Crypto adoption has exploded worldwide, transforming from niche speculation to a mainstream financial tool. In 2025, over 560 million people own crypto globally, representing 6.8% of the population, a massive leap driven by remittances, inflation hedging, and institutional entry. Emerging markets lead grassroots usage, while developed nations dominate institutional flows, according to Chainalysis’ 2025 Global Crypto Adoption Index and Triple-A data.

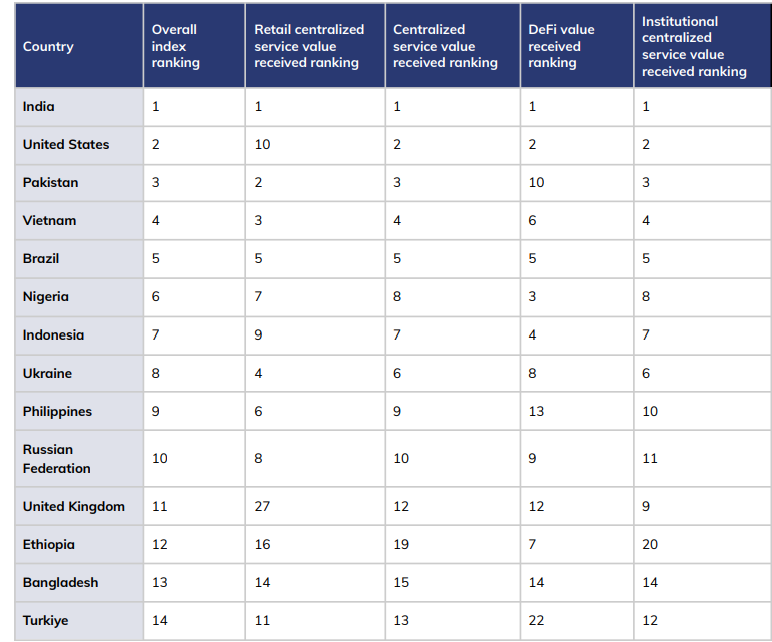

Image Source: Chainalysis

This blog ranks the top countries leading global crypto adoption, analyzing on-chain activity, ownership rates, transaction volumes, and unique drivers. From India’s retail dominance to the US’s institutional surge, discover why these nations are shaping crypto’s future.

India: World’s #1 Crypto Adoption Leader

India tops Chainalysis’ 2025 Global Adoption Index, ranking first across retail, DeFi, and institutional metrics. With 93-119 million owners (6.55% of 1.4B population), India processes massive on-chain volumes despite regulatory hurdles.

Key Drivers:

- Remittances: $100B+ annual inflows favor cheap stablecoin transfers over banks.

- Youth adoption: Millennials/Gen Z (75% under 35) drive P2P trading via UPI-crypto bridges.

- DeFi boom: High mobile penetration fuels DEX usage.

Stats: APAC’s 69% YoY growth led by India; ranks #1 in Chainalysis sub-indices.

India’s crypto market hit $2.6B in 2024, projected at $15B by 2035, cities like Bengaluru and Mumbai lead, but Tier-2 hubs like Jaipur surge.

United States: Institutional Powerhouse

The US ranks #2 overall (Triple-A: 15.6% ownership, 52M users), dominating absolute volumes ($2T+ on-chain) via ETFs and regulated platforms.

Key Drivers:

- Spot Bitcoin ETFs: $50B+ inflows in 2025 legitimize crypto for pensions.

- Regulatory clarity: GENIUS Act and CFTC approvals boost TradFi integration.

- Tech hubs: Silicon Valley and NYC drive venture funding ($10B+).

Stats: 50% YoY activity surge; leads North America with institutional transfers >$1M.

Pakistan: Emerging Market Surge

Pakistan (#3 Chainalysis) boasts 6.6% ownership (15.9M users), fueled by economic instability and freelance remittances.

Key Drivers:

- Inflation hedge: 25%+ inflation pushes savings into USDT.

- P2P dominance: LocalBitcoins-style trades evade banking restrictions.

- Youth remittances: 10M+ freelancers prefer crypto payouts.

Stats: APAC’s grassroots leader; top 5 for retail-sized transfers.

Vietnam: Mobile-First Powerhouse

Vietnam (#4) has 21.2% ownership (20.9M users), leading ASEAN in transaction volume alongside Thailand.

Key Drivers:

- Gaming/NFTs: Axie Infinity popularized crypto earning.

- Cross-border trade: Stablecoins settle Vietnam-China commerce.

- Tech-savvy youth: 70% under 35 own crypto.

Stats: Consistent top-5 Chainalysis ranking; high DeFi engagement.

Brazil: Latin America’s Crypto Capital

Brazil (#5) with 12% ownership (26M users) processes $500B+ on-chain, driven by inflation and elections.

Key Drivers:

- Pix integration: Instant fiat-crypto ramps.

- Election betting: 2025 polls boosted DEX volume.

- Remittances: $4B annual flows via stablecoins.

Stats: Latin America’s 63% YoY growth leader.

| Region | YoY Growth | Key Leader |

| APAC | 69% | India |

| Latin America | 63% | Brazil |

| Sub-Saharan Africa | 52% | Nigeria |

| North America | Steady | US |

Why Emerging Markets Lead Adoption

Lower/middle-income countries dominate Chainalysis’ top 20 (15/20 spots) due to:

- Economic necessity: Hyperinflation (Venezuela, Argentina) makes the USD stable vital.

- Remittances: $800B global flows favor 1-2% crypto fees vs 7% wires.

- Banking gaps: 1.4B unbanked prefer mobile wallets.

- Mobile-first: 80% smartphone penetration in Vietnam/India vs legacy systems elsewhere.

High-income nations (US, UK) excel in institutional activity, ETFs, and tokenized assets, but lag in grassroots.

Barriers and Future Catalysts

Challenges:

- Regulation: India’s 30% tax deters some; Nigeria’s bank bans persist.

- Infrastructure: High fees in Africa; scams erode trust.

- Volatility contagion: 2022 crashes hit retail hardest.

2026 Catalysts:

- Stablecoin laws (US GENIUS Act global template).

- CBDCs: 130+ pilots integrate crypto rails.

- Layer-2 scaling: Lower fees boost emerging markets.

Conclusion

India, the US, Pakistan, Vietnam, and Brazil lead global crypto adoption through complementary strengths: grassroots necessity meets institutional scale. Emerging Asia/Latin America drives volume growth (69%/63% YoY), while North America institutionalizes crypto via ETFs and policy. With 560M+ owners and $2.36T APAC activity, adoption proves resilient, solving remittances, inflation, and inclusion where fiat fails. 2026 favors mobile-first nations, bridging retail hype with regulatory maturity, cementing crypto as borderless finance.

In the grand scheme of things, ZebPay blogs are here to provide you with crypto wisdom. Get started today and join 6 million+ registered users to explore endless features on ZebPay!

FAQs

Which country leads global crypto adoption?

India tops Chainalysis 2025 Index across retail/DeFi/institutional metrics.

Why do emerging markets adopt crypto fastest?

Remittances, inflation hedging, unbanked populations, crypto solves real problems banks ignore.

What’s US crypto adoption?

Institutional dominance: ETFs, regulated platforms drive $2T+ volumes.

How many Indians own crypto?

93-119M (6.55% population), leading absolute numbers.

Will adoption continue growing?

Yes, stablecoin laws, L2 scaling, and CBDC pilots accelerate 2026 momentum.