Crypto assets are transforming the way we interact with money, opening doors to global markets, long-term wealth creation, and financial systems that go beyond conventional banking. For newcomers, the pace of innovation and the unfamiliar jargon can make the initial journey feel overwhelming.

This guide provides a clear overview of the main types of crypto assets driving today’s digital economy, giving you a practical foundation before exploring more complex concepts.

As we move through 2026, crypto continues to evolve into a more integrated and mature part of the global financial system. Staying informed, building a solid understanding, and approaching the ecosystem thoughtfully will help you navigate it with confidence and a long-term mindset.

Introduction to Crypto

Crypto tokens have moved far beyond their early use cases and are now integral to how many digital platforms function. They act as the economic layer of decentralized systems, supporting everything from transactions and rewards to governance and access.

Backed by blockchain technology that prioritizes trust and transparency, these tokens are being adopted across gaming, digital ownership, and online communities. Their rise points to a future where digital participation is more interactive, user-driven, and value-oriented—reshaping how people engage, contribute, and create within digital ecosystems.

Also Read: Crypto 2025 Recap: Top 7 Events That Shaped the Year!

Top 10 Crypto Assets

| Coin Name | Current Price | Market Capitalization | 24-Hour Volume |

| Bitcoin (BTC) | $68,219.14 | $1.36 trillion | $54.66 billion |

| Ethereum (ETH) | $1,995.70 | $240.86 billion | $25.79 billion |

| Tether (USDT) | $0.9998 | $183.61 billion | $106.96 billion |

| XRP (XRP) | $1.36 | $83.24 billion | $3.29 billion |

| BNB (BNB) | $633.11 | $86.33 billion | $2.04 billion |

| USDC (USDC) | $1 | $76.08 billion | $18.48 billion |

| Solana (SOL) | $85.56 | $48.74 billion | $5.30 billion |

| TRON (TRX) | $0.2821 | $26.73 billion | $449.67 million |

| Dogecoin (DOGE) | $0.09134 | $15.44 billion | $1.27 billion |

| Bitcoin Cash (BCH) | $443.72 | $8.87 billion | $395.60 million |

Note: This list has been made based on internal research and should not be taken as investment advice. Investors should do their thorough research before buying or selling crypto assets.

Also Read: Is Crypto Legal in India in 2026? Legal Status, Tax Rules, RBI & More

Bitcoin (BTC)

The oldest and most popular crypto token on the market, Bitcoin was the coin that started the entire crypto craze. From its humble beginnings in 2009, it has soared to unimaginable heights and gained the attention of investors, the media and businesses.

The network is used as an alternative means of payment to cash and is protected through Proof of Work consensus. All transactions are stored on a blockchain, while miners can earn rewards for each block of transactions they confirm.

Pros of Bitcoin

- Most well-known token, which leads to heavy investments in the project.

- Relatively stable compared to some newer crypto tokens.

Cons of Bitcoin

- BTC operates on proof of work, which consumes a lot of electricity and requires excessive time to confirm transactions.

- As BTC acts as an index of the general crypto market, it rarely deviates from general market trends and conditions.

Ethereum (ETH)

After Bitcoin, Ethereum has established itself as one of the most dominant forces in the crypto market. It was the first to introduce smart contract functionality, which enables developers to create and automate several key features we take for granted today. Ethereum is also built to provide a platform for decentralised applications and finance, becoming the leading blockchain to service this need.

Pros of Ethereum

- The largest player in the DeFi and dApp space. This gives it market dominance and requires that competitors offer much greater incentives to switch.

- Ethereum’s Proof of Stake consensus mechanism has made the blockchain highly efficient. The future upgrades are focused on increasing TPS and improving the already robust security protocols.

Cons of Ethereum

- Ethereum sometimes has high network traffic that can slow transactions down to a crawl. It must rely on scaling solutions to address the traffic on its network.

- Ethereum’s transaction costs can also skyrocket. In some cases, the fees can be higher than the value of the transaction.

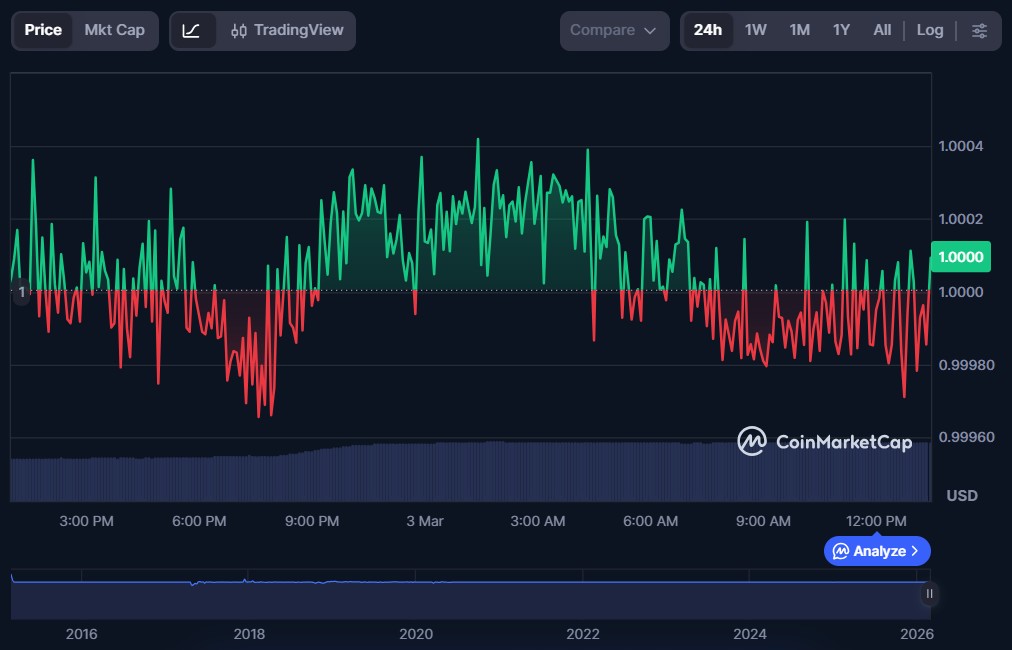

Tether (USDT)

Tether (USDT) is a stablecoin designed to maintain a 1:1 peg with the US dollar. Its primary goal is to provide stability in the crypto ecosystem, making it easier for traders and investors to move funds between exchanges, hedge against market volatility, and settle trades without converting back to fiat. USDT is widely used across multiple blockchains, enabling fast and cost-effective transfers globally.

Tether has played a key role in improving liquidity and efficiency in crypto markets by bridging the gap between traditional fiat currencies and digital assets.

Also Read: How to Buy Tether (USDT)

Pros of Tether

- Price stability due to its peg to the US dollar.

- High liquidity and widespread acceptance across exchanges and blockchains.

Cons of Ripple

- Ongoing concerns around transparency and the composition of its reserves.

- Centralised issuance and control by Tether Limited.

XRP (XRP)

Unlike other general-purpose tokens, XRP is focused on creating payment solutions for banks and financial institutions. It solves several problems with competing systems like SWIFT for international settlements. Instead of requiring several hours or days for transfers to be finalised, XRP allows such settlements to be completed in a matter of seconds. Ripple has made traditional finance much more accessible for users through the efficient application of blockchain technology.

Also Read: What is Ripple (XRP)

Pros of XRP

- Much faster than its competitors like SWIFT.

- Expand access to banking and international settlement by lowering barriers to use.

Cons of XRP

- The network is highly centralised as all transactions are confirmed by a federated group of financial institutions.

- XRP’s adoption is closely tied to partnerships with financial institutions, which means its growth can be impacted by regulatory decisions and institutional acceptance.

BNB (BNB)

Launched in 2017, BNB has evolved from a simple token to powering its own ecosystem. At first, BNB was used to provide special benefits to users of the Binance crypto exchange, such as lower fees, exclusive access to initial coin offerings and cashback.

Today, it forms the backbone of the BNB Chain ecosystem, which boasts high speed and low cost to compete with Ethereum’s dominance. It has established itself as a strong option in the market.

Pros of BNB

- Low costs and high throughput mean it can service much greater demand than many competitors.

- Owning BNB provides you benefits on the Binance exchange platform

Cons of BNB

- BNB is a highly centralized token, as it is controlled and managed by Binance. This reduces the freedom available to its community.

- BNB’s success is tied to Binance, which the regulators of several countries like the UK, Japan and Germany have targeted.

USDC (USDC)

USD Coin (USDC) is a regulated, fiat-backed stablecoin designed to maintain a 1:1 peg with the US dollar. Issued by Circle, USDC aims to bring transparency and trust to the stablecoin ecosystem by backing its supply with cash and short-duration US government treasuries. It is widely used for trading, payments, DeFi applications, and cross-border transactions across multiple blockchain networks.

USDC has emerged as a preferred stablecoin for users seeking reliability, regulatory alignment, and seamless integration between traditional finance and blockchain-based systems.

Also Read: Difference between USDT and USDC

Pros of USDC

- High transparency with regular reserve attestations and strong regulatory compliance.

- Stable value and broad adoption across exchanges, DeFi platforms, and blockchain networks.

Cons of Cardano

- Centralised control, allowing the issuer to freeze or blacklist addresses when required.

- Dependence on the traditional banking system, which can expose it to regulatory or banking risks.

Solana (SOL)

Solana is a high-performance Layer-1 blockchain designed to support decentralised applications (dApps), DeFi platforms, NFTs, and Web3 use cases at scale. It is known for its unique Proof of History (PoH) mechanism, which works alongside Proof of Stake to enable extremely fast transaction processing and low fees. This makes Solana a popular choice among developers building applications that require speed and high throughput.

Solana has positioned itself as a strong alternative to other smart contract platforms by focusing on scalability without relying on complex Layer-2 solutions.

Also Read: What is Solana (SOL)

Pros of Solana

- High transaction speeds with very low fees, making it suitable for high-volume applications.

- Growing ecosystem of dApps, DeFi projects, NFTs, and developer tools.

Cons of Chainlink

- Past network outages have raised concerns around reliability and stability.

- Higher hardware requirements for validators, which can impact decentralisation.

TRON (TRX)

TRON (TRX) is a blockchain platform designed to decentralize the internet by enabling fast, low-cost transactions and supporting a wide range of decentralized applications (dApps). Its focus on scalability and efficiency has made it a popular choice for developers and users alike.

Pros of Tron

- TRON offers fast, low-cost transactions suitable for high-volume decentralized applications.

- Its expanding ecosystem supports diverse use cases, including DeFi, NFTs, and gaming.

Cons of Tron

- The network faces criticism for being more centralized than other major blockchains.

- Ongoing regulatory scrutiny and leadership controversies may affect its long-term perception.

Dogecoin (DOGE)

Dogecoin is one of the most popular tokens among investors. Initially started as a joke on Bitcoin, it became an internet sensation that garnered a passionate and active community. Its unique value is that it is based on the popular “Doge” meme.

The project has been endorsed by several figures in the crypto community and celebrities like Elon Musk and Vitalik Buterin. It is important to note that Dogecoin is a memecoin and does not have intrinsic value, except for a strong community. Investors should conduct thorough due diligence before deciding to invest in memecoins.

Pros of Dogecoin

- The unique value proposition of a memecoin that has sustained its power in the market.

- Active community working for the token’s success.

Cons of Dogecoin

- No practical application, value is only based on a meme.

- There is no cap on the total supply of DOGE, which leads to inflation in the token.

Bitcoin Cash (BCH)

Bitcoin Cash (BCH) is a peer-to-peer crypto asset created as a fork of Bitcoin with the goal of enabling faster and cheaper on-chain transactions. By increasing the block size, Bitcoin Cash aims to support a higher number of transactions per block, making it more suitable for everyday payments and merchant adoption compared to Bitcoin’s original design.

Bitcoin Cash focuses on functioning as digital cash, emphasising usability for payments rather than primarily serving as a store of value.

Also Read: What is Bitcoin Cash

Pros of Bitcoin Cash

- Lower transaction fees and faster confirmations compared to Bitcoin.

- Larger block size allows for higher transaction throughput on the base layer.

Cons of Bitcoin Cash

- Lower adoption and ecosystem support compared to Bitcoin.

- Weaker network security due to lower hash rate relative to Bitcoin.

Also Read: Matt Hougan Signals Bullish Outlook for Crypto in 2026

Conclusion

The crypto landscape is expanding through a dynamic combination of established assets and innovative newcomers, each shaping the market in distinct ways. Recognised tokens provide stability and familiarity, making them an ideal entry point for those beginning their crypto journey.

Meanwhile, seasoned participants often explore emerging projects that bring fresh concepts, advanced features, or practical real-world use cases. This balance between proven assets and pioneering innovation keeps the crypto ecosystem flexible, progressive, and continuously evolving.

Just like pineapple on pizza, ZebPay blogs offer a unique twist on crypto insights. Learn more and start your journey with millions on ZebPay!

FAQs

How much should I invest when I start?

It depends on your risk appetite and overall financial situation. As a general guideline, only invest money you’re comfortable losing. Most beginners start with a small, fixed amount and gradually increase their investment as they gain confidence and experience.

What makes Bitcoin still a strong investment in 2026?

Bitcoin remains one of the most trusted crypto assets thanks to its fixed supply of 21 million, increased institutional adoption, and its role as a store of value. Despite its volatility, it continues to be regarded as digital gold.

Which crypto asset should I invest in right now?

Investors often focus on strong, established assets like Bitcoin, Ethereum, BAT, and other reliable high-utility altcoins. The ideal choice ultimately depends on your risk tolerance, time horizon, and overall investment approach—there’s no single coin that suits everyone.

What risks should I consider when investing in altcoins?

Altcoins could come with risks, including:

– High volatility compared to Bitcoin

– Smart contract vulnerabilities

– Regulatory uncertainty across different countries

– Low adoption risk if the project fails to scale

Diversifying across multiple projects can help reduce overall exposure.

How is ROI calculated for crypto assets?

ROI = (Current Value − Initial Investment) ÷ Initial Investment.

If you earn staking rewards or yields, include those amounts in the current value to get a more accurate ROI calculation.

How do crypto prices typically react to macroeconomic events (e.g., inflation, regulation) in 2026?

Crypto markets tend to react sharply to major macro events. Rising inflation or interest rate changes often drive investors toward Bitcoin as a hedge. On the other hand, tougher regulations or new tax policies can lead to short-term market pullbacks.

How can I start investing in crypto?

Begin by learning the basics of blockchain and how crypto assets work. Choose a reliable exchange, start with a small amount, and approach investing with a long-term perspective. Use strategies like rupee-cost averaging (RCA) can help manage risk and smooth out market volatility.

What are the tax implications of buying, holding, and selling crypto assets in India?

In India (2026):

– 30% tax on profits

– 1% TDS on each trade

– No deductions allowed other than the cost of acquisition

Investors should use exchange-generated reports for accurate filing and stay updated with the latest CBDT guidelines.

How to assess whether a crypto project has long-term utility versus just hype?

Look for:

– Real, practical use cases

– Strong and consistent developer activity

– Adoption or integration by businesses

– Clear and transparent tokenomics

– Independent third-party audits

Projects with active ecosystems and genuine adoption generally have a better chance of long-term success.

How can I stay safe and protect my crypto investments from fraud, hacks, or regulatory risk?

Best practices:

– Use hardware wallets or other secure storage options

– Enable 2FA on all exchange accounts

– Avoid suspicious links, messages, and phishing scams

– Trade only on regulated and reputable exchanges like ZebPay

– Stay updated on local regulations and compliance requirements