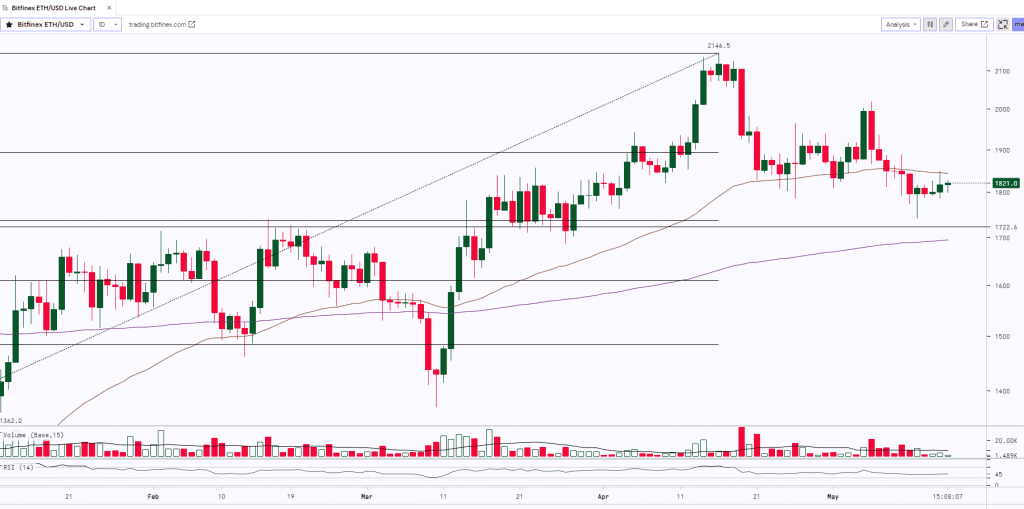

Ether rallied from the 50% Fibonacci retracement level of $1,754 on May 12th and after a few days of consolidation, the bulls pushed the price to the 20-day EMA ($1,854). The bears will attempt to vigorously protect the support line and turn it into resistance. The total Staked value continued to rise, supported by a bullish ETH session and an uptrend in ETH staking inflows. A large increase in staking inflows would limit the effect of an increase in withdrawals. The asset’s dominance is at 20.3% as of 16th May.

At the time of writing, ETH was trading at $1,821

ETH after witnessing a rally from $1,370 to $2,146 started consolidating at the highs and was trading sideways making small ‘Spinning Top’ candles that indicated indecision in trend. The bulls failed to manage the grip on the asset as it saw some profit booking and the prices dropped to $1,741.5. ETH made a ‘Hammer’ candle at the recent low where the lower longer shadow indicates buying around the support zone ($1,700- $1,725). Currently, on the daily time frame, ETH is consolidating and trading sideways and is resisting its 50-Day Moving Average.

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $1,500 | $1,725 | ETH | $1,850 | $2,000 |