the asset started trading in a ‘Descending Channel’ pattern. Last week, BNB gave a breakout below the pattern and broke the long held support of $255 and made the low of $220. Currently, the asset is consolidating between $255 and $235. To witness a rally, BNB needs to close and sustain above the key level of $255.

Weekly Snapshot:

| USD ($) | 15 Dec 22 | 22 Dec 22 | Previous Week | Current Week | |||

| Close | Close | % Change | High | Low | High | Low | |

| BTC | $17,365 | $16,830 | -3.08% | $18,319 | $16,899 | $17,506 | $16,398 |

| ETH | $1,266 | $1,218 | -3.80% | $1,346 | $1,243 | $1,278 | $1,160 |

| BNB | $258.27 | $245.89 | -4.79% | $291.57 | $257.08 | $264.25 | $221.00 |

| Cryptocurrency | 1w – % Vol. Change (Global) |

| BitCoin (BTC) | -13.74% |

| Ethereum (ETH) | -3.26% |

| Binance Coin (BNB) | -6.25% |

| Resistance 2 | $22,500 | $1,750 | $1.20 | $300 |

|---|---|---|---|---|

| Resistance 1 | $18,000 | $1,400 | $1.05 | $255 |

| USD | BTC | ETH | Matic | BNB |

| Support 1 | $15,500 | $1,000 | $0.75 | $215 |

| Support 2 | $12,000 | $881 | $0.62 | $185 |

Market Updates:

- A U.S. bankruptcy court has granted Bitcoin miner Core Scientific interim approval to access a $37.5 million loan from existing creditors to fund it amid liquidity issues.

- Unique addresses on the BNB Chain have now surpassed Ethereum, according to a Dec. 22 statement from the developer.

- The South Korean court has ordered a freeze of 120 billion won ($92 million) in assets of former and incumbent CEOs of Terraform Labs’ affiliate firm Kernel Labs, The Korea Economic Daily reported on Dec. 20.

- Jair Bolsonaro, the president of Brazil set to leave office on Dec. 31, has signed a bill aimed at legalising the use of crypto as a payment method within the country.

Disclaimer: This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation, or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness, or reliability of the information, opinions, or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in cryptocurrencies viz. Bitcoin, Bitcoin Cash, Ethereum, etc are very speculative and are subject to market risks. The analysis by the Author is for informational purposes only and should not be treated as investment advice.