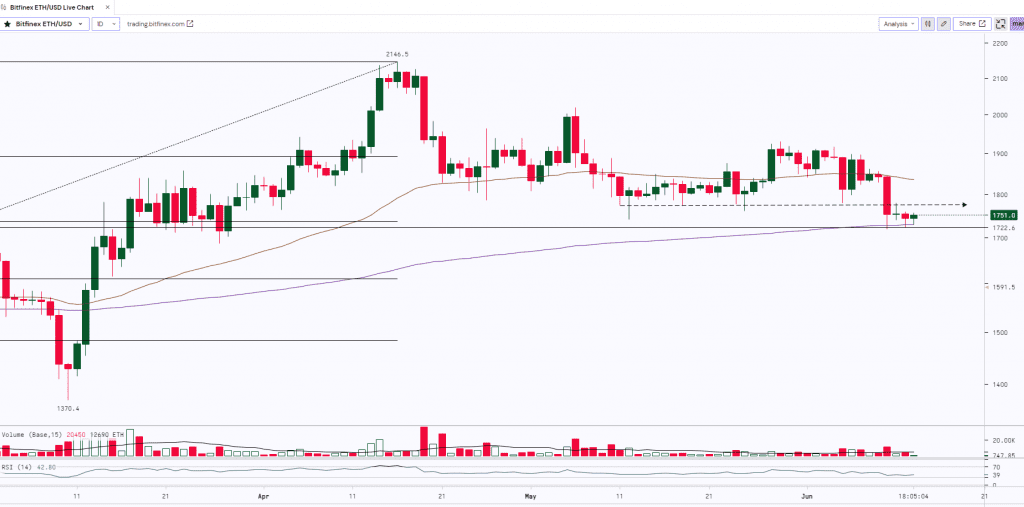

Ethereum was below $1,800 at the start of the week, staying close to a multi-month low. After peaking at $1,776.85 on Sunday, ETH/USD fell to $1,722.91 on Monday. This brought Ethereum closer to the weekend low of $1,716, which marked its weakest point since March 28th. As a result of this recent decline, Ethereum’s 10-day moving average finally surpassed its 25-day moving average. Furthermore, the RSI is currently at 38.00 which remains in the oversold territory. Last week, Ether products witnessed $36 million of outflows, marking the largest weekly outflows for the asset since the Merge in September 2022. The asset’s global volume is up by about 6%, while the price rose by 0.8% over the day.

At the time of writing, ETH was trading at $1,752.2.

ETH after making the recent top of $2,146 witnessed some profit booking and the prices corrected almost by 18.5% and dropped to $1,741.5. Post this move, the asset started consolidating and traded sideways from $1,775 to $1,850 with low volumes. The Bulls tried to break the range on the upside and the prices went up to $1,930 (With Low Volumes), but the price failed to sustain above the range and witnessed a minor correction and made a low of $1,718.9. ETH is trying to take the support at the key level of $1,725 (Horizontal Trendline & 200-day Moving Average). If it sustains and holds the support then we can expect some relief rally whereas a break below the support can lead to further downfall.

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $1,500 | $1,725 | ETH | $1,850 | $2,000 |