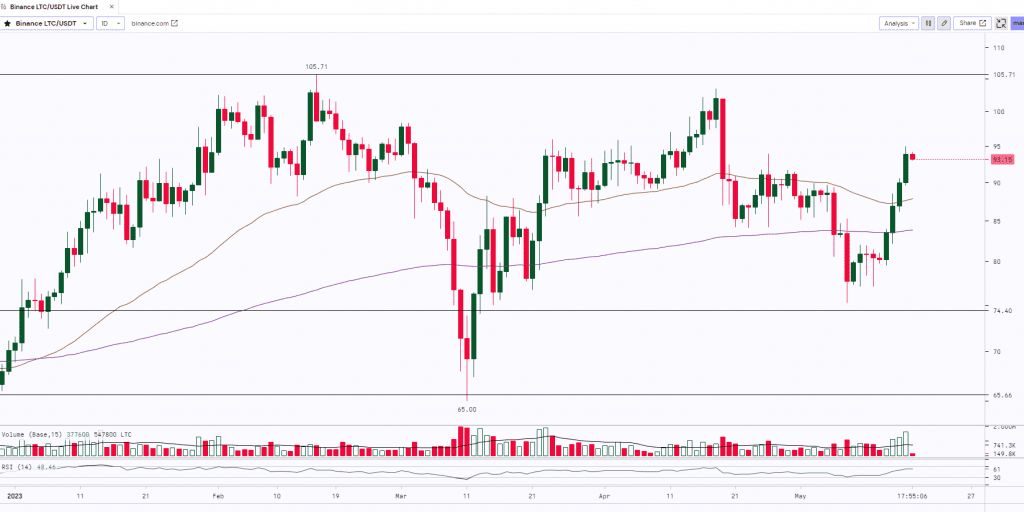

LTC is gearing up for an eventful period over the next eight weeks. Litecoin halving is approaching, an event that has caused significant market activity in the past. The scarcity factor could theoretically increase the price of LTC. Investors had a hard time with Litecoin, because of the overall crypto market downtrend. LTC broke the 20-day EMA ($85) on May 15th and revived above the 50-day SMA ($89) on May 16th. The LTC/USDT pair is nearing the $96 level where the bears are likely to mount strong defences.

At the time of writing, LTC was trading at $93.12.

LTC witnessed a massive rally from $65 to $103.55 surging almost by 59%. The bulls failed to push the prices above the previous top of $105 and the asset saw some profit booking and the prices dropped to $75.2. Post this move, LTC started to consolidate and was trading sideways in a range from $77 to $81.5. The asset finally gave a breakout above the range and started trading upwards by forming a ‘Higher Top Higher Bottom’ pattern. Once LTC breaks and closes above the key resistance level of $105 then we can expect it to further rally up to the next resistance level which is at $125 – $130.

| Support 2 | Support 1 | Asset | Resistance 1 | Resistance 2 |

| $65 | $75 | LTC | $105 | $125 |