El Salvador is the first country to adopt bitcoin as legal tender. Let’s understand why, and this decision’s second and third-order effects

Money typically serves three purposes –

- A store of value: it can be held and exchanged later for goods and services at an approximate value.

- A unit of accounts: a means of keeping track of how much something is worth.

- A medium of exchange: an object that is generally accepted as a form of payment.

In India, Bitcoin and cryptocurrency enthusiasts have known Bitcoin to be an amazing store of value, that has given returns higher than any other major asset in the last 5 years.

This, however is not in line with Bitcoin’s original vision – to be a a Peer-to-Peer Electronic Cash System.

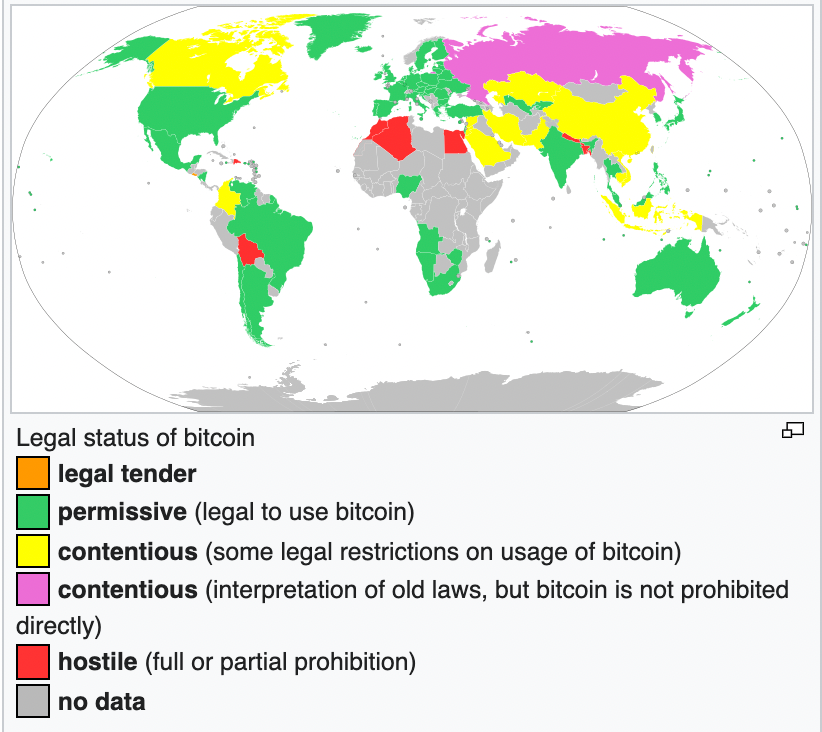

The biggest reason for this is that no country or legislation had deemed bitcoin to be legal tender, or an accepted medium of exchange. Yet.

El Salvador declares Bitcoin as Legal Tender

On the 8th of June, for the first time in the history of bitcoin, a country has made bitcoin legal tender by passing The Bitcoin Law, which will come into effect on September 7, 2021.

The Bitcoin Law was passed by the Legislative Assembly of El Salvador on 8 June 2021, giving bitcoin the status of legal tender within El Salvador. It was proposed by President Nayib Bukele. The text of the law claims that “the purpose of this law is to regulate bitcoin as unrestricted legal tender with liberating power, unlimited in any transaction, and to any title that public or private natural or legal persons require carrying out”

The adoption of bitcoin by El Salvador follows a long and complicated history from using cacao beans, to experimenting with its own currency (the colón) in 1892, adopting the US Dollar in 2001, and the latest of which is the recent passing of the Bitcoin Law with a “supermajority” (62 out of 84 votes).

Notably, bank accounts in US dollars will remain in dollars, and salaries and pensions will continue to be paid in dollars.

Why El Salvador is turning to Bitcoin

Financial inclusion

According to the law, about 70% of the country’s population does not have access to “traditional financial services”. Making bitcoin El Salvador’s local currency could accelerate the financial inclusion of Salvadorans.

Investment in Bitcoin from crypto enthusiasts around the world.

President Nayib Bukele hopes to see El Salvador become a hub for Bitcoin mining.

El Salvador is also offering an immediate permanent residency for people who invest crypto in real estate and business.

There will also be no capital gains tax for bitcoin, since it will be a legal currency.

El Salvador is really trying to proposition the crypto-wealthy to move to the country to settle down, buy real estate, and set up businesses.

Prominent Bitcoin enthusiasts and influencers have flocked to El Salvador to learn how to set up businesses there.

Cutting Down on Fees for Remittances

Due to a large number of Salvadorans (~2 million) having moved to the US and other countries for work, remittances account for ~20% (>$5.9 billion in 2020) of El Salvador’s GDP.

Paying transfer fees means most of this value is lost. Bitcoin can facilitate these remittances for a fraction of the cost, especially with the Lightning Network, which is seeing record adoption.

De-dollarization

El Salvador is a dollarized economy, and is massively affected by American fiscal and monetary decisions. Adopting Bitcoin will make the nation more independent.

“(We will be) at least becoming a little less dependent on the output of new dollars, and the new inflation that’s coming with those all those new dollars”.

President Bukele

Today, the dollar is leading the charge of experimental monetary policy, with the supply more than doubling over the last 10 years to $20 trillion as of April, according to the Federal Reserve Bank of St. Louis’ data.

$11 trillion, about half of that, was added in just the last 18 months.

In this context, bitcoin starts to seem like the more “stable” currency. No country can “manage” Bitcoin for its own benefit.

How El Salvador is gearing up for Bitcoin adoption

The government of El Salvador is taking multiple measures to bring Bitcoin as legal tender to its populace.

In El Zonte , a town on the Pacific Coast in El Salvador, hundreds of businesses and individuals now use the currency for everything from paying utilities bills to buying a can of soda. The town now boasts El Salvador’s only bitcoin teller machine where people deposit US dollars in cash into a personal bitcoin “wallet,” then use a smartphone app to spend it.

All Business to Accept Bitcoin

Starting September 7th, with the government supporting this adoption with the following measures.

- Installing 1500 ATM’s for people to purchase bitcoin.

- Creating a national Bitcoin wallet – Chivo (meaning cool in local slang)- that will give users $30 on signup. Chivo will allow users to store USD and BTC and seamlessly switch between them. For this, the government has partnered with Jack Mallers’ Strike.

- The Bitcoin Law guarantees that the necessary training and mechanisms for implementing the measure will be the responsibility of the State.

- The Salvadoran government will establish a $150 million trust at the Development Bank of El Salvador (Banco de Desarrollo de El Salvador, or BANDESAL), that will exchange the bitcoin that businesses and individuals receive back into U.S. dollars at market prices, for those who do not want to hold bitcoin. In this way, bitcoin adoption will grow organically in the country, and those who find bitcoin’s volatility too risky will not have to maintain it on their balance sheets.

- A satellite infrastructure to address the lack of connectivity in rural areas. Blockstream plans to contribute their expertise and tech to make the nation a model for the world.

- Volcano powered bitcoin! El Salvador is investing in clean mining of bitcoin using the country’s geothermal capabilities.

How the world reacted to El Salvador adopting bitcoin

This move by El Salvador has polarised people around the globe.

In a matter of three days El Salvador went from just a country in Central America, to being at the centre of global discussion.

Interestingly, Latin American leaders are publicly endorsing the move.

In fact Paraguay might just follow suit and adopt bitcoin as legal tender as well!

Meanwhile, the World Bank rejected El Salvador’s request for technical assistance on implementing Bitcoin, citing “environmental and transparency shortcomings“.

The International Monetary Fund (IMF) said it saw “macroeconomic, financial and legal issues” with El Salvador’s adoption of Bitcoin. This could further complicate the Central American country’s quest to seek a more than $1 billion (roughly Rs. 7,280 crore)-programme with the IMF.

Bitcoin’s feasibility as a local currency has raised several question, given its volatility, the risk of secure storage and money laundering, as well as events like hard forks.

Wait and Watch

Now, can Bitcoin become a de facto Means of Exchange for carrying out financial transactions like the INR, USD, etc? Or is it simply a Store of Value like gold as it isn’t as bound to traditional economic cycles, when compared to other assets?

Its too early to say how this experiment will unfold for 6 million Salvadorans.

Safe to say we will be waiting and watching keenly along with the rest of the world.