What is Bitcoin halving?

Essential Conditions for Bitcoin Halving

How does a Bitcoin halving work?

Constant Third-party Testing

Historical Bitcoin Halving Events

Bitcoin Halving in 2012

The inaugural crypto halving event took place on November 28, 2012, marking a crucial milestone in the crypto world and shedding light on questions surrounding the significance, duration, and price impact of halving.

Initially, the halving did not yield any noticeable impact on the price of Bitcoin. However, starting in early 2013, the value of the coin started a gradual ascent. In April of that year, a correction ensued, and the upward trend resumed in the fall of 2013, culminating in a value exceeding $1,100. Subsequently, there was an extended period of price decline, reaching as low as $152 on January 14, 2015. Eventually, in October 2015, approximately nine months before the next halving, a sustained growth phase was initiated once again.

Bitcoin Halving in 2016

The second occurrence of the Bitcoin halving occurred on July 9, 2016, resulting in a reduction of the Bitcoin block reward to 12.5 BTC. Throughout this second halving phase, Bitcoin faced notable competition in the crypto market, with the emergence of Ethereum and Initial Coin Offerings (ICOs) contributing to the formation of the broader crypto market, reaching its peak in late 2017 and early 2018. Despite a significant decline in Bitcoin dominance during this period, investors in BTC still had the chance to attain substantial profits, with the price reaching an almost $20,000 peak.

Bitcoin Halving in 2020

The third halving event, occurring on May 11, 2020, like its predecessor, did not result in an immediate surge in Bitcoin price. While historical patterns indicate growth typically initiates in the lead-up to the halving, the impact of the coronavirus crisis, beginning in March, led to a significant decline in Bitcoin’s value. This complicates the evaluation of how much of the halving’s influence is already incorporated into the price. Across each of these cycles, the effect of halving on Bitcoin prices followed a similar pattern: a substantial upswing preceding the halving, followed by a brief correction and a phase of consolidation before the onset of a major bullish trend.

Bitcoin Halving in 2024

The anticipated 2024 Bitcoin halving is predicted to take place either in late March or early April, contingent on the countdown timer employed. This event will mark approximately four years since the last halving occurred in May 2020. Following the pattern of previous halving events, the 2024 halving will reduce block rewards, with the current 6.25 Bitcoins per block being halved to 3.125 Bitcoins.

Examining historical price trends post-previous halvings, there is a general observation of significant price increases in the market. While it’s essential to recognize that past performance does not guarantee future outcomes, many analysts and enthusiasts are anticipating the 2024 halving to contribute to a bullish trend in Bitcoin’s price.

Leading up to the 2024 halving, there is an expected continuation of growth in institutional interest in Bitcoin. As more well-established financial institutions, corporations, and investment firms adopt Bitcoin as a store of value and an asset class, their involvement in the market is likely to impact price dynamics.

Future Bitcoin Halving Event Dates

(Till the year 2060)

| Year | Estimated Date | Approximate Block Reward |

| 2024 | April 6 | 3.125 BTC |

| 2028 | April 10 | 1.562 BTC |

| 2032 | April 14 | 0.78 BTC |

| 2036 | April 18 | 0.39 BTC |

| 2040 | April 21 | 0.195 BTC |

| 2044 | April 25 | 0.09 BTC |

| 2048 | April 29 | 0.04 BTC |

| 2052 | May 2 | 0.02 BTC |

| 2056 | May 6 | 0.01 BTC |

| 2060 | May 6 | 0.006 BTC |

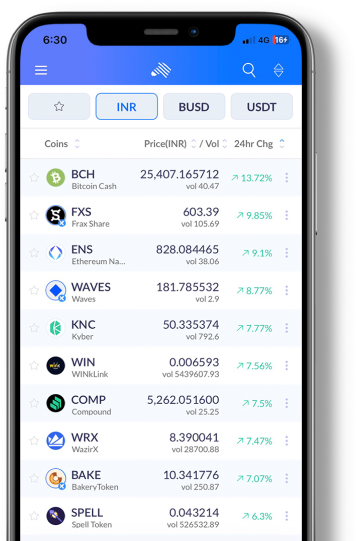

How to Buy Bitcoin on ZebPay Before

Bitcoin Halving?

You can also use ZebPay’s web platform to get started

Ensure that your KYC and Bank Verification is complete and approved

Transfer your desired INR amount to your ZebPay wallet through NEFT/IMPS/RTGS

Search for Bitcoin (BTC) in the Quick Trade or Exchange panel and enter your desired INR amount

Review your order details and place your order

You can also explore CryptoPacks with Bitcoin(BTC) and trade as you wish

FAQs

01 What is the Impact of Bitcoin Halving on Mining?

The halving event holds economic consequences for both Bitcoin miners and the broader market. Miners are compelled to adjust their operations to maintain profitability in light of a reduced block reward, intensifying competition and leading to less efficient miners to exit the market. Consequently, this dynamic can influence the overall security and decentralization of the network.

02 Is Bitcoin Halving Predictable?

The halving is a completely predictable occurrence, implying that all participants in the market are aware of its schedule in advance. Consequently, the current price may already encompass the anticipated impact of the halving before it actually takes place.

03 When Will All 21 Million Bitcoins be Mined?

By the year 2140, the entire supply of 21 million Bitcoins will have been mined, contributing to the network’s increased scarcity and value.

04 Is Bitcoin Halving Necessary?

Bitcoin Halving, which halves the mining rewards, slows down the generation rate of new Bitcoins. As Bitcoin becomes scarcer over time, it presents a compelling value proposition as a deflationary asset. Typically, there is an increase in Bitcoin volatility after the halving. The diminishing supply of available Bitcoin amplifies the value of yet-to-be-mined Bitcoin, enhancing its appeal as an asset for investors.

05 What is the Current Bitcoin Block Reward?

The present reward for a bitcoin block is 6.25 BTC coins.