Crypto markets traded mixed this week after consumer price inflation rose at a slower-than-expected rate in April. Cardano, Solana and Polkadot traded for gains while Bitcoin, Ethereum and Polygon traded for declines. Bitcoin (BTC) fell 0.37% to $27,537, while Ethereum (ETH) was below the $1,850 level. Meanwhile, BTC volume hovered around $20.82 billion, up 53.29% in the last 24 hours. The crypto market was almost flat as the encouraging CPI data showed that inflation is cooling and we can expect monetary easing in the future. The global Crypto market was at $1.14 trillion, falling 0.20% in the last 24 hours. The total volume in DeFi is currently $3.33 billion, 7.23% of the total 24-hour crypto market volume. The volume of all stablecoins currently stands at $41.56 billion, which is 90.13% of the crypto market’s total 24-hour volume.

BTC price action offers little relief to bitcoin bulls, despite major US data releases showing an easing in inflation. Assets headed for $27,000 after Wall Street opened on May 11th as bulls failed to show strength. Data observed that BTC/USD faced another drop in support. After a modest rebound from yesterday’s local lows, the pair remained weak even as fresh US macro data provided bullish signals. As previously reported, market participants continued to prepare downside targets with many targeting the $25,000 area. Bitcoin’s price drop to below $28,000 over the past week has put the bears in a better position for Friday’s expiry.

The BTC/USD pair broke through $29,800 on May 6, but the tide turned quickly on stronger-than-expected resistance. The subsequent two-day correction of 8.2% tested the support at $27,400 and reinforced the sideways trading thesis as investors assess the dynamics of the economic crisis and its potential impact on crypto assets. Bitcoin’s $900M weekly options expiring on May 12 could play a crucial role in whether the price will give way and fall below $27K.

After a brief break above $2,000 on May 6th, Ether’s price has returned to a tight range between $1,820 and $1,950, which has been the norm for the past three weeks. According to the latest ether futures and options data, there are good chances for ether prices to break below the $1820 support as professional traders have been reluctant to add neutral positions to bullish positions using derivative contracts. Not even the Memecoin frenzy like PEPE, which fueled demand for the Ethereum network, could inspire investor confidence. Ethereum’s average transaction fee rose to $27.70 on May 6, its highest level in 12 months. Furthermore, the increase in gas fees has pushed users towards Layer 2 solutions, which could be interpreted as a weakness. Some analysts believe that the Ethereum Foundation’s $30 million ether sale helped ETH fail to surpass $2,000 as nearly 20,000 ETH was sent to the Crypto exchange Kraken.

On the macro front, US CPI data for April, released on May 10th, came in at 4.9%, slightly below consensus, further raising investor expectations for stable interest rates at the forthcoming June Federal Reserve meeting. Although inflation remains stubbornly above the Federal Reserve’s 2% target, traders will be content with the slower rate of increase. This suggests that the Fed’s rate hikes are having an effect and further rate hikes may not be necessary.

Technical Outlook

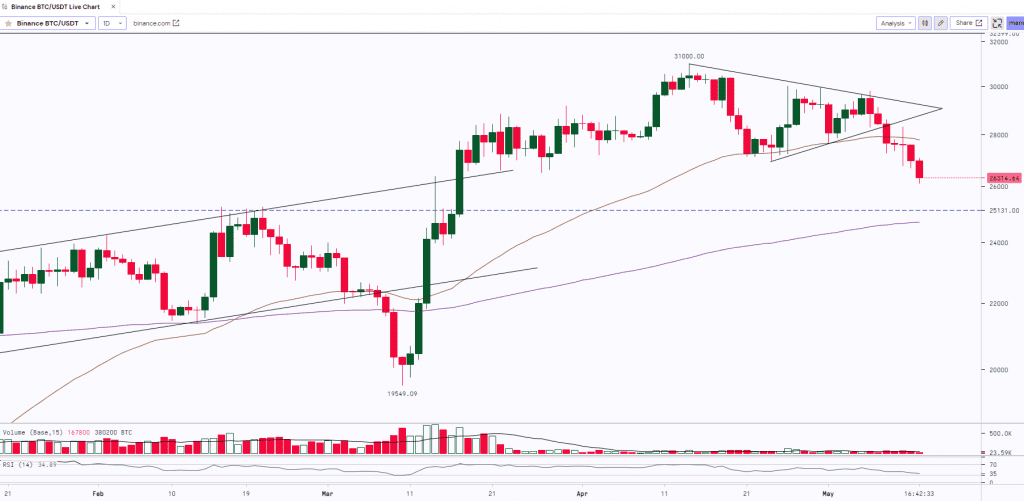

Bitcoin:

BITCOIN witnessed a sharp rally from $19,550 to $31,000. Post this move, the asset started trading sideways in a range forming a ‘Symmetrical triangle’. BTC finally gave a breakout on the downside early this week and also broke the 50-Day Moving average and has made a low of $26,120. BTC has strong support at $25,000, if it holds and sustains above the support then we can expect the bulls to resume the up move from the support levels whereas a break below $25k will lead to further downfall.

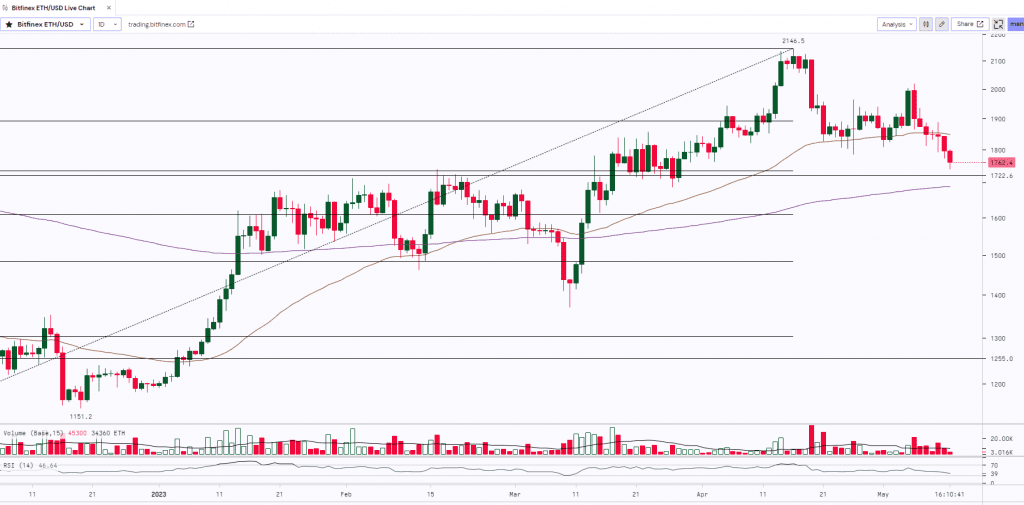

ETH:

ETH after witnessing a massive rally from $1,073.5 to $2,146 saw some profit booking at higher levels and the prices dropped to $1,800. Post this move, the asset started to consolidate and was trading sideways in a broad range from $1,950 to $1,800. ETH gave a breakout on the downside and it made a low of $1,741. It has strong support at $1,700. If it breaks $1,700 with good volumes then we can expect further downfall to the next support which is at $1,500.

BNB:

BNB after making a high of $350 made a ‘Tweezer Top’ Candle that witnessed a profit booking and the prices plunged to $315. The asset was taking support at its 50-Day Moving Average. However, BNB broke the support and closed below its 50-Day Moving Average and witnessed further downfall making the weekly low of $301.2. The asset has strong support at $300. If it sustains and holds above the support then we may expect some rally whereas a break below this will lead to further downfall.

Monthly Snapshot

| USD ($) | 04 Apr 23 | 11 Apr 23 | Previous Week | Current Week | |||

| Close | Close | % Change | High | Low | High | Low | |

| BTC | $28,847 | $27,000 | -6.40% | $29,952 | $27,680 | $29,820 | $26,781 |

| ETH | $1,878 | $1,796 | -4.35% | $1,938 | $1,809 | $2,017 | $1,774 |

| BNB | $323.92 | $307.70 | -5.01% | $331.20 | $319.59 | $328.90 | $304.96 |

| Crypto | 1w – % Vol. Change (Global) |

| BitCoin (BTC) | 2.81% |

| Ethereum (ETH) | 20.48% |

| Binance Coin (BNB) | -33.22% |

| Resistance 2 | $32,500 | $2,250 | $1.30 | $350 |

|---|---|---|---|---|

| Resistance 1 | $28,500 | $2,000 | $1.05 | $336 |

| USD | BTC | ETH | Matic | BNB |

| Support 1 | $25,000 | $1,700 | $0.95 | $300 |

| Support 2 | $22,000 | $1,500 | $0.75 | $255 |

Market Updates:

- An unidentified issue on Ethereum’s Beacon Chain led to an issue with transaction finality for nearly half an hour on May 11.

- Crypto wallet and decentralized application (DApp) provider MetaMask has started rolling out Ether purchases via PayPal for users in the United States — one of Metamask’s biggest markets.

- The United States Chamber of Commerce has blasted the Securities and Exchange Commission for its “haphazard, enforcement-based approach” to regulating the Crypto industry on American soil.

- The Federal Reserve’s forthcoming instant payment service FedNow will be integrated with Metal Blockchain, according to a May 11 announcement from the Metal Blockchain team.