Ether has been trading near the 20-day EMA ($1,833) for the past few days. Although the bears successfully defended the level, the bulls kept the pressure up. This improves the prospects for a break above the 20-day EMA. In fact, the ETH stake on the network has been growing, hitting an all-time high of 21.8 million. Ethereum’s current staking rate is 15.2%, giving it much room to grow. Since Ethereum shares all of its profits with validators, the recent meme-coin frenzy actually resulted in over 20,000 ETH profit for validators in the last week.

At the time of writing, ETH was trading at $1,858.5

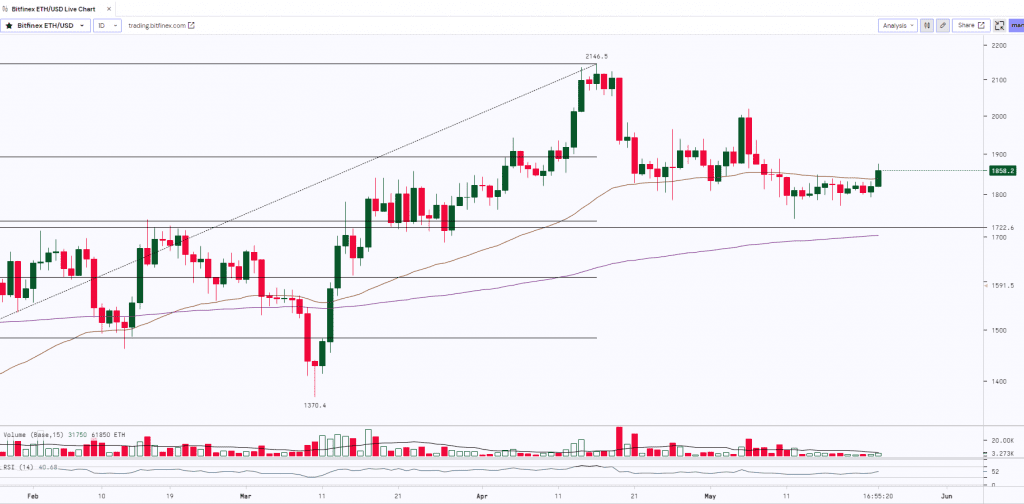

ETH after witnessing a rally from $1,370 to $2,146 started consolidating at the highs and is trading sideways making small ‘Spinning Top’ candles that indicated indecision in trend. The bulls failed to manage the grip on the asset as it saw some profit booking and the prices dropped to $1,741.5. ETH made a ‘Hammer’ candle at the recent low where the lower longer shadow indicates buying around the support zone ($1,700- $1,725) and started consolidating between $1,750 to $1,850. The asset was resisting at its 50 Day Moving Average as well. However, today it has given a breakout above the range and its 50-Day Moving Average. If it closes and sustains above the resistance then we can expect the prices to rally up to the $2k mark further.

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $1,500 | $1,725 | ETH | $1,850 | $2,000 |