Crypto asset whales, who derive their name from giant mammals that swim the Earth’s oceans, refer to individuals or entities that hold large amounts of crypto. In the case of Bitcoin (BTC), one can be considered a whale if they have more than 1,000 BTC and less than 2,500. Since Bitcoin addresses are pseudonymous, it is often difficult to determine who owns a wallet. While many associate the term “whale” with some lucky early adopters of Bitcoin, not all whales are actually created equal. There are several categories:

Exchanges:

Since the widespread adoption of cryptos, crypto exchanges have become some of the largest whales as they hold significant amounts of cryptos in their order books.

Companies and Institutions:

Under the leadership of CEO Michael Saylor, the software company MicroStrategy has acquired more than 130,000 BTC. Other public companies like Square and Tesla have also been buying large amounts of Bitcoin. Countries like El Salvador have also bought significant amounts of Bitcoin to bolster their cash reserves. There are custodians like Grayscale who hold Bitcoins on behalf of large investors.

Individuals:

During the early days of Bitcoin, many whales had bought the asset when the price was much less than what it is now. The founders of the Gemini cryptocurrency exchange, Cameron and Tyler Winklevoss, invested $11 million in Bitcoin at $141 per coin in 2013, buying over 78,000 BTC. American venture capitalist Tim Draper bought 29,656 BTC at $632 each at a US Marshals Service auction. Digital Currency Group founder and CEO Barry Silbert attended the same auction and bought 48,000 BTC.

Wrapped BTC:

There are presently over 236,000 BTC wrapped within the ERC-20 Wrapped Bitcoin (wBTC) token. These wBTC are specially held with custodians that preserve a 1:1 peg to Bitcoin.

Read more: What is Wrapped Coin and Wrapped Bitcoin (WBTC)

Satoshi Nakamoto:

The mysterious and still unknown inventor of Bitcoin needs to be discussed for sure when we talk about Crypto whales. It is estimated that Satoshi could have more than 1 million BTC. While there isn’t a single wallet containing 1 million BTC, using on-chain data shows that of the first 1.8 million BTC created for the first time, 63% were never spent, making Satoshi a definite multi-billionaire.

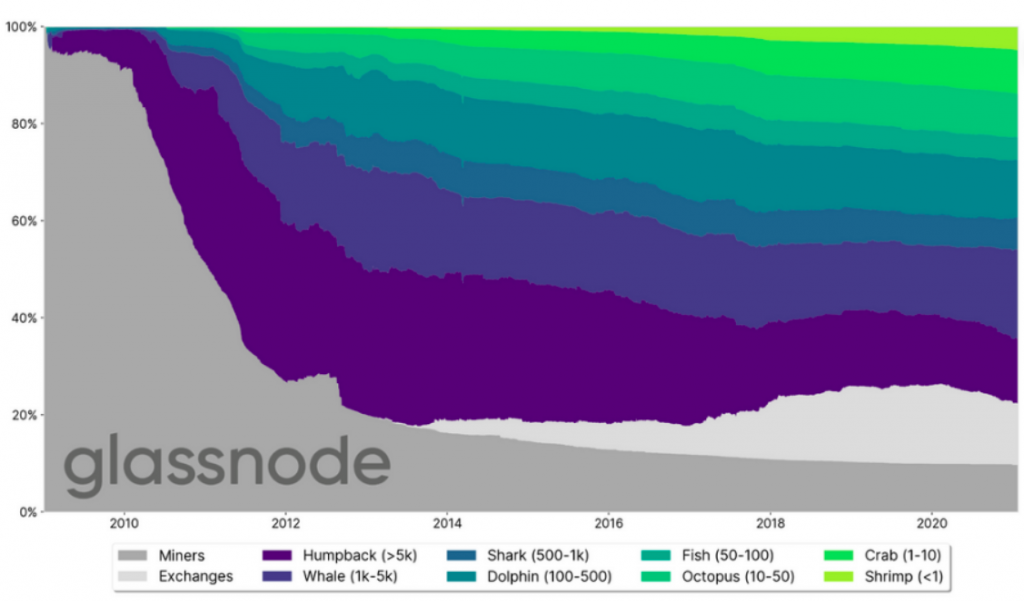

Critics of the crypto ecosystem say whales are making this space centralised, perhaps even more centralised than traditional financial markets. A Bloomberg report claimed that 2% of accounts controlled more than 95% of Bitcoin. It is estimated that the world’s top 1% controls 50% of global wealth, meaning that wealth inequality is more pervasive in Bitcoin than in traditional financial systems — an accusation that shatters the notion that Bitcoin can potentially disrupt centralised hegemonies. The accusation of centralization within the Bitcoin ecosystem has dire results that may probably make the crypto marketplace easy to manipulate. However, Glassnode’s knowledge shows that these numbers seem exaggerated and do not take into account the nature of the addresses. There can be a few degrees of centralization, however that may be a characteristic of unfastened markets. Especially while there aren’t any marketplace guidelines, and a few whales believe in Bitcoin more than the common retail investor, this centralization could probably occur.

The Sell Wall

In several instances, the whale puts up a massive order to sell a huge chunk of their Bitcoin. The whales place their order at a lower price than other sell orders. That causes volatility, leading to the reduction of the actual price of Bitcoin. This is often followed by a series reaction where individuals panic and begin selling their Bitcoin at a less expensive value. The BTC price can solely stabilise once the whale pulls their massive sell orders. So, currently the value is wherever the whales need it to be so that they will accumulate a lot of coins at their desired price point. The subsequent manoeuvre is referred to as a “sell wall.”

The opposite of this tactic is known as a fear-of-miss tactic or a FOMO tactic. This is when the whales put tremendous buying pressure on the market at prices in excess of current demand, forcing bidders to raise their bid prices so they can sell orders and fill their buy orders. However, this tactic requires significant amounts of capital that are not required to hit a sell wall. Observing whale buying and selling patterns can sometimes be a good indicator of price movements. There are websites like Whalemap, dedicated to tracking all whale metrics, and Twitter accounts like Whale Alert, which serve as a guide for Twitter users around the world to stay up to date on whale movements.

64 of the top 100 addresses have yet to withdraw or transfer bitcoin, showing that the largest whales could be the largest HODLers in the ecosystem, apparently based on the return on their investment. Evidence that whales are still profitable most of the time can be seen in the chart above. Calculated on a 30-day moving average, whales have remained profitable over 70% of the time over the past decade. In many ways, your confidence in bitcoin fuels the price action. Being profitable for most of your investment period (month-to-month in this case) helps increase your confidence in the HODL strategy. Even in 2022, one of the most bearish years in Bitcoin history, balances in the crypto exchanges are in decline, showing that most HODLers are stocking up on Bitcoin. Most experienced crypto investors refrain from having their long-term Bitcoin investments on exchanges and use cold wallets for HODLing.

Ever since the last market cycle in 2018, Bitcoin has carefully accompanied conventional investment assets. The consolation during this trend is that Bitcoin has entered the thought in terms of client sentiment and can now be seen as a peripheral asset. On the flip side, a 0.6 Pearson correlation with the S&P five hundred in no way means a hedge against the normal markets. Different consultants inside the crypto scheme conjointly appear to be annoyed with this trend. The broader macroeconomics could be a key reason behind the correlation between stocks and bitcoin. The last few years have seen capital inflows into the stock markets at an unprecedented rate. There are theories that in a prolonged bear market or in the face of financial disasters, the correlation with the stock market could break.

Although, searching the on-chain records for beyond 3 months suggests that the range of whale wallets have been reduced by nearly 10%. However, there was a corresponding growth in wallets that range from 1 BTC to 1,000 BTC. The whales appear to be derisking their positions and the larger retail buyers are amassing in turn, presenting liquidity to the whales. History suggests that each time this occurs, there may be a short-time period where there is a dip in Bitcoin Price that allows whales to aggressively gather more. What the marketplace can know from the whales is that the destiny of Bitcoin is wherein one’s guess must be. Locally, the emotions may be manipulated and the price may be influenced. However, in the long run when the dust settles, HODLERS will prevail.

Disclaimer : This report is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. The Company has prepared this report based on information available to it, including information derived from public sources that have not been independently verified. No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed herein. This report is preliminary and subject to change; the Company undertakes no obligation to update or revise the reports to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Trading & Investments in cryptocurrencies viz. Bitcoin, Bitcoin Cash, Ethereum etc. are very speculative and are subject to market risks. The analysis by Author is for informational purposes only and should not be treated as investment advice.