Crypto markets traded mixed on Friday. Bitcoin, XRP and Polygon traded for gains while Ethereum, BNB and Cardano traded at declines. Bitcoin (BTC) is up 0.58% to $26,532, while Ethereum (ETH) is below the $1,850 level. The global crypto market cap was higher, hovering around $1.1 trillion, up 0.53% over the past 24 hours. Crypto markets have traded sideways for the past 24 hours. The Crypto Fear and Greed Index continues to hold yesterday’s position right in the middle of the scale at 50 points.

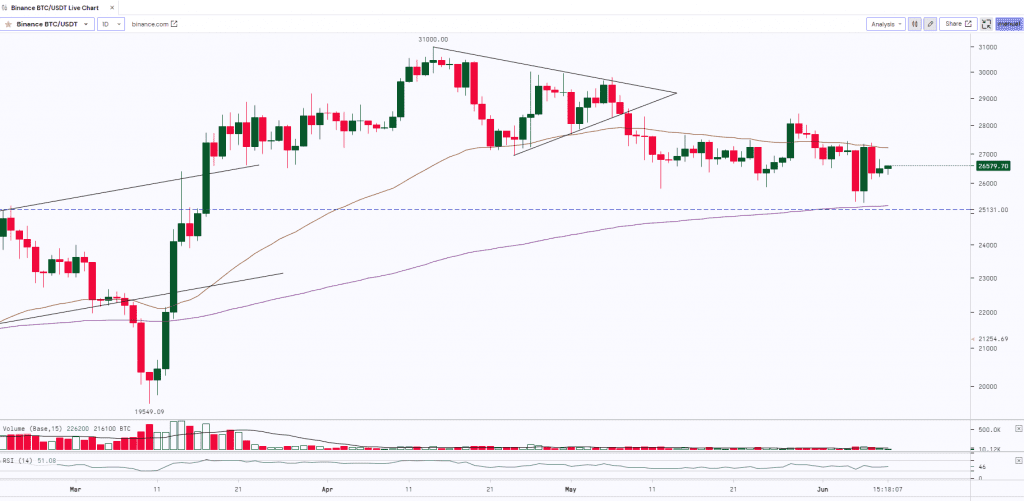

Bitcoin may have shown strength by quickly recovering from the $25,500 support level on June 6, but that doesn’t mean the break above $27,500 will be an easy task. It is attempting to solidify an inverse head and shoulders pattern that could spark a sprint to $40,000. The weekly chart shows BTC/USD completing an inverse head and shoulders pattern and is now retesting it. This is the bullish counterpart of the standard head and shoulders pattern, which shows resistance consolidating and a downtrend usually follows after this consolidation. While a bearish head and shoulders pattern has formed around the local highs of $31,000 in April on the daily timeframes, the broader trend could still work in the bulls’ favour. Overall, bitcoin bulls appear to be in bad shape, both due to the deteriorating crypto regulatory environment and the unfolding global economic crisis. Bitcoin derivatives markets are pointing to a low probability of BTC prices breaking $27,500 in the short to medium term. In other words, Bitcoin’s market structure is bearish, making a retest of the $25,500 support the most likely outcome.

Ethereum developers on Thursday agreed on the full scope of the next network upgrade dubbed “Dencun”. Expected later this year, the upgrade, also called a hard fork, includes five Ethereum Improvement Proposals (EIPs) aimed at creating more storage space for data and reducing fees. At the heart of this update is EIP-4844, better known as Proto Dankharding. This feature will scale the blockchain by freeing up more space for “blobs” of data, which is then expected to result in lower gas fees for Layer 2 rollups.

On the macro front, Investors are still expecting tighter regulatory scrutiny following FTX’s bankruptcy in November 2022, including recent lawsuits against Coinbase and Binance. The US Securities and Exchange Commission (SEC) has taken a total of eight crypto-related enforcement actions in the past six months. According to revised estimates by the region’s statistics office, Eurostat, released on June 8, the eurozone slipped into recession in the first quarter of this year. Poor economic performance could limit the European Central Bank’s ability to keep raising interest rates to deal with inflation.

Technical Outlook

BITCOIN:

BTC after making a ‘Long Legged Doji’ candle at the recent top of $31,000 witnessed a profit booking and the prices corrected almost by 18% and made the low of $25,351. Post this move, the asset started consolidating and trading sideways in a range from $26,000 to $27,500. BTC, on a daily time frame, has very strong support at $25,000 (Horizontal Trendline & 200-Day Moving Average). If the asset holds and sustains above the support and crosses the immediate resistance of $28,500 then we can expect a rally up to $32,500 whereas a break below $25k will lead to further downfall.

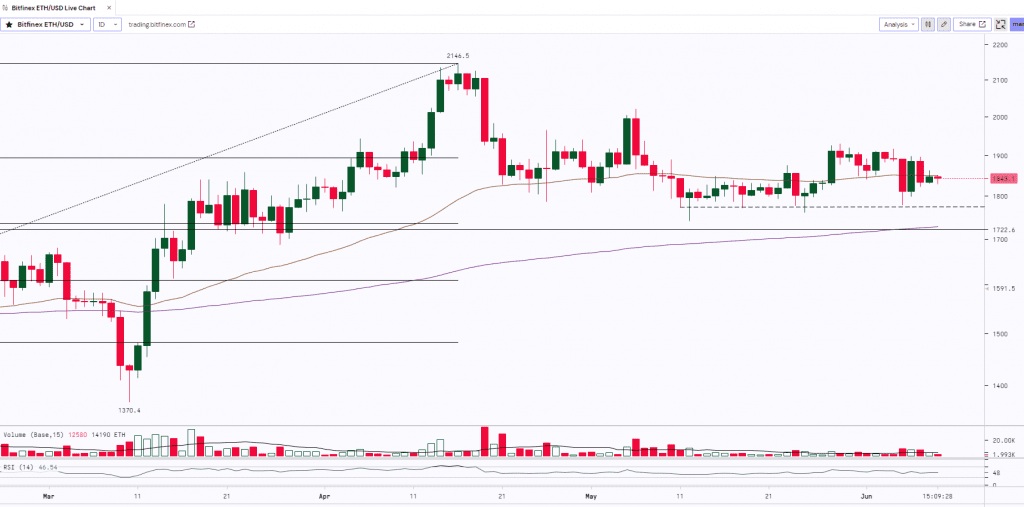

ETH:

ETH after witnessing a rally from $1,370 to $2,146 started consolidating at the highs and trading sideways making small ‘Spinning Top’ candles that indicated indecision in trend. The bulls failed to manage the grip on the asset as it saw some profit booking and the prices dropped to $1,741.5. ETH made a ‘Hammer’ candle at the recent low where the lower longer shadow indicates buying around the support zone ($1,700- $1,725). Currently, on the daily time frame, ETH has made an ‘Inside Bar’ candle on 6th June which indicates consolidation and sideways movement. A series of inside days can set up indicators for trend reversals in technical analysis.

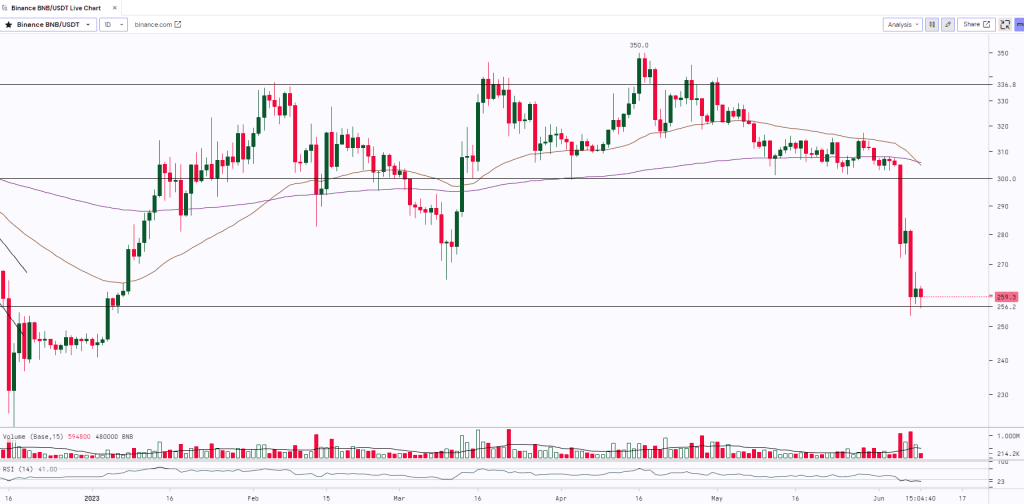

BNB:

BNB after making a high of $350 made a ‘Tweezer Top’ Candle that witnessed a profit booking and the prices plunged to $301. The asset was taking multiple support at $300 levels. It broke the support on 5th June and witnessed a sharp fall. The prices plunged almost 15% and made a low of $253.6 within 2 days. BNB has strong support at $255. Currently, the asset is trying to take the support at the key level. If it breaks the support then it can further drop to $236 levels.

Monthly Snapshot

| USD ($) | 01 Jun 23 | 08 Jun 23 | Previous Week | Current Week | |||

| Close | Close | % Change | High | Low | High | Low | |

| BTC | $26,820 | $26,508 | -1.16% | $28,432 | $26,343 | $27,407 | $25,435 |

| ETH | $1,862 | $1,846 | -0.84% | $1,926 | $1,798 | $1,912 | $1,780 |

| BNB | $304.95 | $262.15 | -14.04% | $316.80 | $301.89 | $308.40 | $256.10 |

| crypto | 1w – % Vol. Change (Global) |

| BitCoin (BTC) | 14.42% |

| Ethereum (ETH) | 15.37% |

| Binance Coin (BNB) | 36.31% |

| Resistance 2 | $32,500 | $2,000 | $1.30 | $336 |

|---|---|---|---|---|

| Resistance 1 | $28,500 | $1,850 | $0.95 | $300 |

| USD | BTC | ETH | Matic | BNB |

| Support 1 | $25,000 | $1,700 | $0.75 | $255 |

| Support 2 | $22,000 | $1,500 | $0.63 | $236 |

Market Updates

- Ethereum co-founder Vitalik Buterin is working with India-based crypto fund Crypto Relief and Polygon co-founder Sandeep Nailwal to send $100 million toward COVID-19 research and medical infrastructure development in India.

- ARK Invest CEO Cathie Wood doesn’t appear to have been swayed by recent crypto regulatory action, buying another $19.9 million shares of Block Inc. right after buying $21 million in Coinbase stock.

- Lawmakers in the United States have proposed two new bipartisan bills targeting issues of transparency and innovation in artificial intelligence (AI).