One small bright spot in this chaos caused by the SEC is that Bitcoin has held up relatively well. This suggests that institutional investors are not panicking and exiting their positions. Due to its outperformance, Bitcoin’s year-to-date dominance has surged to a high of 47.6%. Bitcoin fell again to the crucial support at $25,000 on Jun 10, suggesting the bears are keeping the pressure on. Repeatedly testing a support level at short intervals tends to weaken it. The asset price has risen by a marginal 1% while the global volume is down by almost 45% in the last 24 hours.

At the time of writing, BTC was trading at $25,833.

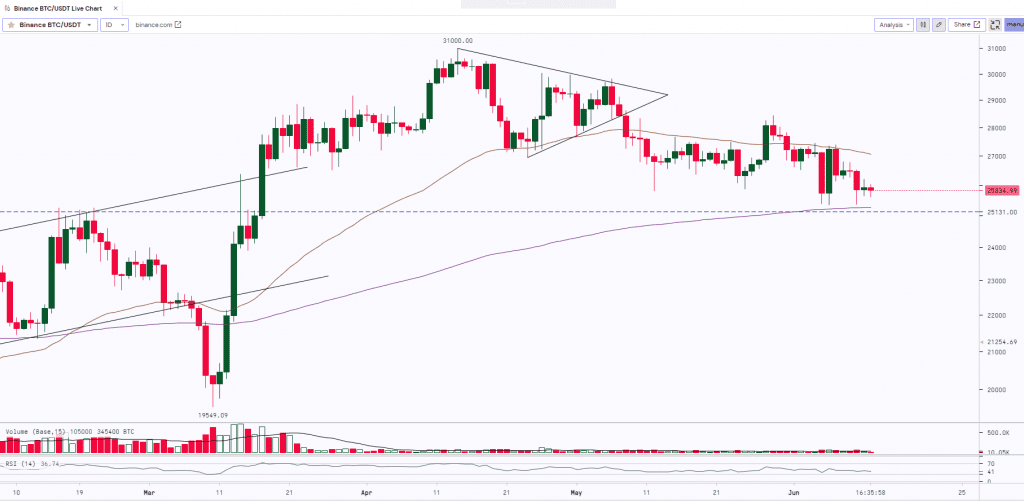

BITCOIN after making a recent top of $31,000 started trading in a downtrend and made a low of $25,811. Post this move, the asset started consolidating and was trading sideways in a range from $26,000 to $27,750. The bulls tried to give a breakout above the range but they failed to push the prices above the key resistance level of $28,500 and the asset witnessed correction making the low of $25,351. BITCOIN has a strong support zone from $25,250 to $25,000 (Horizontal Trendline & 200-Day Moving Average). If it holds, sustains and rebounds from the support then we can expect some relief rally whereas a break below the support will lead to further downfall.

Key Levels:

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2. |

| $22,500 | $25,000 | BTC | $28,500 | $32,500 |