Ethereum and altcoins saw a sharp selloff after it was announced that the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Binance in U.S. District Court for unregistered securities trading. ETH broke out of the falling wedge pattern on May 28 and successfully retested it on June 1, but the bulls failed to initiate a fresh move to push the price higher. The average gas fee (transaction fee) on the Ethereum network has declined significantly in the first week of June after hitting a multi-month high in May, driven by the memecoin frenzy and numerous maximum drawable value (MEV) bot activity.

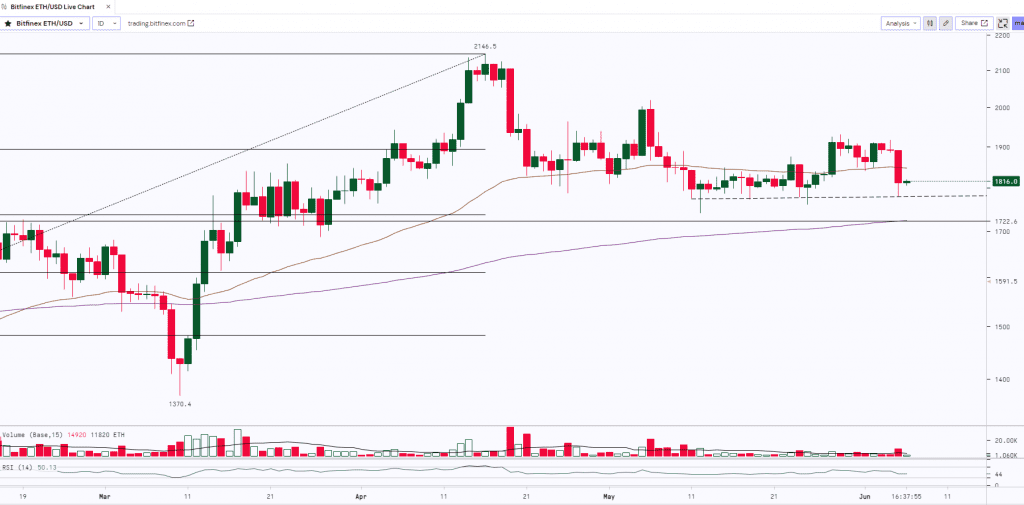

At the time of writing, ETH was trading at $1,816

ETH after making the recent top of $2,146 witnessed some profit booking and the prices corrected almost by 18.5% and dropped to $1,741.5. Post this move, the asset started consolidating and traded sideways from $1,775 to $1,850 with low volumes. Last week, the Bulls tried to break the range on the upside and the prices went up to $1,930 (With Low Volumes) but the prices failed to sustain above the range and it witnessed a minor correction. ETH has a strong support zone from $1,775 to $1,750. If it holds and sustains above the support then we may expect the prices to trade in the range whereas a break below the support will lead to further downfall. To witness a rally, it needs to close and sustain above the resistance zone from $1,950 to $2,000.

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $1,500 | $1,750 | ETH | $1,850 | $2,000 |