Don’t want to just leave your crypto laying idle as you HODL? Let’s explore how Celsius Network allows you to make an interest on your idle crypto and also allows you to borrow stable currencies by using your crypto as collateral.

This post has been written by our guest authors for the week. Chinmay Gargava, VP Product Delivery and Maria Shaikh, Data Scientist.

A quick disclaimer: This isn’t investment advice.

With Fiat currencies and traditional banks, just putting your savings into a savings account will earn you a small interest on it annually. Makes sense. They are putting your money to work, and paying you a cut of the profits. You make money on your idle savings. The bank makes money by charging borrowers an interest on it. And borrowers have timely access to funds for a fee.

But how does this translate to the world of crypto.

Enter crypto “banks” like Celsius Network, BlockFi, Nexo, among others.

In this blog we will look at Celsius Network, their product offering and the unique tokenomics that has driven their meteoric rise this past year.

Earn interest while HODLing

Celsius’ Earn feature allows you to store your cryptos (40+ different cryptocurrencies accepted) with Celsius and get paid weekly with interest earned on your coins.

Each currency has its own Annual Percentage Yield (APY) which is the effective interest earned by storing the coin with Celsius for one year.

If you decide to earn interest in the native CEL token, you will be able to avail an even higher APY. We’ll get to this in a bit.

Borrow Stable currency against your crypto

Don’t want to sell your crypto, but in need of funds ? Use coins as collateral to borrow a stablecoin that is pegged to a fiat currency.

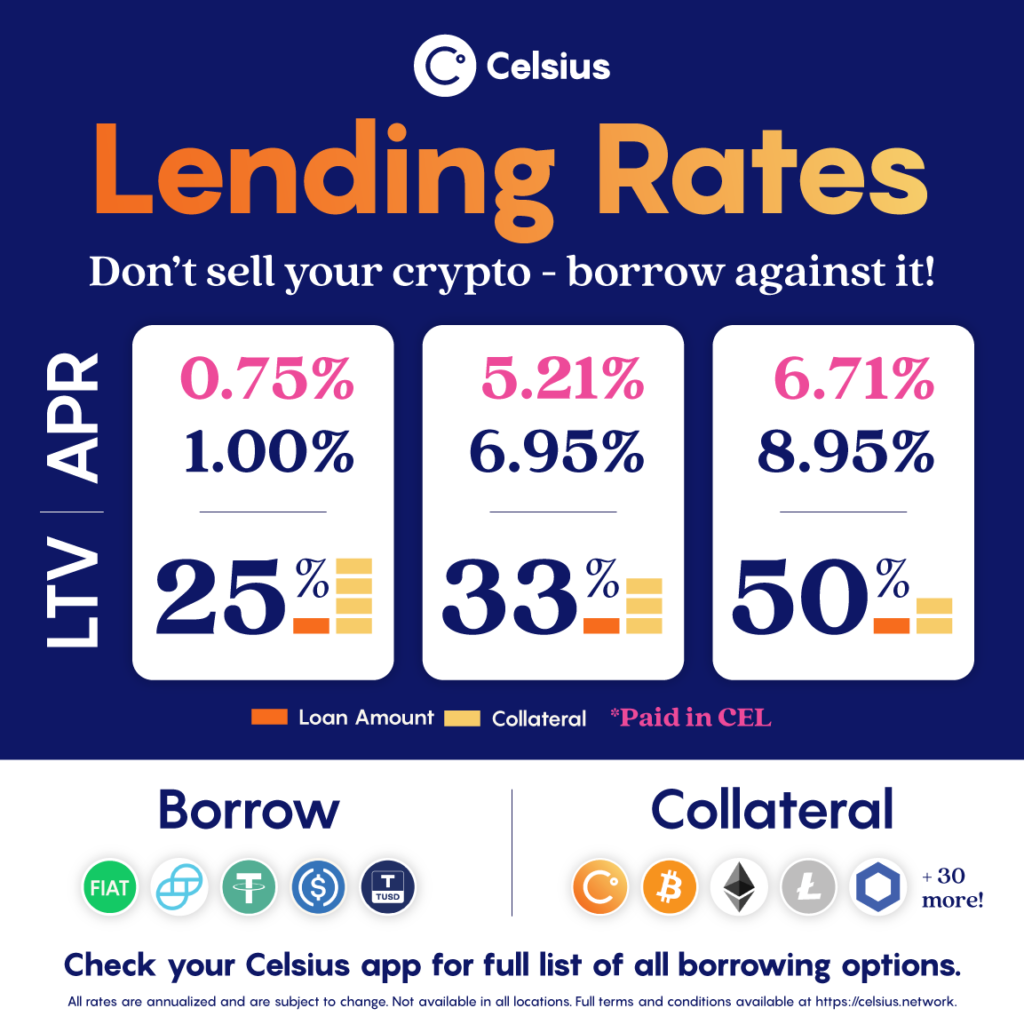

You can choose your Loan-To-Value (LTV). The higher the amount of collateral you put up against your loan, the lower will be your Annual Percentage Rate (APR) or the annual interest to be paid towards your loan.

If you pay your interest in the native CEL token, then you can avail even lower rates.

P2P payments with zero fees

Celsius also powers zero fee p2p payments for their customers.

CEL Token

Celsius network has had quite a year.

At the time of writing they were managing more than $17 Billion worth of assets for their customers. They have grown from 250,000 users at the end of 2020 to 680,000 users signed up to their platform now.

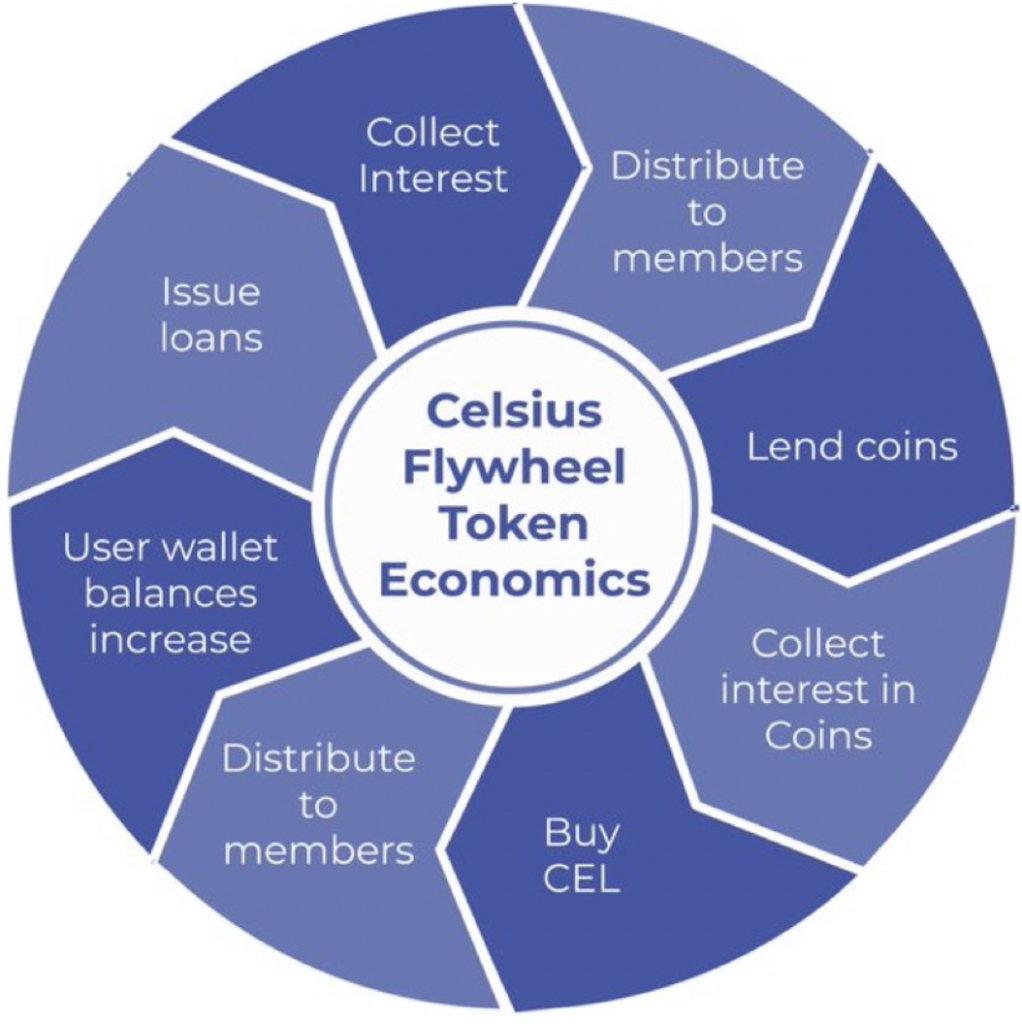

They have achieved this by providing some serious value to their customers, and a lot of this value can be attributed to the network effect of their CEL token.

The CEL token is an ERC-20 Utility token, that only has utility within the Celsius ecosystem.

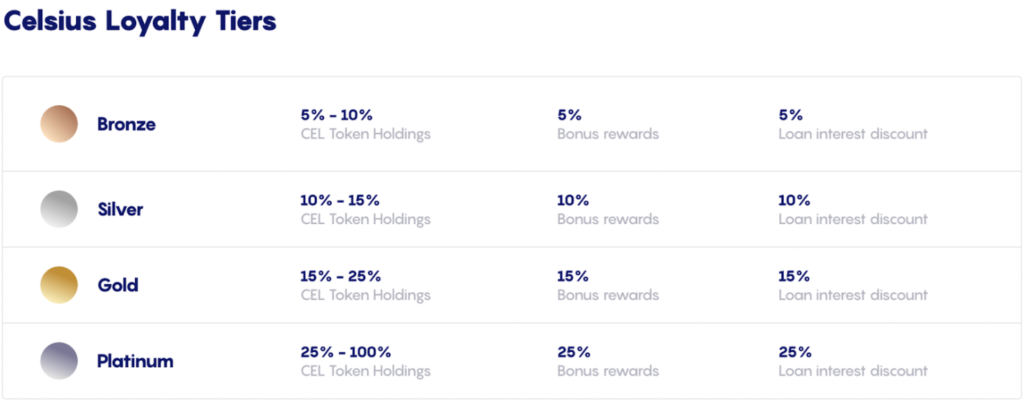

If you choose to hold CEL as part of your portfolio, you get better rates for borrowing and lending.

Features of the CEL token

- Reduced APR on borrowing against crypto if you pay interest in CEL

- Increased APY on lending if you earn interest in CEL

The more CEL you hold, the better your rates get, thanks to their tiered loyalty.

Holding the CEL token?

The adoption of the CEL token is very high for CEL customers (>60% are earning interest in CEL). So when it comes time to pay off weekly interest, a high demand for CEL exists in the market, and so the price of CEL rises with every passing week.

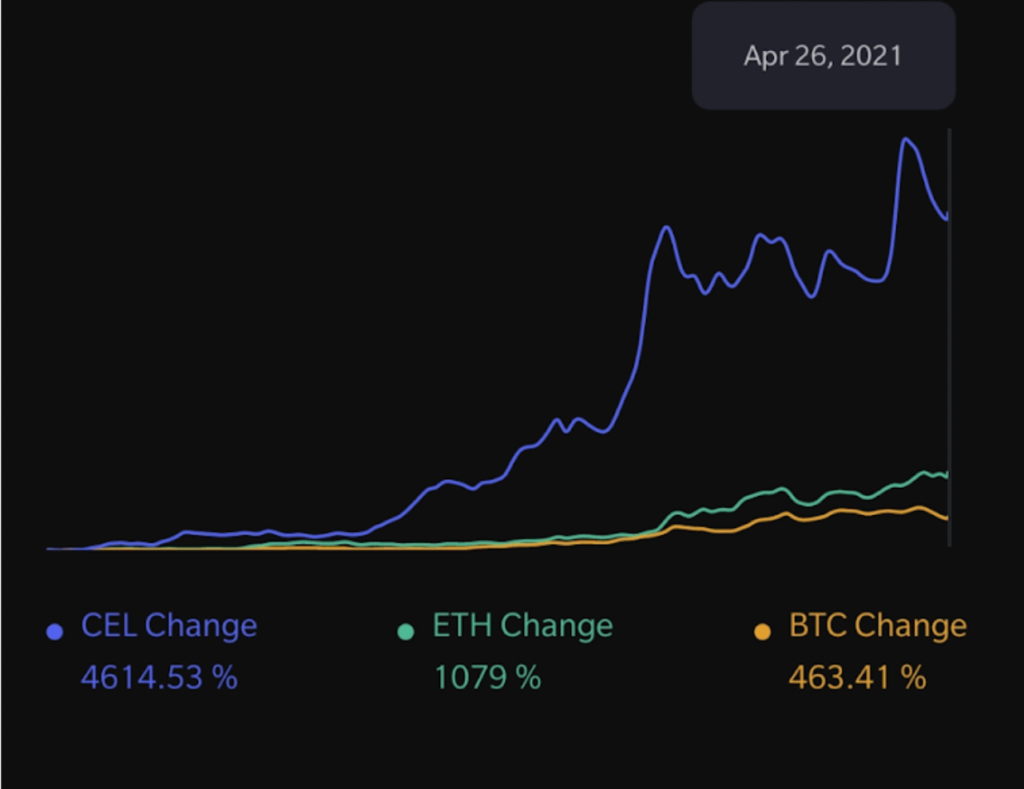

Also, CEL has outdone the BTC and ETH price change over the last one year.

It is risky to hold CEL tokens, but you can always choose to optionally rebalance your portfolio at any time.

Risks

- Any loss of faith in Celsius the company will tank the price of CEL, and so your Store of Value is now very tightly coupled with Celsius, as opposed to a more battle hardened store of value like BTC.

- By holding CEL, you would be converting parts of your stack from BTC/ETH/etc to CEL, and might miss out any gains (or in a bear market, stability) that those coins can afford you.

- A token based lending model is quite common in the cryptoverse, but this is a very new model of a hybrid utility and security passthrough token, and it definitely adds a massive layer of complexity to an already complex lending business. How it performs in a bear market is yet to be truly understood.

- Not your keys, not your coin. The risk of custodial cryptocurrency cannot be ignored. And if you were to go custodial there are more secure players like BlockFi.

- Major competition from DeFi and other CeFi players. Increased competition will impact how much the CEL token will be worth if people start leaving the Celsius platform to look for greener pastures. And these pastures are sprouting up everywhere.