Since August 2021, when the EIP-1559 protocol was launched, close to $4.6 billion worth of Ethereum has been burnt. Burning is a process where the supply of a token is controlled or reduced by sending crypto to a wallet without a private key. This will effectively cut off the burnt token from the supply. The process of Token Burning can spike up the price of the crypto as it follows the fundamental axiom of supply and demand – When the supply is less and the demand is more the price increases.

Ethereum token burning is taking place across different assets. This includes NFTs, Crypto tokens, and yield tokens. The current estimates of the number of Ether tokens removed from circulation are close to 2.8 million.

As per Ultrasound money, close to 16364 ETH have been removed from circulation over the past 10 days. At this rate, it is estimated that the number of tokens burnt is higher than the ones retrieved by stakers as a reward for transaction validation. The supply rate has reduced by approximately 1% since EIP-1559 effectively making Ethereum deflationary by nature. As per data from Ultrasound money, the categories which have burnt the most Ethereum in the recent past are NFTs and Defi. These are also the categories which use the Ethereum blockchain the most.

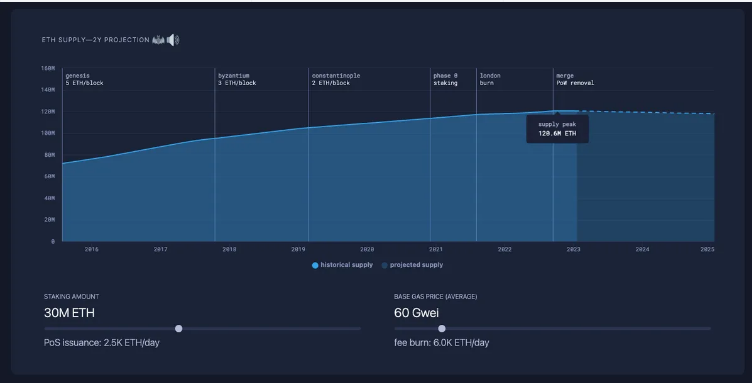

Looking at the above graph it is clear that the projected supply of Ethereum is going to remain constant over the next two years. With the number of applications on the Ethereum blockchain touching sky-high, it is quite logical to assume that the demand is only going to increase in the years to come thereby positively appreciating the price.

Read more: What is Ethereum

You can trade Ethereum on ZebPay. Visit ZebPay blogs to stay up to date on the latest Crypto news.