Bitcoin appeared to regain $27,000 at the weekly close on May 14th as volatility surged in after-hours trading. The asset hit its highest level in several days, reflecting a rise of around 7.5% from local lows set in the week’s last trading session on Wall Street. However, the lack of a strong supply of whales at lower levels could be a worrying sign. The bullish outlook could be invalidated if Bitcoin stays below the 200-week moving average. It looks like Bitcoin has started a corrective phase. The dominance of the asset is currently at 46.37%.

At the time of writing, BTC was trading at $27,440

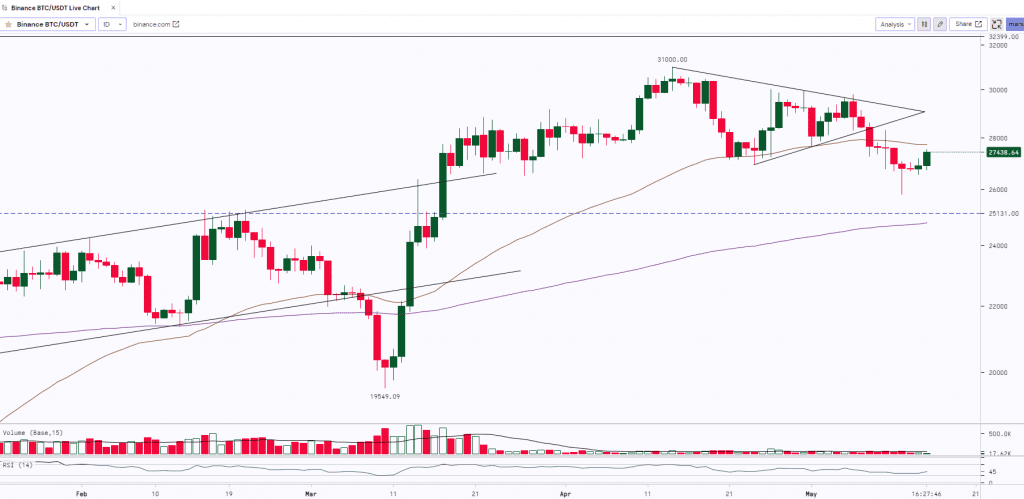

BITCOIN after witnessing a rally from $19,550 to $31,000 was trading in a range forming a ‘Symmetrical Triangle’ pattern with low volumes where the upper downsloping trendline was acting as a resistance and the lower upsloping trendline was acting as a support for the asset. The asset finally gave a breakout on the downside of the pattern and it made a low of $25,811. BTC made a red body ‘Hammer’ candle at the recent low and is trying to recover. $28,500 and $32,500 will be the major hurdles for the bulls. To witness a rally BITCOIN needs to break, close and sustain above these levels whereas $25k will act as a strong support.

Key Levels:

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2. |

| $22,500 | $25,000 | BTC | $28,500 | $32,500 |